Answered step by step

Verified Expert Solution

Question

1 Approved Answer

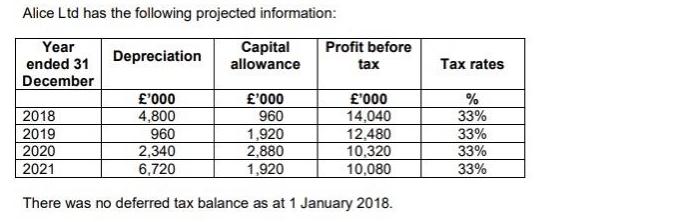

Alice Ltd has the following projected information: Year ended 31 December 2018 2019 2020 2021 Depreciation '000 4,800 960 2,340 6,720 Capital allowance '000

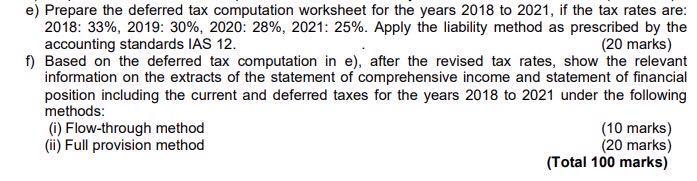

Alice Ltd has the following projected information: Year ended 31 December 2018 2019 2020 2021 Depreciation '000 4,800 960 2,340 6,720 Capital allowance '000 960 Profit before tax '000 14,040 12,480 10,320 10,080 1,920 2,880 1,920 There was no deferred tax balance as at 1 January 2018. Tax rates % 33% 33% 33% 33% e) Prepare the deferred tax computation worksheet for the years 2018 to 2021, if the tax rates are: 2018: 33%, 2019: 30%, 2020: 28%, 2021: 25%. Apply the liability method as prescribed by the accounting standards IAS 12. (20 marks) f) Based on the deferred tax computation in e), after the revised tax rates, show the relevant information on the extracts of the statement of comprehensive income and statement of financial position including the current and deferred taxes for the years 2018 to 2021 under the following methods: (i) Flow-through method (ii) Full provision method (10 marks) (20 marks) (Total 100 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started