Answered step by step

Verified Expert Solution

Question

1 Approved Answer

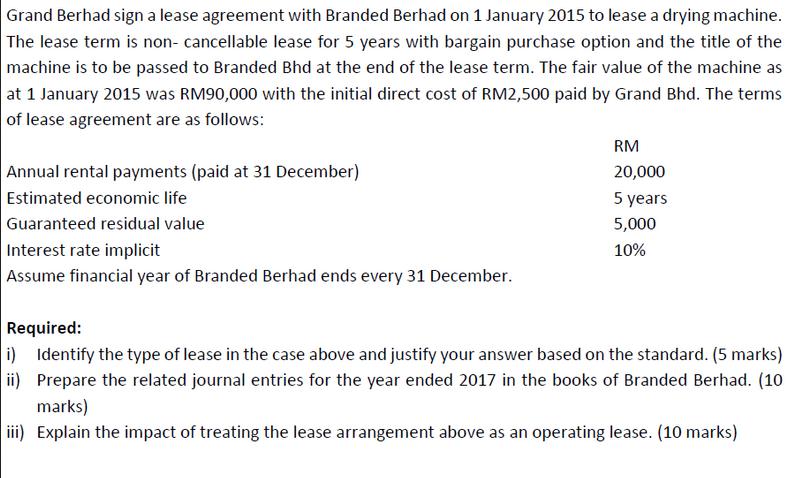

Grand Berhad sign a lease agreement with Branded Berhad on 1 January 2015 to lease a drying machine. The lease term is non- cancellable

Grand Berhad sign a lease agreement with Branded Berhad on 1 January 2015 to lease a drying machine. The lease term is non- cancellable lease for 5 years with bargain purchase option and the title of the machine is to be passed to Branded Bhd at the end of the lease term. The fair value of the machine as at 1 January 2015 was RM90,000 with the initial direct cost of RM2,500 paid by Grand Bhd. The terms of lease agreement are as follows: RM Annual rental payments (paid at 31 December) Estimated economic life 20,000 5 years Guaranteed residual value 5,000 Interest rate implicit 10% Assume financial year of Branded Berhad ends every 31 December. Required: i) Identify the type of lease in the case above and justify your answer based on the standard. (5 marks) ii) Prepare the related journal entries for the year ended 2017 in the books of Branded Berhad. (10 marks) iii) Explain the impact of treating the lease arrangement above as an operating lease. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started