Answered step by step

Verified Expert Solution

Question

1 Approved Answer

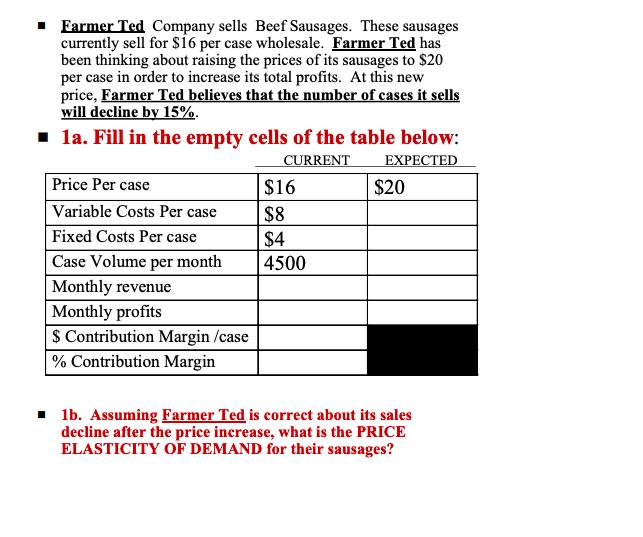

Farmer Ted Company sells Beef Sausages. These sausages currently sell for $16 per case wholesale. Farmer Ted has been thinking about raising the prices

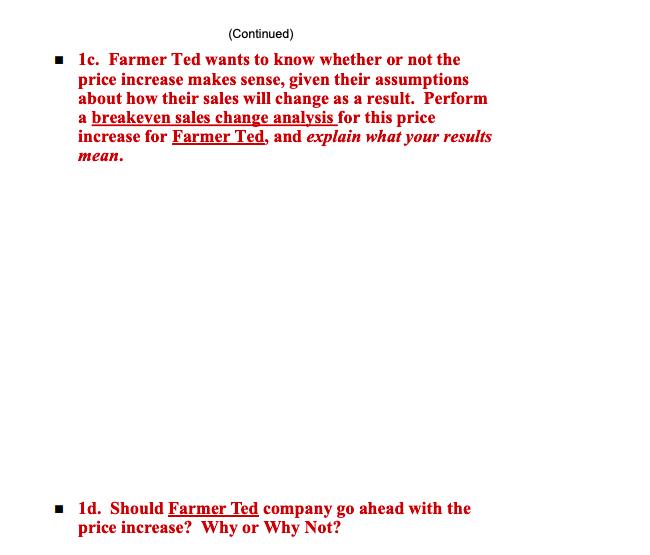

Farmer Ted Company sells Beef Sausages. These sausages currently sell for $16 per case wholesale. Farmer Ted has been thinking about raising the prices of its sausages to $20 per case in order to increase its total profits. At this new price, Farmer Ted believes that the number of cases it sells will decline by 15%. 1a. Fill in the empty cells of the table below: CURRENT EXPECTED Price Per case Variable Costs Per case Fixed Costs Per case Case Volume per month Monthly revenue Monthly profits $ Contribution Margin /case % Contribution Margin $16 $8 $4 4500 $20 1b. Assuming Farmer Ted is correct about its sales decline after the price increase, what is the PRICE ELASTICITY OF DEMAND for their sausages? (Continued) 1c. Farmer Ted wants to know whether or not the price increase makes sense, given their assumptions about how their sales will change as a result. Perform a breakeven sales change analysis for this price increase for Farmer Ted, and explain what your results mean. 1d. Should Farmer Ted company go ahead with the price increase? Why or Why Not?

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started