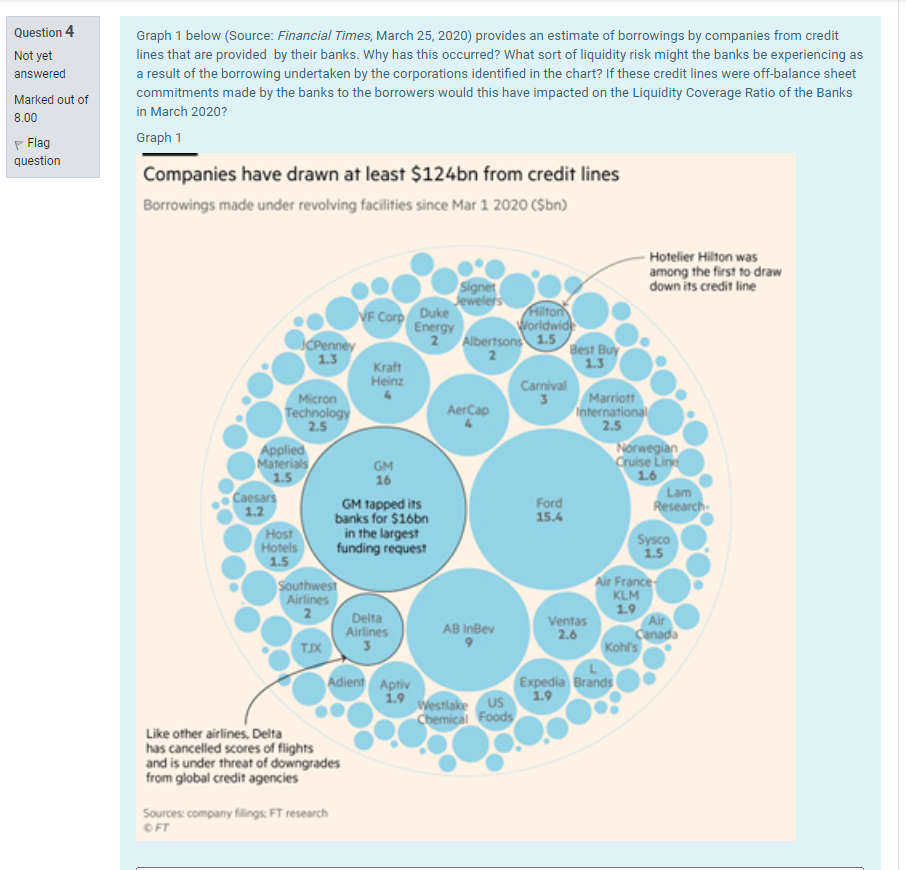

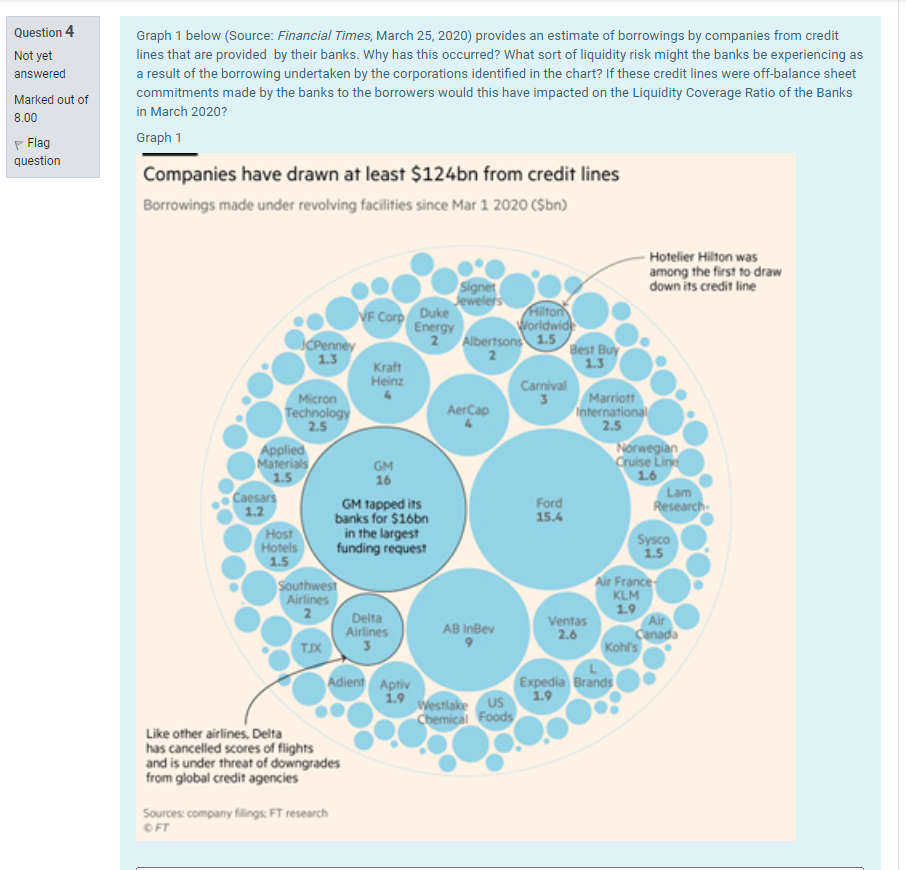

- Graph 1 below (Source: Financial Times, March 25, 2020) provides an estimate of borrowings by companies from credit lines that are provided by their banks. Why has this occurred? What sort of liquidity risk might the banks be experiencing as a result of the borrowing undertaken by the corporations identified in the chart? If these credit lines were off-balance sheet commitments made by the banks to the borrowers would this have impacted on the Liquidity Coverage Ratio of the Banks in March 2020?

Question 4 Not yet answered Graph 1 below (Source: Financial Times, March 25, 2020) provides an estimate of borrowings by companies from credit lines that are provided by their banks. Why has this occurred? What sort of liquidity risk might the banks be experiencing as a result of the borrowing undertaken by the corporations identified in the chart? If these credit lines were off-balance sheet commitments made by the banks to the borrowers would this have impacted on the Liquidity Coverage Ratio of the Banks in March 2020? Graph 1 Marked out of 8.00 P Flag question Companies have drawn at least $124bn from credit lines Borrowings made under revolving facilities since Mar 1 2020 ($bn) VF Corp Duke Hotelier Hilton was among the first to draw Signet down its credit line Jewelers Hilton Energy Worldwide JCPenney 2 Albertsons 1.5 Best Buy 1.3 Kraft 1.3 Heinz Carnival Micron 3 Marriott Technology AerCap International 2.5 2.5 Applied Norwegian Materials GM Cruise Line 1.5 Caesars Lam 1.2 Ford GM tapped its Research banks for $16bn 15.4 Host in the largest Hotels funding request Sysco 1.5 1.5 Southwest Air France Airlines KLM 2 1.9 Delta Ventas Air Airlines AB InBev 2.6 9 Canada TJX Kohl's 16 1.6 Adient Aptiv Expedia Brands 1.9 1.9 Westlake US Chemical Foods Like other airlines, Delta has cancelled scores of flights and is under threat of downgrades from global credit agencies Sources company filings FT research FT Question 4 Not yet answered Graph 1 below (Source: Financial Times, March 25, 2020) provides an estimate of borrowings by companies from credit lines that are provided by their banks. Why has this occurred? What sort of liquidity risk might the banks be experiencing as a result of the borrowing undertaken by the corporations identified in the chart? If these credit lines were off-balance sheet commitments made by the banks to the borrowers would this have impacted on the Liquidity Coverage Ratio of the Banks in March 2020? Graph 1 Marked out of 8.00 P Flag question Companies have drawn at least $124bn from credit lines Borrowings made under revolving facilities since Mar 1 2020 ($bn) VF Corp Duke Hotelier Hilton was among the first to draw Signet down its credit line Jewelers Hilton Energy Worldwide JCPenney 2 Albertsons 1.5 Best Buy 1.3 Kraft 1.3 Heinz Carnival Micron 3 Marriott Technology AerCap International 2.5 2.5 Applied Norwegian Materials GM Cruise Line 1.5 Caesars Lam 1.2 Ford GM tapped its Research banks for $16bn 15.4 Host in the largest Hotels funding request Sysco 1.5 1.5 Southwest Air France Airlines KLM 2 1.9 Delta Ventas Air Airlines AB InBev 2.6 9 Canada TJX Kohl's 16 1.6 Adient Aptiv Expedia Brands 1.9 1.9 Westlake US Chemical Foods Like other airlines, Delta has cancelled scores of flights and is under threat of downgrades from global credit agencies Sources company filings FT research FT