Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Graphical derivation and interpreting beta You are analyzing the performance of two stocks as shown in the following graphs. The first shown in Panel A.

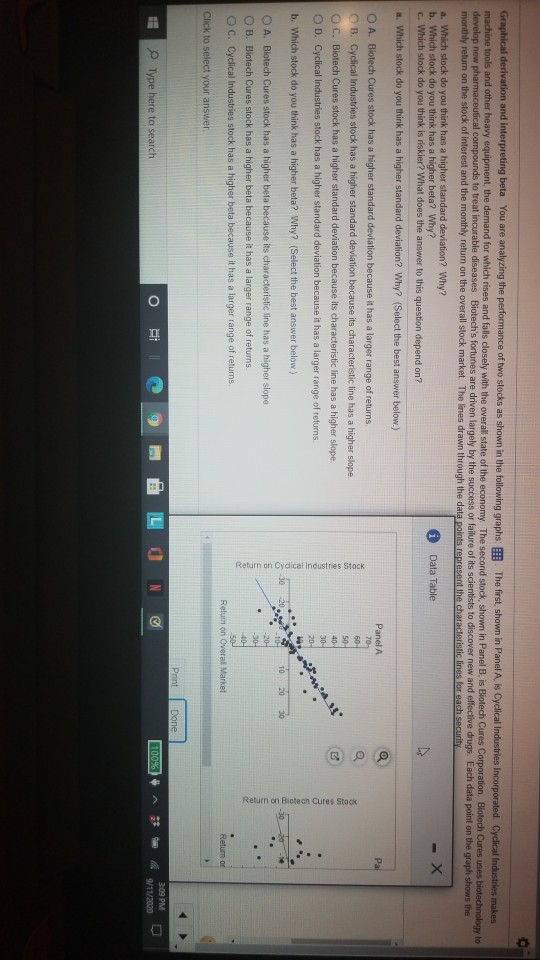

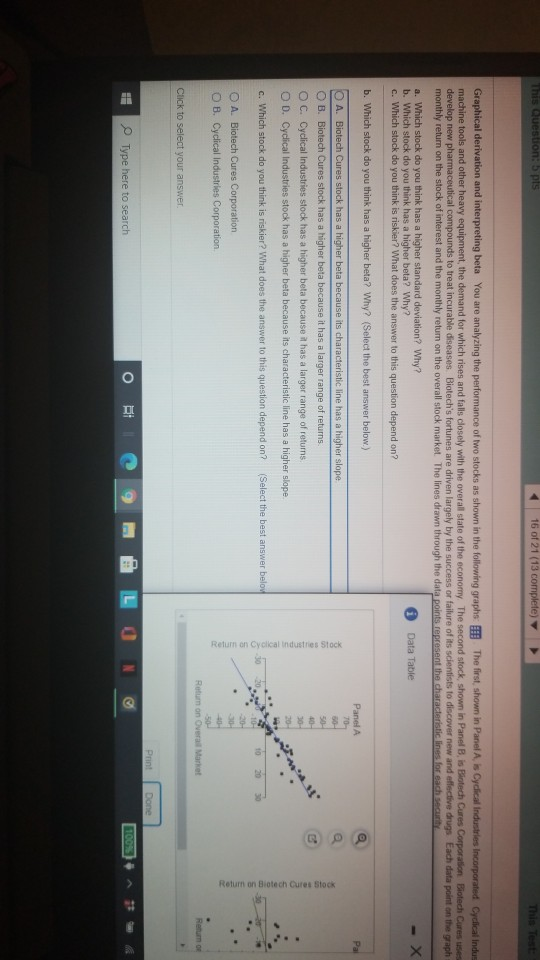

Graphical derivation and interpreting beta You are analyzing the performance of two stocks as shown in the following graphs. The first shown in Panel A. is Cyclical Industries Incorporated Cyclical Industries makes machine tools and other heavy equipment, the demand for which rises and falls closely with the overall state of the economy. The second stock, shown in Panel B, is Biotech Cures Corporation. Biotech Cures uses biotechnology to develop new pharmaceutical compounds to treat incurable diseases Biotech's fortunes are driven largely by the success or failure of its scientists to discover new and effective drugs. Each data point on the graph shows the monthly return on the stock of interest and the monthly return on the overall stock market. The lines drawn through the data points represent the characteristic lines for each security a. Which stock do you think has a higher standard deviation? Why? b. Which stock do you think has a higher beta? Why? Data Table c. Which stock do you think is riskier? What does the answer to this question depend on? a. Which stock do you think has a higher standard deviation? Why? (Select the best answer below.) Panel A Pal O A. Biotech Cures stock has a higher standard deviation because it has a larger range of returns 70 OB. Cyclical Industries stock has a higher standard deviation because its characteristic line has a higher slope 60- 50 OC. Biotech Cures stock has a higher standard deviation because its characteristic line has a higher slope 40 30- OD. Cyclical Industries stock has a higher standard deviation because it has a larger range of retums 20 b. Which stock do you think has a higher beta? Why? (Select the best answer below) TO 20 O A. Biotech Cures stock has a higher beta because its characteristic line has a higher slope -20- -30 O B. Biotech Cures stock has a higher beta because it has a larger range of returns 404 OC. Cyclical Industries stock has a higher beta because it has a larger range of returns 50- Return on Overal Market Return of Click to select your answer e 44 Return on Cyclical Industries Stock Return on Biotech Cures Stock Print Done Type here to search O IT 9 LON 100% 3:09 PM 9/11/2020 > This Question: 5 pls 16 of 21 (13 complete) Graphical derivation and interpreting beta You are analyzing the performance of two stocks as shown in the following graphs: The first shown in Panel A. is Cyclical Industries Incorporated Cyclical Indus machine tools and other heavy equipment, the demand for which rises and falls closely with the overall state of the economy. The second stock, shown in Panel B. is Biotech Cures Corporation Biotech Cures uses develop new pharmaceutical compounds to treat incurable diseases. Biotech's fortunes are driven largely by the success or failure of its scientists to discover new and effective drugs Each data point on the graph monthly return on the stock of interest and the monthly return on the overall stock market. The lines drawn through the data points represent the characteristic lines for each a. Which stock do you think has a higher standard deviation? Why? Data Table b. Which stock do you think has a higher beta? Why? c. Which stock do you think is riskier? What does the answer to this question depend on? b. Which stock do you think has a higher beta? Why? (Select the best answer below.) Pal Panel A 70 50 O A. Biotech Cures stock has a higher beta because its characteristic line has a higher slope O B. Biotech Cures stock has a higher beta because it has a larger range of returns OC. Cyclical Industries stock has a higher beta because it has a larger range of returns OD. Cyclical Industries stock has a higher beta because its characteristic line has a higher slope. Return on Cyclical Industries Stock Return on Biotech Cures Stock c. Which stock do you think is riskier? What does the answer to this question depend on? (Select the best answer below O A Biotech Cures Corporation OB. Cyclical Industries Corporation Return on Overs Market Rerum of Click to select your answer. Print Done Type here to search O III 9 L LON 100% Graphical derivation and interpreting beta You are analyzing the performance of two stocks as shown in the following graphs. The first shown in Panel A. is Cyclical Industries Incorporated Cyclical Industries makes machine tools and other heavy equipment, the demand for which rises and falls closely with the overall state of the economy. The second stock, shown in Panel B, is Biotech Cures Corporation. Biotech Cures uses biotechnology to develop new pharmaceutical compounds to treat incurable diseases Biotech's fortunes are driven largely by the success or failure of its scientists to discover new and effective drugs. Each data point on the graph shows the monthly return on the stock of interest and the monthly return on the overall stock market. The lines drawn through the data points represent the characteristic lines for each security a. Which stock do you think has a higher standard deviation? Why? b. Which stock do you think has a higher beta? Why? Data Table c. Which stock do you think is riskier? What does the answer to this question depend on? a. Which stock do you think has a higher standard deviation? Why? (Select the best answer below.) Panel A Pal O A. Biotech Cures stock has a higher standard deviation because it has a larger range of returns 70 OB. Cyclical Industries stock has a higher standard deviation because its characteristic line has a higher slope 60- 50 OC. Biotech Cures stock has a higher standard deviation because its characteristic line has a higher slope 40 30- OD. Cyclical Industries stock has a higher standard deviation because it has a larger range of retums 20 b. Which stock do you think has a higher beta? Why? (Select the best answer below) TO 20 O A. Biotech Cures stock has a higher beta because its characteristic line has a higher slope -20- -30 O B. Biotech Cures stock has a higher beta because it has a larger range of returns 404 OC. Cyclical Industries stock has a higher beta because it has a larger range of returns 50- Return on Overal Market Return of Click to select your answer e 44 Return on Cyclical Industries Stock Return on Biotech Cures Stock Print Done Type here to search O IT 9 LON 100% 3:09 PM 9/11/2020 > This Question: 5 pls 16 of 21 (13 complete) Graphical derivation and interpreting beta You are analyzing the performance of two stocks as shown in the following graphs: The first shown in Panel A. is Cyclical Industries Incorporated Cyclical Indus machine tools and other heavy equipment, the demand for which rises and falls closely with the overall state of the economy. The second stock, shown in Panel B. is Biotech Cures Corporation Biotech Cures uses develop new pharmaceutical compounds to treat incurable diseases. Biotech's fortunes are driven largely by the success or failure of its scientists to discover new and effective drugs Each data point on the graph monthly return on the stock of interest and the monthly return on the overall stock market. The lines drawn through the data points represent the characteristic lines for each a. Which stock do you think has a higher standard deviation? Why? Data Table b. Which stock do you think has a higher beta? Why? c. Which stock do you think is riskier? What does the answer to this question depend on? b. Which stock do you think has a higher beta? Why? (Select the best answer below.) Pal Panel A 70 50 O A. Biotech Cures stock has a higher beta because its characteristic line has a higher slope O B. Biotech Cures stock has a higher beta because it has a larger range of returns OC. Cyclical Industries stock has a higher beta because it has a larger range of returns OD. Cyclical Industries stock has a higher beta because its characteristic line has a higher slope. Return on Cyclical Industries Stock Return on Biotech Cures Stock c. Which stock do you think is riskier? What does the answer to this question depend on? (Select the best answer below O A Biotech Cures Corporation OB. Cyclical Industries Corporation Return on Overs Market Rerum of Click to select your answer. Print Done Type here to search O III 9 L LON 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started