Answered step by step

Verified Expert Solution

Question

1 Approved Answer

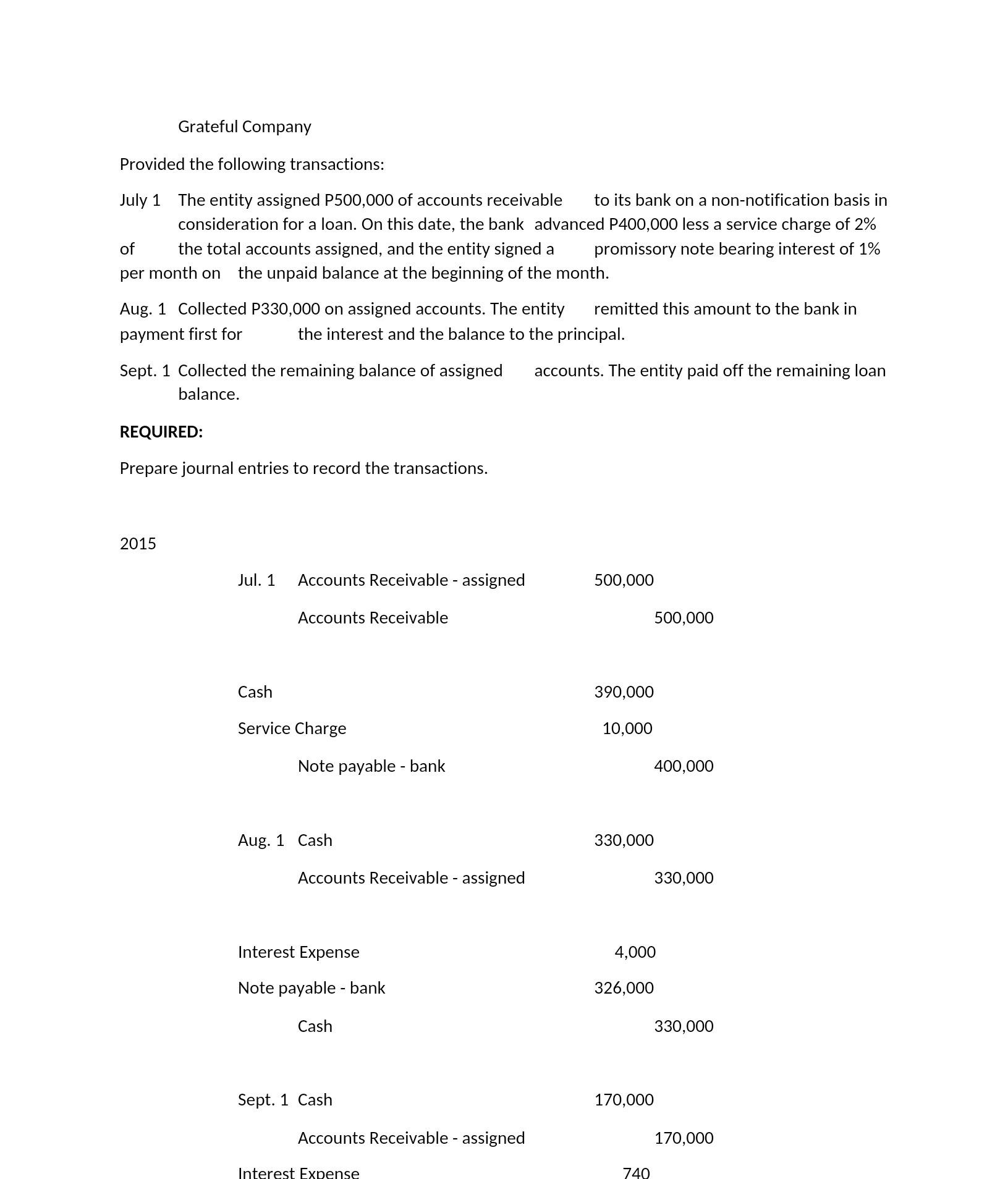

Grateful Company Provided the following transactions: July 1 The entity assigned P500,000 of accounts receivable to its bank on a non-notification basis in consideration

Grateful Company Provided the following transactions: July 1 The entity assigned P500,000 of accounts receivable to its bank on a non-notification basis in consideration for a loan. On this date, the bank advanced P400,000 less a service charge of 2% the total accounts assigned, and the entity signed a promissory note bearing interest of 1% of per month on the unpaid balance at the beginning of the month. Aug. 1 Collected P330,000 on assigned accounts. The entity remitted this amount to the bank in payment first for the interest and the balance to the principal. Sept. 1 Collected the remaining balance of assigned balance. REQUIRED: Prepare journal entries to record the transactions. 2015 Jul. 1 Accounts Receivable - assigned Accounts Receivable Cash Service Charge Note payable - bank Aug. 1 Cash Accounts Receivable - assigned Interest Expense Note payable - bank Cash Sept. 1 Cash Accounts Receivable - assigned Interest Expense accounts. The entity paid off the remaining loan 500,000 390,000 10,000 500,000 330,000 170,000 400,000 740 4,000 326,000 330,000 330,000 170,000

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Note payable bank 0 Accounts Receivable 500000 To record the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started