Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grandeur Pte Ltd (Grandeur) has a financial year end of 31 December and details of its property, plant, and equipment (PPE) are as follows:

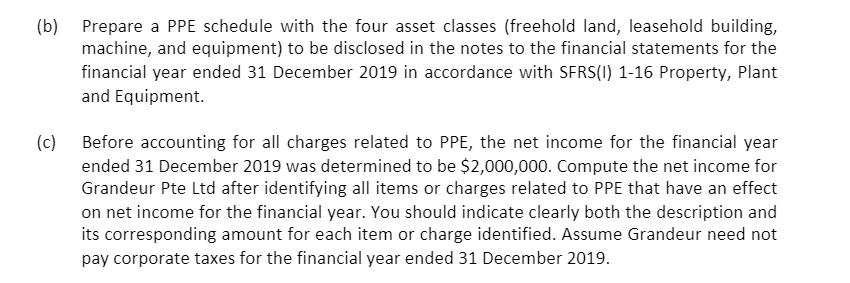

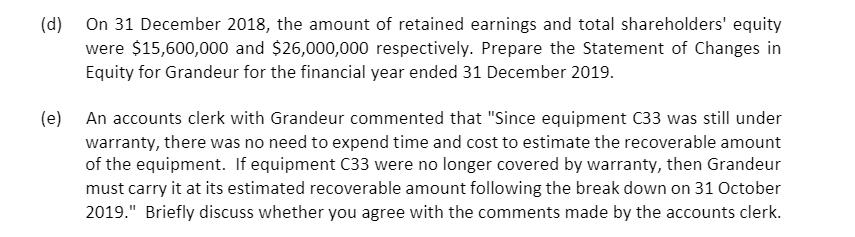

Grandeur Pte Ltd ("Grandeur") has a financial year end of 31 December and details of its property, plant, and equipment (PPE) are as follows: Freehold land was bought for $20,000,000 in January 2010 and was subsequently revalued to $23,000,000 in 2013, $21,000,000 in 2016 and $19,500,000 in 2019. Leasehold building was acquired for $7,000,000 on 1 July 2014 and was initially revalued to $6,785,000 on 1 July 2019 by applying paragraph 35(a) of SFRS(I) 1-16 Property, Plant & Equipment whereby its gross carrying amount and accumulated depreciation were restated proportionately upon revaluation. A new machine (299) with fair value of $245,000 was acquired on 1 October 2019 by way of exchange with a piece of equipment (A11) and payment of $15,000 in cash. Equipment A11 was bought on 1 January 2018 for $400,000. The post-tax cash flow of Grandeur would be significantly higher with the exchange transaction. A piece of equipment (B22) was purchased on 1 March 2019 with cash payment of $90,000. Equipment C33 was bought on 1 April 2017 for $300,000. It came with a 1-year standard product warranty and Grandeur paid another $3,000 to purchase a 2-year extended warranty on acquisition date. Equipment C33 broke down on 31 October 2019. As equipment C33 was covered by the 2-year extended warranty, it was repaired by the supplier at no charge. If it were not under warranty, repair cost would have amounted to $5,950. The repair restored equipment C33 to its usual operating capacity with no change in expected future benefits derived from the equipment. The value in use of equipment C33 was determined to be $108,000 on 31 October 2019. Grandeur depreciates its PPE as follows: Leasehold building: straight line basis over 30 years with residual value of $400,000 Machine: sum-of-year-digit method over 5 years with residual value of $5,000 Equipment: straight line basis over 4 years with no residual value Required (a) Compute the depreciation expense for equipment for the financial year ended 31 December 2019. (b) Prepare a PPE schedule with the four asset classes (freehold land, leasehold building, machine, and equipment) to be disclosed in the notes to the financial statements for the financial year ended 31 December 2019 in accordance with SFRS(I) 1-16 Property, Plant and Equipment. (c) Before accounting for all charges related to PPE, the net income for the financial year ended 31 December 2019 was determined to be $2,000,000. Compute the net income for Grandeur Pte Ltd after identifying all items or charges related to PPE that have an effect on net income for the financial year. You should indicate clearly both the description and its corresponding amount for each item or charge identified. Assume Grandeur need not pay corporate taxes for the financial year ended 31 December 2019. (d) On 31 December 2018, the amount of retained earnings and total shareholders' equity were $15,600,000 and $26,000,000 respectively. Prepare the Statement of Changes in Equity for Grandeur for the financial year ended 31 December 2019. (e) An accounts clerk with Grandeur commented that "Since equipment C33 was still under warranty, there was no need to expend time and cost to estimate the recoverable amount of the equipment. If equipment C33 were no longer covered by warranty, then Grandeur must carry it at its estimated recoverable amount following the break down on 31 October 2019." Briefly discuss whether you agree with the comments made by the accounts clerk.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Depreciation expense for equipment for the financial year ended 31 December 2019 Equipment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started