Question

Grape-to-Gullet Ltd. (GTG) has operated a vertically integrated wine business for a number of years. It owns vineyards in Ontario and British Columbia, and it

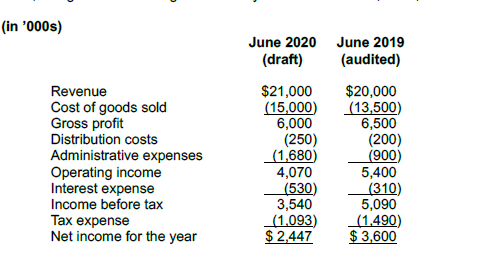

Grape-to-Gullet Ltd. (GTG) has operated a vertically integrated wine business for a number of years. It owns vineyards in Ontario and British Columbia, and it uses the grapes in its own wine-fermentation facilities. It then sells the wine through the companys own chain of retail outlets. GTGs year end is June 30, and the company prepares its financial statements in accordance with ASPE. The audited income statement for the year ended June 30, 2019, along with the draft figures for the year ended June 30, 2020, are as follows:

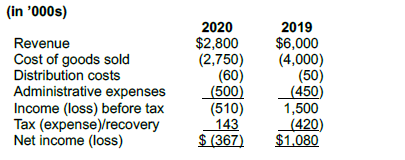

For several years, GTGs wine retailing business has faced severe competition; it incurred an operating loss for the year ended June 30, 2020. The directors decided in July 2019 to sell the wine retailing business. A binding sales agreement was entered into in November 2019 and the sale was completed on December 31, 2019, for $4,600,000. The assets, liabilities, revenue, and costs of the wine retailing business are separately distinguishable and form a separate component of the business.

The figures for the wine retailing business included in the above statements of comprehensive income are as follows:

The carrying value of the assets of the wine retailing business on December 31, 2019, equalled $4,320,000. The company had no liabilities relating to the wine retailing business. The proceeds of the sale were recorded by debiting cash $4,600,000 and crediting an account called suspense. This suspense account is not reflected in the above income statement. Assume there will be no tax payable regarding the disposal of the wine retailing operation. GTGs tax rate is 28%.

Required: a) Prepare an updated income statement of GTG (including comparatives) for the year ended June 30, 2020. b) Prepare a suitable disclosure note relating to the discontinuance of the wine retailing business.

(in '000s) June 2020 June 2019 (draft) (audited) Revenue Cost of goods sold Gross profit Distribution costs Administrative expenses Operating income Interest expense Income before tax Tax expense Net income for the year $21,000 (15,000 6,000 (250) (1,680) 4,070 (530) 3,540 (1,093) $ 2,447 $20,000 (13,500) 6,500 (200) (900) 5,400 (310) 5,090 (1.490) $3,600 (in '000s) Revenue Cost of goods sold Distribution costs Administrative expenses Income (loss) before tax Tax (expense)/recovery Net income (loss) 2020 $2,800 (2,750) (60) (500) (510) 143 $ (367) 2019 $6,000 (4,000) (50) (450) 1,500 (420) $1,080

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started