Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grand Clothing is a manufacturer of designer suits. The cost of each suit is the sum of three variable costs (direct materials costs, direct

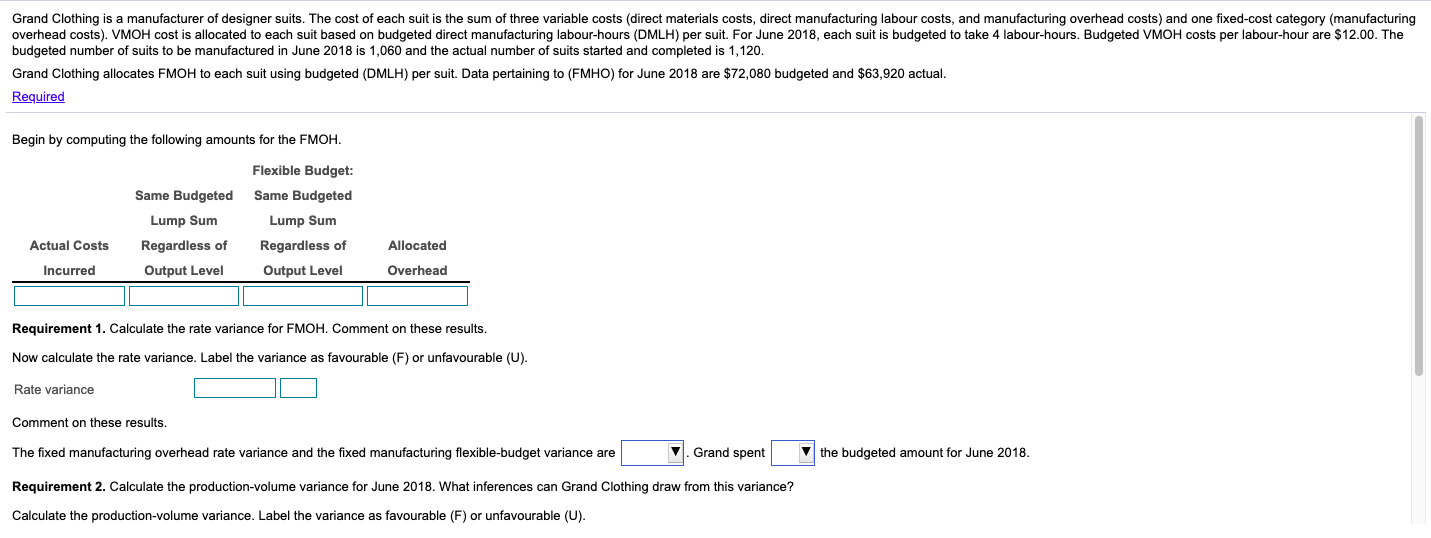

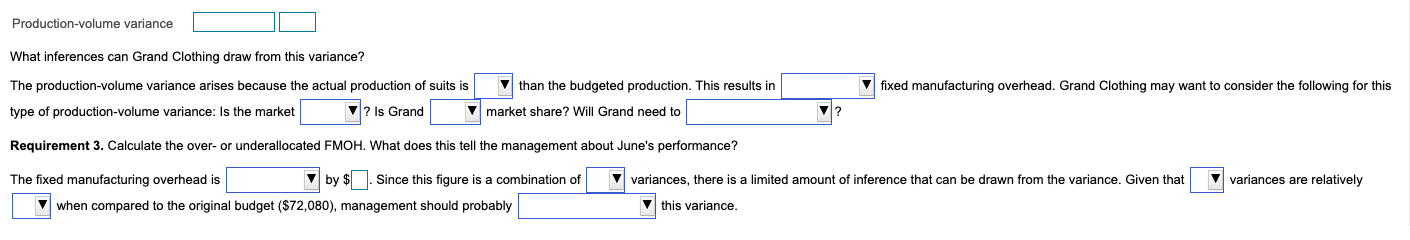

Grand Clothing is a manufacturer of designer suits. The cost of each suit is the sum of three variable costs (direct materials costs, direct manufacturing labour costs, and manufacturing overhead costs) and one fixed-cost category (manufacturing overhead costs). VMOH cost is allocated to each suit based on budgeted direct manufacturing labour-hours (DMLH) per suit. For June 2018, each suit is budgeted to take 4 labour-hours. Budgeted VMOH costs per labour-hour are $12.00. The budgeted number of suits to be manufactured in June 2018 is 1,060 and the actual number of suits started and completed is 1,120. Grand Clothing allocates FMOH to each suit using budgeted (DMLH) per suit. Data pertaining to (FMHO) for June 2018 are $72,080 budgeted and $63,920 actual. Required Begin by computing the following amounts for the FMOH. Flexible Budget: Same Budgeted Lump Sum Actual Costs Same Budgeted Lump Sum Regardless of Regardless of Allocated Incurred Output Level Output Level Overhead Requirement 1. Calculate the rate variance for FMOH. Comment on these results. Now calculate the rate variance. Label the variance as favourable (F) or unfavourable (U). Rate variance Comment on these results. The fixed manufacturing overhead rate variance and the fixed manufacturing flexible-budget variance are Requirement 2. Calculate the production-volume variance for June 2018. What inferences can Grand Clothing draw from this variance? Calculate the production-volume variance. Label the variance as favourable (F) or unfavourable (U). Grand spent the budgeted amount for June 2018. Production-volume variance What inferences can Grand Clothing draw from this variance? The production-volume variance arises because the actual production of suits is type of production-volume variance: Is the market ? Is Grand than the budgeted production. This results in market share? Will Grand need to ? Requirement 3. Calculate the over- or underallocated FMOH. What does this tell the management about June's performance? The fixed manufacturing overhead is by $ Since this figure is a combination of when compared to the original budget ($72,080), management should probably fixed manufacturing overhead. Grand Clothing may want to consider the following for this variances, there is a limited amount of inference that can be drawn from the variance. Given that variances are relatively this variance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement 1 Calculate the rate variance for FMOH The rate variance is calculated as follows Rate V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started