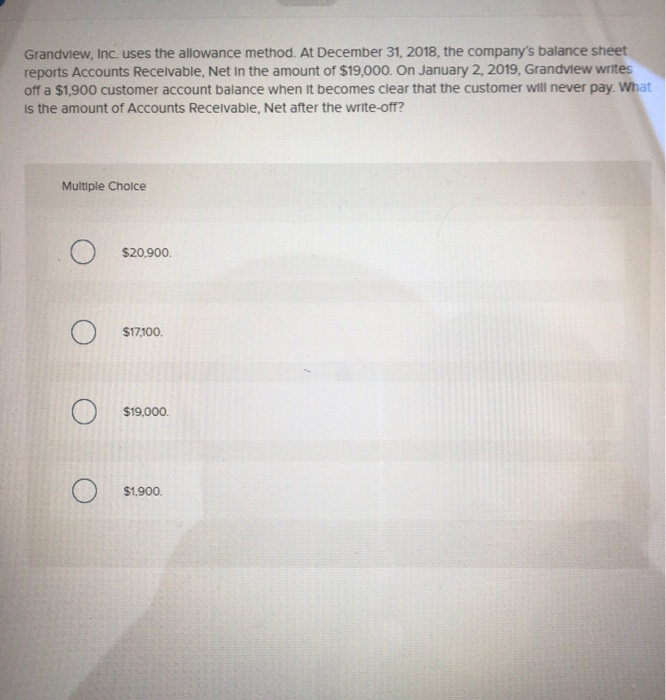

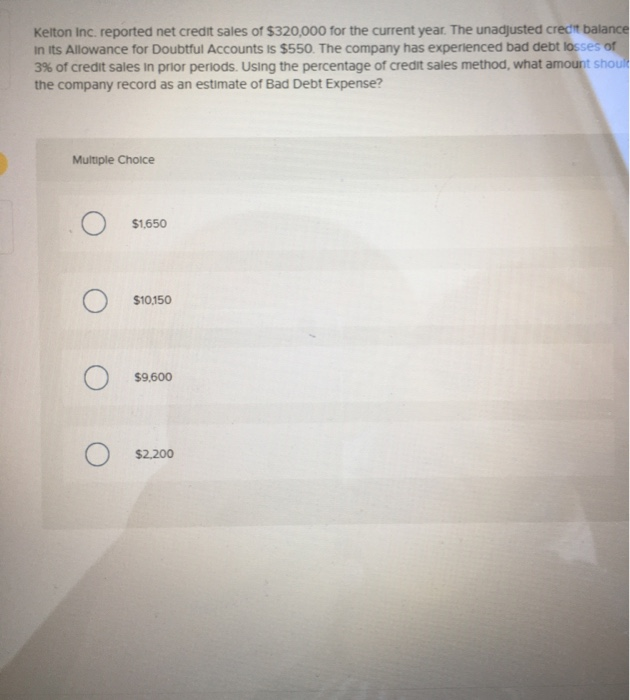

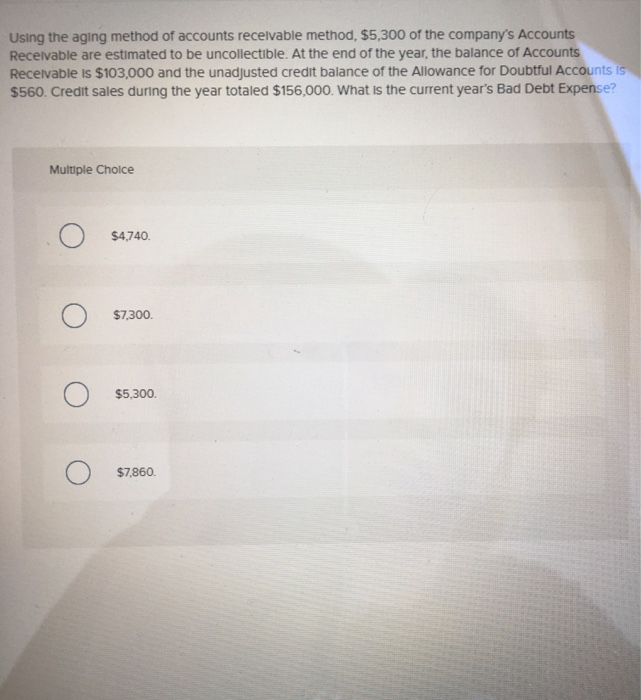

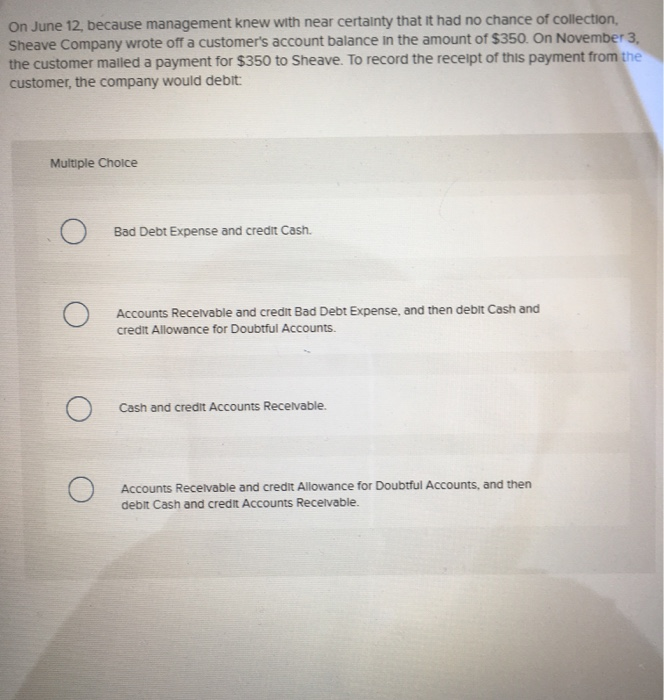

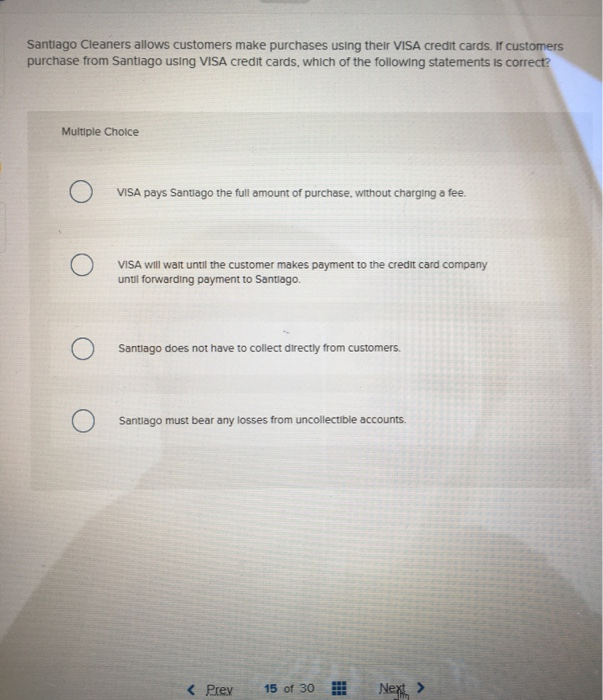

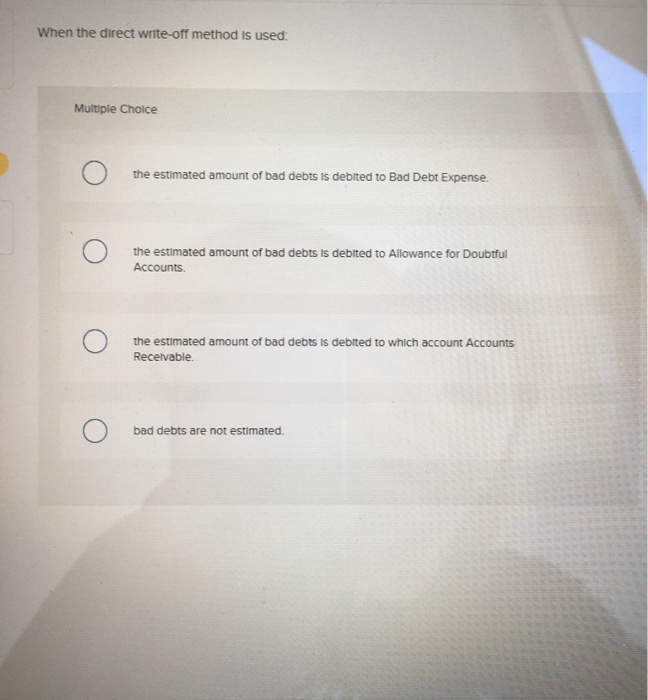

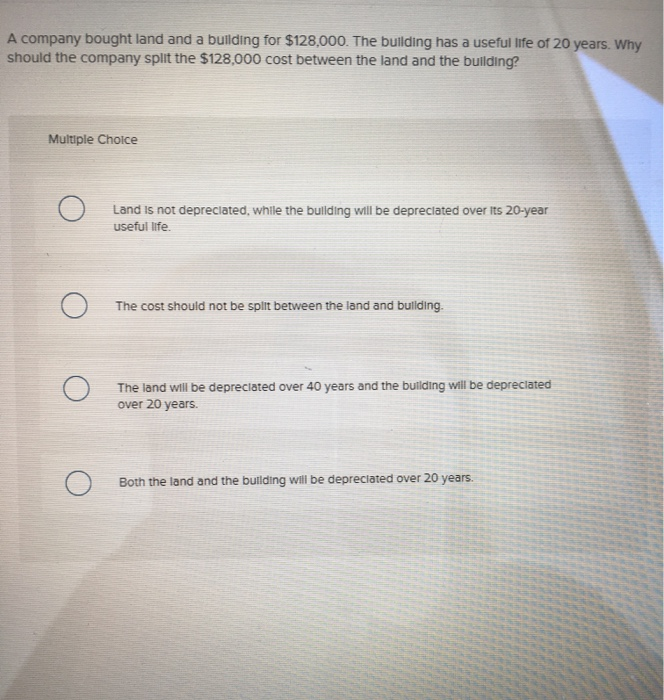

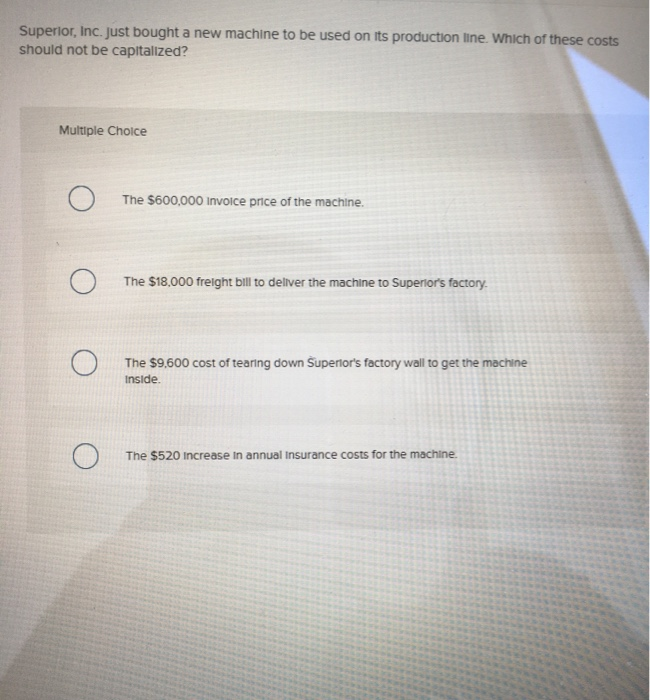

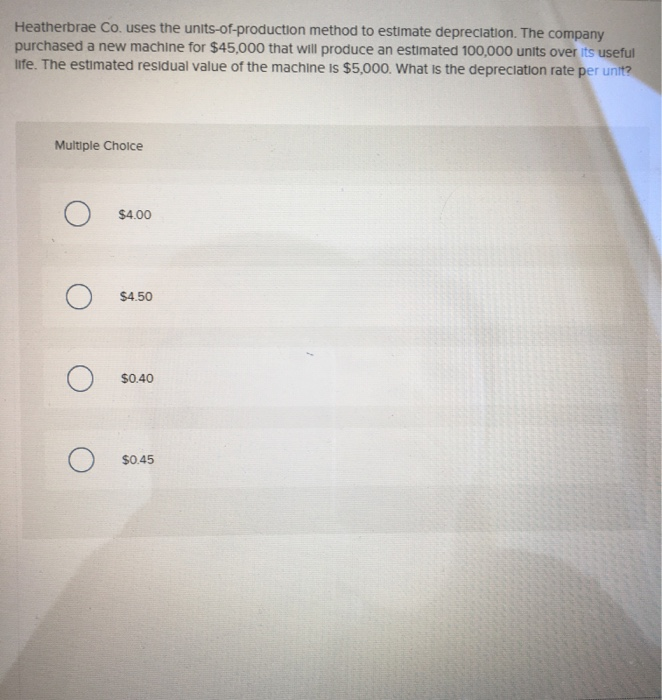

Grandview, Inc. uses the allowance method. At December 31, 2018, the company's balance sheet reports Accounts Receivable, Net in the amount of $19,000. On January 2, 2019, Grandview writes off a $1,900 customer account balance when it becomes clear that the customer will never pay. What is the amount of Accounts Receivable, Net after the write-off? 1 Multiple Choice $20.900. 0 O $17,100. 0 0 $19,000 0 $1,900 $1,900 0 Kelton Inc. reported net credit sales of $320,000 for the current year. The unadjusted credit balance in its Allowance for Doubtful Accounts is $550. The company has experienced bad debt losses of 3% of credit sales in prior periods. Using the percentage of credit sales method, what amount should the company record as an estimate of Bad Debt Expense? Multiple Choice 1 $1,650 o $10,150 o o $9,600 $2.200 o Using the aging method of accounts receivable method, $5,300 of the company's Accounts Receivable are estimated to be uncollectible. At the end of the year, the balance of Accounts Receivable is $103,000 and the unadjusted credit balance of the Allowance for Doubtful Accounts is! $560. Credit sales during the year totaled $156,000. What is the current year's Bad Debt Expense? S4,740. S7,300. $5,300. S7,860. On June 12, because management knew with near certainty that it had no chance of collection Sheave Company wrote off a customer's account balance in the amount of $350. On November 3, the customer malled a payment for $350 to Sheave. To record the receipt of this payment from the customer, the company would debit: Multiple Choice Bad Debt Expense and credit Cash Accounts Receivable and credit Bad Debt Expense, and then debit Cash and credit Allowance for Doubtful Accounts. Cash and credit Accounts Receivable. Accounts Receivable and credit Allowance for Doubtful Accounts, and then debit Cash and credit Accounts Receivable. Santiago Cleaners allows customers make purchases using their VISA credit cards. If customers purchase from Santiago using VISA credit cards, which of the following statements is correct? Multiple Choice VISA pays Santiago the full amount of purchase, without charging a fee. VISA will wait until the customer makes payment to the credit card company unul forwarding payment to Santiago. Santiago does not have to collect directly from customers. Santiago must bear any losses from uncollectible accounts When the direct write-off method is used: Multiple Choice the estimated amount of bad debts is debited to Bad Debt Expense. the estimated amount of bad debts is debited to Allowance for Doubtful Accounts the estimated amount of bad debts is debited to which account Accounts Receivable. bad debts are not estimated Superior, Inc. Just bought a new machine to be used on its production line. Which of these costs should not be capitalized? Multiple Choice 0 The $600,000 Invoice price of the machine. O The $18,000 freight bill to deliver the machine to Superior's factory 0 The $9,600 cost of tearing down Superior's factory wall to get the machine Inside 0 The $520 Increase in annual Insurance costs for the machine Heatherbrae Co. uses the units-of-production method to estimate depreciation. The company purchased a new machine for $45,000 that will produce an estimated 100,000 units over its useful life. The estimated residual value of the machine is $5,000. What is the depreciation rate per unit? Multiple Choice o $4.00 o 54.50 o 50.40 o $0.45