Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grandma gives each of her grandchildren a $3,500 savings bond that matures in 18 years. For each of the following grandchildren, what is the

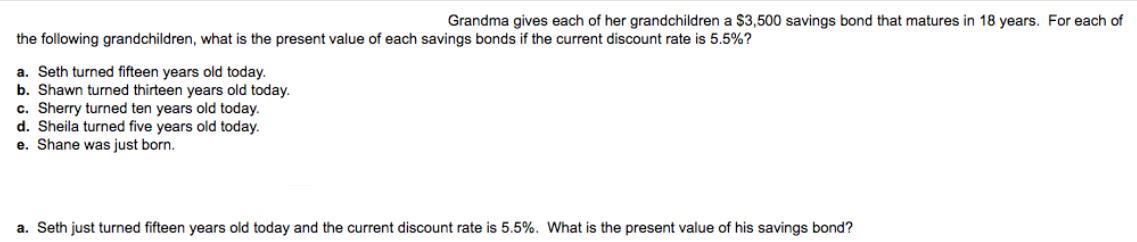

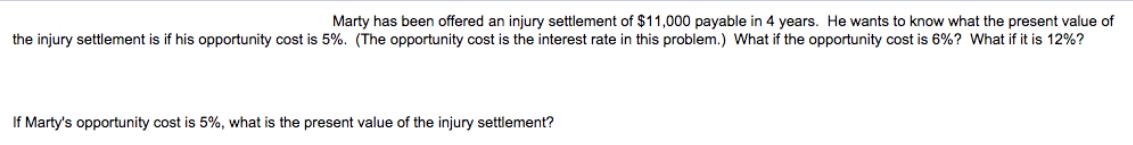

Grandma gives each of her grandchildren a $3,500 savings bond that matures in 18 years. For each of the following grandchildren, what is the present value of each savings bonds if the current discount rate is 5.5%? a. Seth turned fifteen years old today. b. Shawn turned thirteen years old today. c. Sherry turned ten years old today. d. Sheila turned five years old today. e. Shane was just born. a. Seth just turned fifteen years old today and the current discount rate is 5.5%. What is the present value of his savings bond? Marty has been offered an injury settlement of $11,000 payable in 4 years. He wants to know what the present value of the injury settlement is if his opportunity cost is 5%. (The opportunity cost is the interest rate in this problem.) What if the opportunity cost is 6% ? What if it is 12%? If Marty's opportunity cost is 5%, what is the present value of the injury settlement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the present value of the savings bonds or settlements in these problems we will use the present value formula for a single sum which is P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started