Graph the Capital Allocation Line for BUD and the risk-free asset. Extend the line past the 100% investment in BUD, i.e. short the risk-free asset, until 150% investment in BUD.

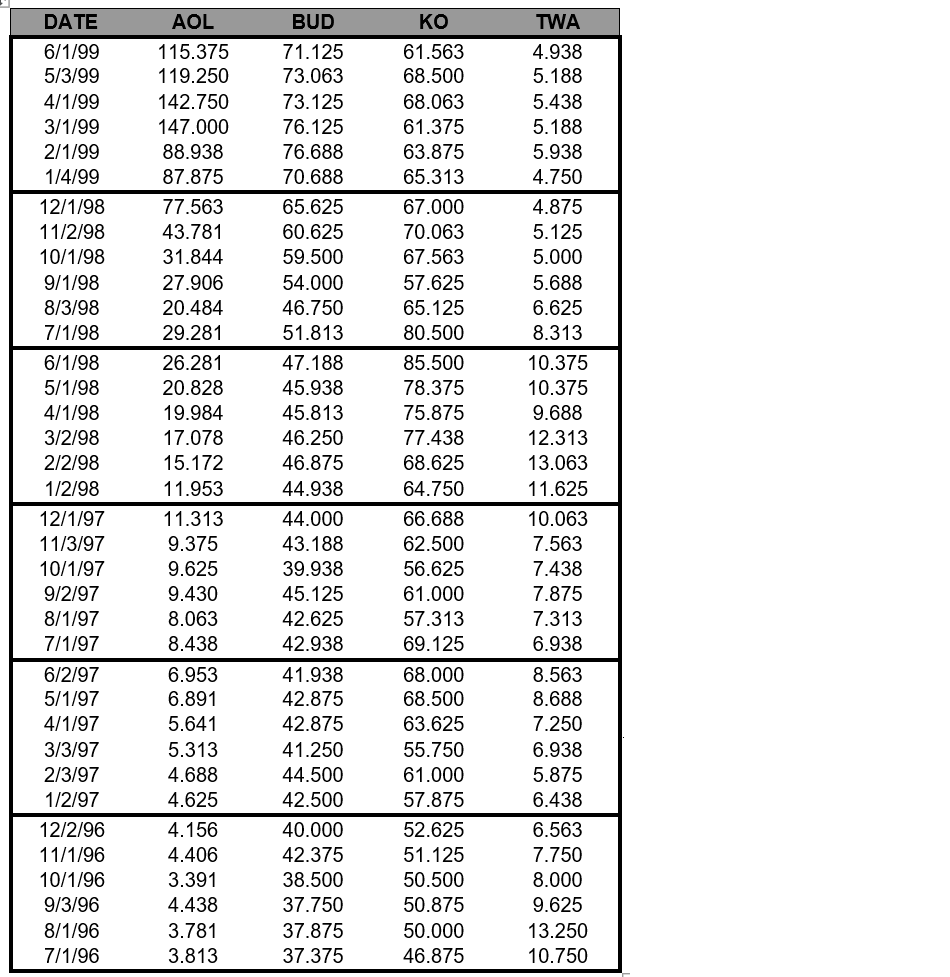

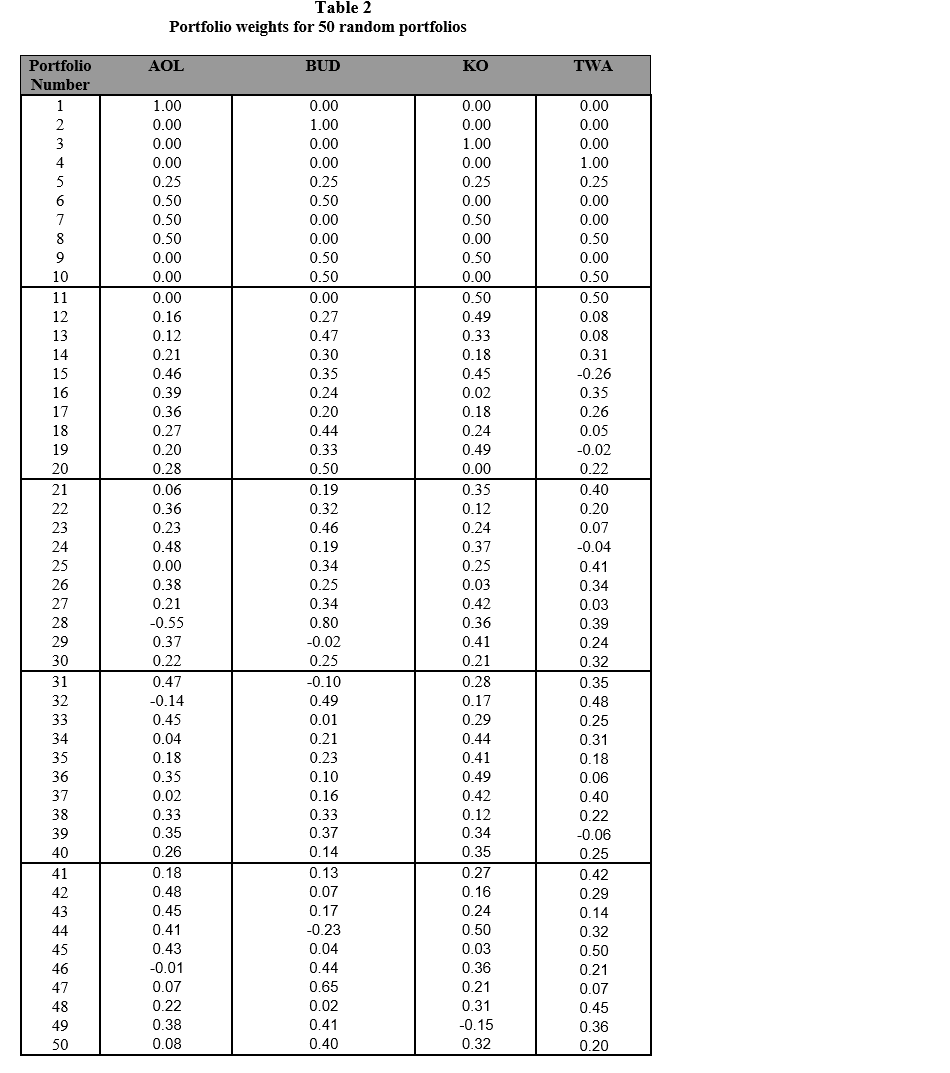

DATE AOL BUD KO TWA 6/1/99 115.375 71.125 61.563 4.938 5/3/99 119.250 73.063 68.500 5.188 4/1/99 142.750 73.125 68.063 5.438 3/1/99 147.000 76.125 61.375 5.188 2/1/99 88.938 76.688 63.875 5.938 1/4/99 87.875 70.688 65.313 4.750 12/1/98 77.563 65.625 67.000 4.875 11/2/98 43.781 60.625 70.063 5.125 10/1/98 31.844 59.500 67.563 5.000 9/1/98 27.906 54.000 57.625 5.688 8/3/98 20.484 46.750 65. 125 6.625 7/1/98 29.281 51.813 80.500 8.313 6/1/98 26.281 47.188 85.500 10.375 5/1/98 20.828 45.938 78.375 10.375 4/1/98 19.984 45.813 75.875 9.688 3/2/98 17.078 46.250 77.438 12.313 2/2/98 15.172 46.875 68.625 13.063 1/2/98 11.953 44.938 64.750 11.625 12/1/97 11.313 44.000 66.688 10.063 11/3/97 9.375 43.188 62.500 7.563 10/1/97 9.625 39.938 56.625 7.438 9/2/97 9.430 45.125 61.000 7.875 8/1/97 8.063 42.625 57.313 7.313 7/1/97 8.438 42.938 69.125 6.938 6/2/97 6.953 41.938 68.000 8.563 5/1/97 6.891 42.875 68.500 8.688 4/1/97 5.641 42.875 63.625 7.250 3/3/97 5.313 41.250 55.750 6.938 2/3/97 4.688 44.500 61.000 5.875 1/2/97 4.625 42.500 57.875 6.438 12/2/96 4. 156 40.000 52.625 6.563 11/1/96 4.406 42.375 51.125 7.750 10/1/96 3.391 38.500 50.500 8.000 9/3/96 4.438 37.750 50.875 9.625 8/1/96 3.781 37.875 50.000 13.250 7/1/96 3.813 37.375 46.875 10.750Table 2 Portfolio weights for 50 random portfolios Portfolio AOL BUD KO TWA Number 1.00 0.00 0.0 0.0 0.00 1.00 0.00 0.0 0.00 0.00 1.00 0.00 0.00 0.00 1.0 0.25 0.25 1.25 0.25 0.50 0.50 ).00 .00 0.50 0 00 0.50 0.00 0.50 0.00 0.00 0.50 0.00 0.50 0.50 0.00 0.00 0.50 0.00 0.50 0.00 0.00 0.50 0.50 0.16 0.27 0.49 0.08 0.12 0.47 0.33 0.08 0.21 0.30 0.18 0.31 0.46 0.35 0.45 0.26 0.39 0.24 0.02 0.35 17 0.36 0.20 0.18 18 0.27 0.44 0.24 19 0.05 0.20 0.33 ).49 20 -0.02 0.28 0.50 0.00 0.22 0.06 0.19 0.35 0.40 0.36 0.32 0.12 0.20 0.23 0.46 0.24 0.07 24 0.48 0.19 0.37 -0.04 25 0.00 0.34 0.25 26 0.41 0.38 0.25 27 0.03 0.34 0.21 0.34 0.42 28 0.03 -0.55 0.80 0.36 29 0.37 0.39 0.02 0.41 30 0.22 0.24 0.25 0.21 0.32 31 0.47 0.10 0.28 32 1.35 0.14 0.49 0.17 0.48 33 0.45 0.01 0.29 34 0.25 0.04 0.21 35 0.44 0.31 0.18 0.23 0.41 36 0.18 0.35 0.10 0.49 37 0.06 0.02 0.16 0.42 38 .40 0.33 0.33 0.12 39 0.22 0.35 0.37 0.34 40 -0.06 0.26 0. 14 ).35 0.25 41 0.18 0.13 42 0.27 0.42 0.48 0.07 0.16 43 0.29 0.45 0.17 0.24 44 0.41 0.14 0.23 0.50 45 0.43 0.04 0.32 0.03 46 -0.01 0.50 0.44 0.36 0.21 47 0.07 0.65 0.21 48 0.07 0.22 0.02 0.31 49 0.45 0.38 0.41 -0.15 50 0.08 0.36 0.40 0.32 0.20