Answered step by step

Verified Expert Solution

Question

1 Approved Answer

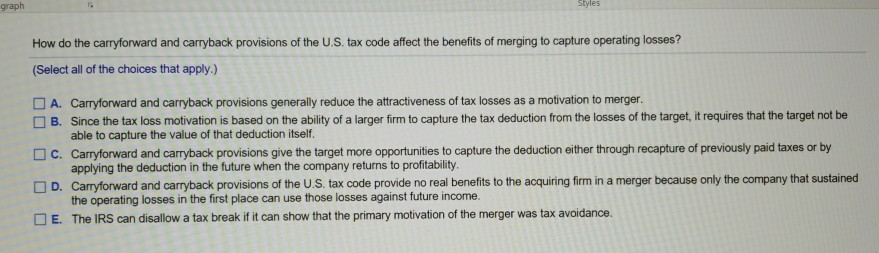

graph How do the carryforward and carryback provisions of the U.S. tax code affect the benefits of merging to capture operating losses? (Select all of

graph How do the carryforward and carryback provisions of the U.S. tax code affect the benefits of merging to capture operating losses? (Select all of the choices that apply.) DA. Carryforward and carryback provisions generally reduce the attractiveness of tax losses as a motivation to merger B. Since the tax loss motivation is based on the abity of a largerfirm to capture the tax deduction from the losses of the target, it requires that the target not be DC. Carryforward and carryback provisions give the target more opportunities to capture the deduction either through recapture of previously paid taxes or by ? D Cam onward and carryback provisions o he US tax code provide no real benefits to the acquiring firm in a merger because only the company that sustained able to capture the value of that deduction itself the operating losses in the first place can use those losses against future income. E. The IRS can disallow a tax break if it can show that the primary motivation of the merger was tax avoidance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started