Question

Grape Ltd acquired all the issued shares of Duck Ltd for $940 000 cash on 1 July 2020. The following information is available at this

Grape Ltd acquired all the issued shares of Duck Ltd for $940 000 cash on 1 July 2020.

The following information is available at this acquisition date:

The equity of Duck Ltd is provided below:

| Share capital | $495 000 00000 |

| Retained earnings | 280 000 |

| General reserve | 125 000 |

All the identifiable assets and liabilities of Duck Ltd were recorded at fair value in the statement of financial position. The company income tax rate is 30%.

The following transactions and events occurred during the year ended 30 June 2021:

1. During the year Grape Ltd sold inventory to Duck Ltd for $55,000 at cost plus 20%. Duck Ltd has sold 10% of these items externally as at 30 June 2021.

2. On 1 April 2021, Duck Ltd sold an item of inventory to Grape Ltd for $28,000. This inventory had cost Duck Ltd $20,000. Grape Ltd treated the item as plant and will depreciate it at 20% p.a.

3. Grape Ltd sold land to Duck Ltd for $25,000 which had originally cost $32,000.

4. Dividends: Duck Ltd paid $18 000 interim dividends in September 2020, and Grape Ltd declared $26 000 dividends in May 2021 (to be paid in October 2021).

5. On 1 July 2020, Grape Ltd provided an office for Duck Ltds administrative staff to use. Grape Ltd charges $700 per month. The last rental receipt received by Grape Ltd was on 30 April 2021.

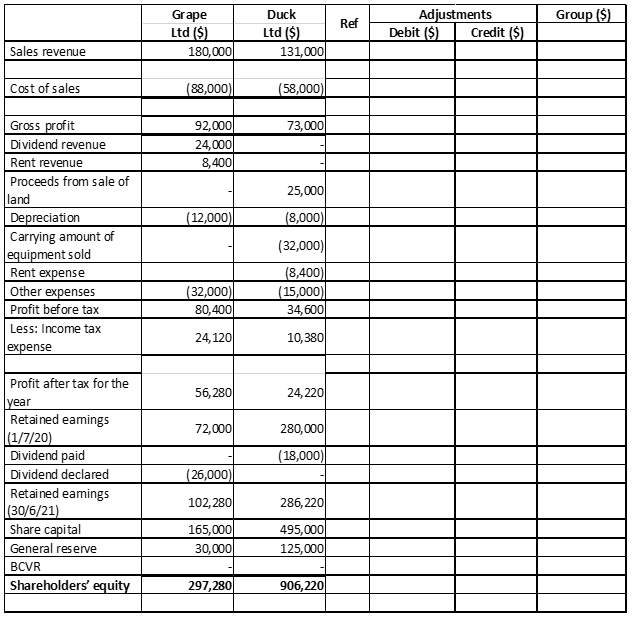

Part (b) Prepare the consolidation entries as at 30 June 2021 in excel using the template below. Include narrations for each entry: (28 marks)

| Date | Particulars | Reference | Debit | Credit |

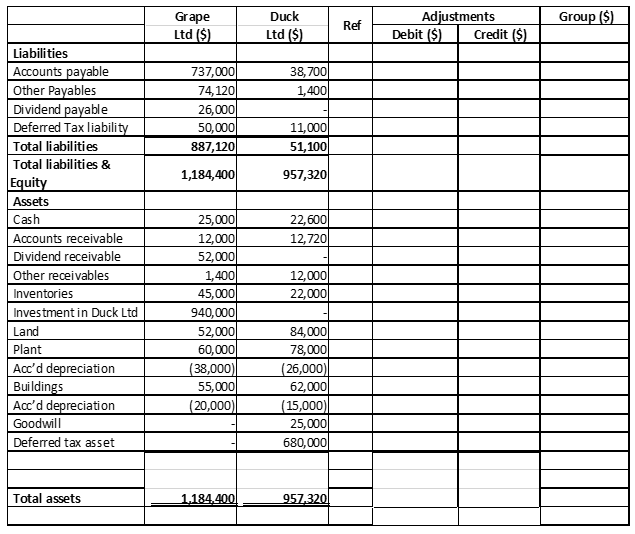

Part (c): Worksheet (24 marks)

Using excel, prepare the consolidation worksheet as at 30 June 2021, showing all entries including the corrected entries discussed in Part (a). Each entry needs to be entered as a separate amount and not entered as subtotals in the worksheet. Round your answers to zero decimal places. The worksheet template is provided below.

Part (d): Group financial statements (12 marks)

Using excel, prepare the Statement of Financial position for Grape Ltd as at 30 June 2021.

Ref Grape Ltd ($) 180,000 Group ($) Duck Ltd ($) 131,000 Adjustments Debit ($) Credit ($) Sales revenue Cost of sales (88,000)| (58,000) 73,000 92,000 24,000 8,400 25,000 (12,000) (8,000) Gross profit Dividend revenue Rent revenue Proceeds from sale of land Depreciation Carrying amount of equipment sold Rent expense Other expenses Profit before tax Less: Income tax expense (32,000) (32,000) 80,400 (8,400) (15,000) 34,600 24, 1201 10,380 56,280 24,220 72,000 280,000 (18,000) (26,000) Profit after tax for the year Retained earings (1/7/20) Dividend paid Dividend declared Retained earnings (30/6/21) Share capital General reserve BCVR Shareholders' equity 102,280 286, 220 165,000 30,000 495,000 125,000 297,2801 906,220 Duck Grape Ltd ($) Group ($) Ref Adjustments Debit ($) Credit ($) Ltd ($) 38,700 1,400 737,000 74,120 26,000 50,000 887,120 11,000 51,100 1,184,400 957,320 22,600 12,720 Liabilities Accounts payable Other Payables Dividend payable Deferred Tax liability Total liabilities Total liabilities & Equity Assets Cash Accounts receivable Dividend receivable Other receivables Inventories Investment in Duck Ltd Land Plant Acc'd depreciation Buildings Acc'd depreciation Goodwill Deferred tax asset 12,000 22,000 25,000 12,000 52,000 1,400 45,000 940,000 52,000 60,000 (38,000) 55,000 (20,000 84,000 78,000 (26,000) 62,000 (15,000) 25,000 680,000 Total assets 1.184.400 957.320! Ref Grape Ltd ($) 180,000 Group ($) Duck Ltd ($) 131,000 Adjustments Debit ($) Credit ($) Sales revenue Cost of sales (88,000)| (58,000) 73,000 92,000 24,000 8,400 25,000 (12,000) (8,000) Gross profit Dividend revenue Rent revenue Proceeds from sale of land Depreciation Carrying amount of equipment sold Rent expense Other expenses Profit before tax Less: Income tax expense (32,000) (32,000) 80,400 (8,400) (15,000) 34,600 24, 1201 10,380 56,280 24,220 72,000 280,000 (18,000) (26,000) Profit after tax for the year Retained earings (1/7/20) Dividend paid Dividend declared Retained earnings (30/6/21) Share capital General reserve BCVR Shareholders' equity 102,280 286, 220 165,000 30,000 495,000 125,000 297,2801 906,220 Duck Grape Ltd ($) Group ($) Ref Adjustments Debit ($) Credit ($) Ltd ($) 38,700 1,400 737,000 74,120 26,000 50,000 887,120 11,000 51,100 1,184,400 957,320 22,600 12,720 Liabilities Accounts payable Other Payables Dividend payable Deferred Tax liability Total liabilities Total liabilities & Equity Assets Cash Accounts receivable Dividend receivable Other receivables Inventories Investment in Duck Ltd Land Plant Acc'd depreciation Buildings Acc'd depreciation Goodwill Deferred tax asset 12,000 22,000 25,000 12,000 52,000 1,400 45,000 940,000 52,000 60,000 (38,000) 55,000 (20,000 84,000 78,000 (26,000) 62,000 (15,000) 25,000 680,000 Total assets 1.184.400 957.320Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started