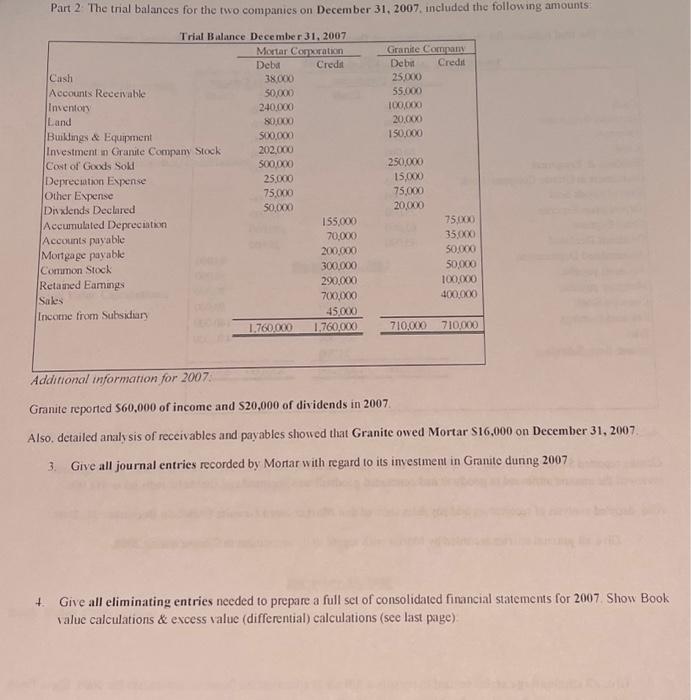

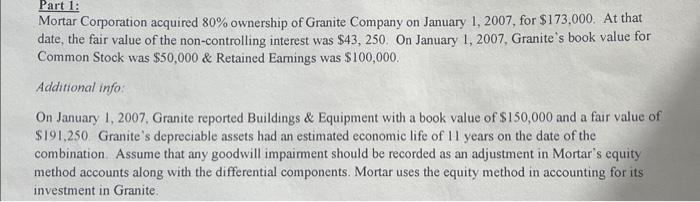

Granite reported $60,000 of income and $20,000 of dividends in 2007. Also. detailed analy sis of receivables and payables showed that Granite owed Mortar S16,000 on December 31, 2007. 3. Give all journal entries recorded by Mortar with regard to its investment in Grante during 2007 4. Give all eliminating entries needed to prepare a full set of consolidated financial statements for 2007. Show Book ralue calculations & excess value (differential) calculations (see last page) Mortar Corporation acquired 80% ownership of Granite Company on January 1, 2007, for $173,000. At that date, the fair value of the non-controlling interest was $43,250. On January 1, 2007, Granite's book value for Common Stock was $50,000 \& Retained Earnings was $100,000. Additional info: On January 1, 2007, Granite reported Buildings \& Equipment with a book value of $150,000 and a fair value of \$191,250 Granite's depreciable assets had an estimated economic life of 11 years on the date of the combination. Assume that any goodwill impairment should be recorded as an adjustment in Mortar's equity method accounts along with the differential components. Mortar uses the equity method in accounting for its investment in Granite: Granite reported $60,000 of income and $20,000 of dividends in 2007. Also. detailed analy sis of receivables and payables showed that Granite owed Mortar S16,000 on December 31, 2007. 3. Give all journal entries recorded by Mortar with regard to its investment in Grante during 2007 4. Give all eliminating entries needed to prepare a full set of consolidated financial statements for 2007. Show Book ralue calculations & excess value (differential) calculations (see last page) Mortar Corporation acquired 80% ownership of Granite Company on January 1, 2007, for $173,000. At that date, the fair value of the non-controlling interest was $43,250. On January 1, 2007, Granite's book value for Common Stock was $50,000 \& Retained Earnings was $100,000. Additional info: On January 1, 2007, Granite reported Buildings \& Equipment with a book value of $150,000 and a fair value of \$191,250 Granite's depreciable assets had an estimated economic life of 11 years on the date of the combination. Assume that any goodwill impairment should be recorded as an adjustment in Mortar's equity method accounts along with the differential components. Mortar uses the equity method in accounting for its investment in Granite