Answered step by step

Verified Expert Solution

Question

1 Approved Answer

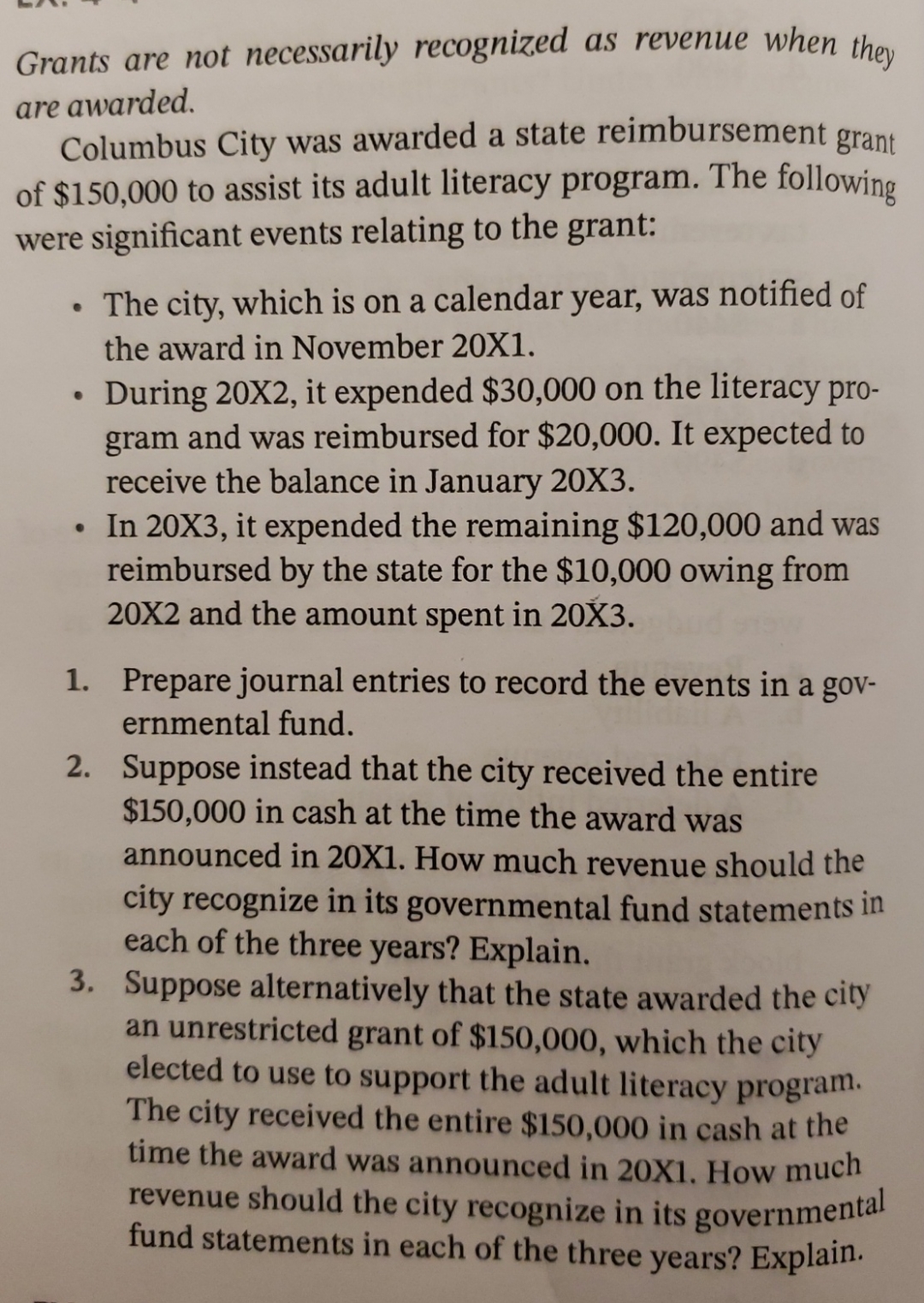

Grants are not necessarily recognized as revenue when they are awarded. Columbus City was awarded a state reimbursement grant of $ 1 5 0 ,

Grants are not necessarily recognized as revenue when they

are awarded.

Columbus City was awarded a state reimbursement grant

of $ to assist its adult literacy program. The following

were significant events relating to the grant:

The city, which is on a calendar year, was notified of

the award in November X

During X it expended $ on the literacy pro

gram and was reimbursed for $ It expected to

receive the balance in January X

In X it expended the remaining $ and was

reimbursed by the state for the $ owing from

and the amount spent in

Prepare journal entries to record the events in a gov

ernmental fund.

Suppose instead that the city received the entire

$ in cash at the time the award was

announced in X How much revenue should the

city recognize in its governmental fund statements in

each of the three years? Explain.

Suppose alternatively that the state awarded the city

an unrestricted grant of $ which the city

elected to use to support the adult literacy program.

The city received the entire $ in cash at the

time the award was announced in X How much

revenue should the city recognize in its governmental

fund statements in each of the three years? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started