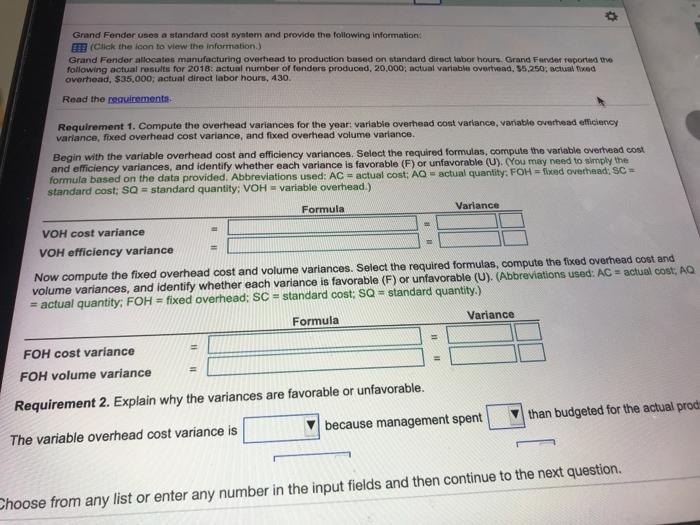

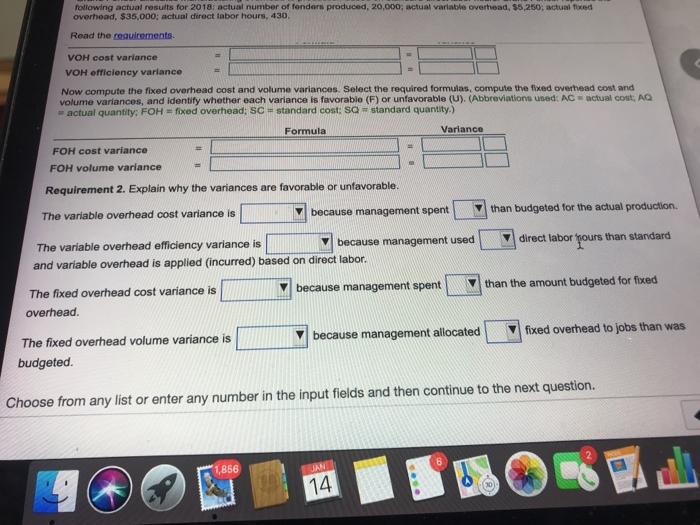

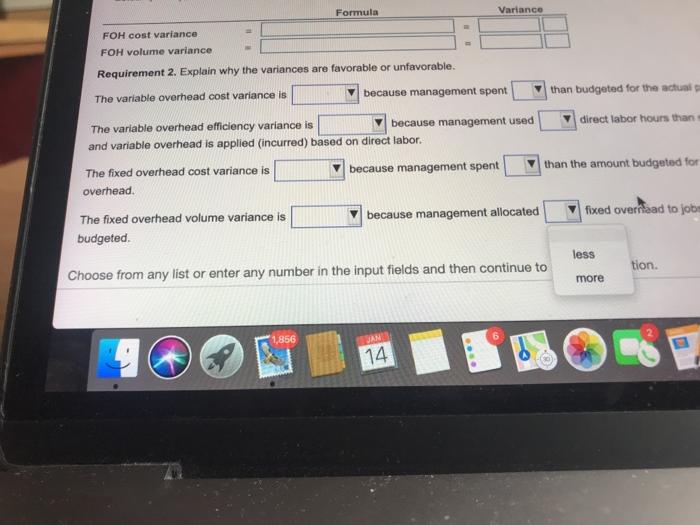

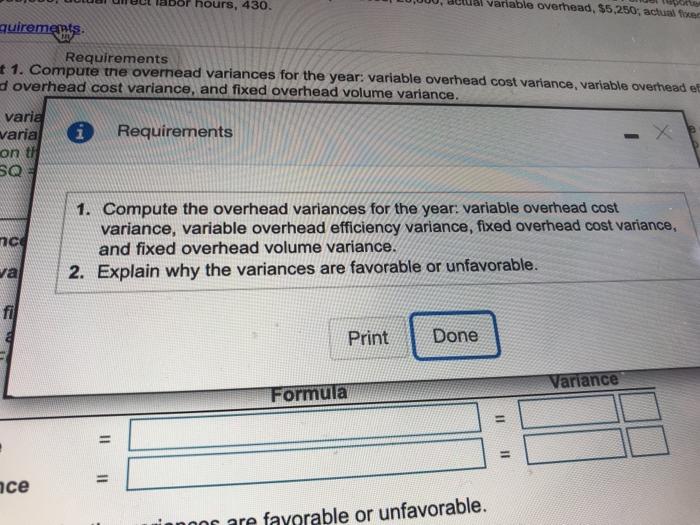

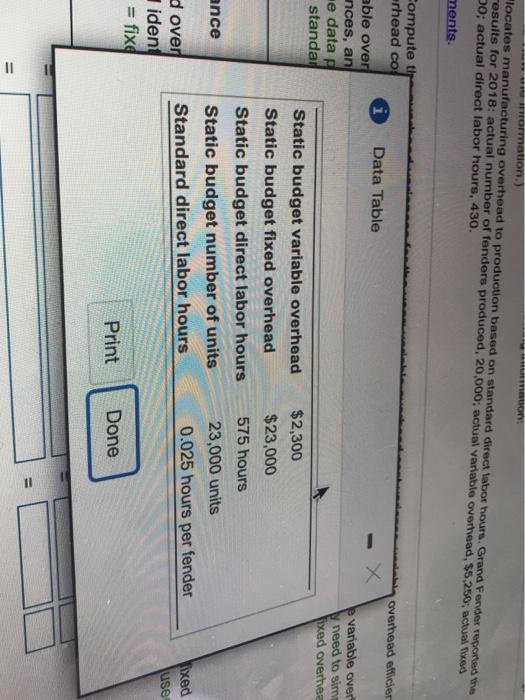

Grand Fender uses a standard cost system and provide the following information 399 (Click the icon to view the information) Grand Fender allocates manufacturing overhead to production based on standard direct labor hours Grand Farvder reported to following actual results for 2018: actual number of fonders produced, 20,000, actual variable overtvead. 55,250, actual ed overhead, $35,000, actual direct labor hours, 430. Read the requirements Requirement 1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. Begin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (You may need to simply the formula based on the data provided. Abbreviations used: AC = actual cost; AQ = actual quantity: FOH = fled overhead: SC standard cost: SQ = standard quantity: VOH = variable overhead.) Variance Formula VOH cost variance VOH efficiency variance Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost, AQ = actual quantity: FOH = fixed overhead: SC = standard cost: SQ = standard quantity.) Formula Variance FOH cost variance FOH volume variance Requirement 2. Explain why the variances are favorable or unfavorable. than budgeted for the actual prod because management spent The variable overhead cost variance is Choose from any list or enter any number in the input fields and then continue to the next question. following actual results for 2018 actual number of fonders produced, 20,000, actual variable overhead, 55,250; actual fixed overhead, $35,000; actual direct labor hours, 430 Read the requirements VOH cost variance VOH efficiency variance Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations uned: AC actual con AQ actual quantity: FOH = fixed overhead: SC = standard cost: SQ standard quantity.) Formula Variance FOH cost variance FOH volume variance Requirement 2. Explain why the variances are favorable or unfavorable. The variable overhead cost variance is because management spent than budgeted for the actual production The variable overhead efficiency variance is because management used direct labor Yours than standard and variable overhead is applied (incurred) based on direct labor. The fixed overhead cost variance is because management spent than the amount budgeted for fixed overhead. The fixed overhead volume variance is because management allocated fixed overhead to jobs than was budgeted. Choose from any list or enter any number in the input fields and then continue to the next question. 8 1,856 UAN 14 Formula Variance FOH cost variance FOH volume variance Requirement 2. Explain why the variances are favorable or unfavorable. The variable overhead cost variance is because management spent than budgeted for the actual The variable overhead efficiency variance is because management used direct labor hours than and variable overhead is applied (incurred) based on direct labor. The fixed overhead cost variance is because management spent than the amount budgeted for overhead. because management allocated fixed overraad to jobs The fixed overhead volume variance is budgeted. less more tion. Choose from any list or enter any number in the input fields and then continue to 1,856 14 4 hours, 430 variable overhead, $5,250, actual fixer quirements Requirements #1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead et doverhead cost variance, and fixed overhead volume variance. i Requirements varia varia on th SQ nc 1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. 2. Explain why the variances are favorable or unfavorable. va Print Done Variance Formula 11 . = unor are favorable or unfavorable. ormation.) locates manufacturing overhead to production based on standard direct labor hours. Grand Fervder reported the results for 2018: actual number of fenders produced, 20,000; actual variable overhead, $5,250, actual es 00; actual direct labor hours, 430. ments Compute thr erhead co Overhead ellicier Data Table able over inces, an ne data standard e variable over need to sim fixed overtes Static budget variable overhead Static budget fixed overhead Static budget direct labor hours Static budget number of units Standard direct labor hours $2,300 $23,000 575 hours ance 23,000 units 0.025 hours per fender Fixed use d over ident = fixe Print Done =