Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gray Corporation uses the FIFO cost flow assumption for maintaining its books during the year. However, it uses the LIFO cost flow assumption for

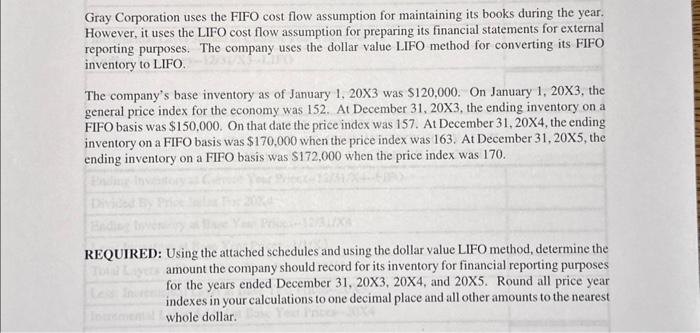

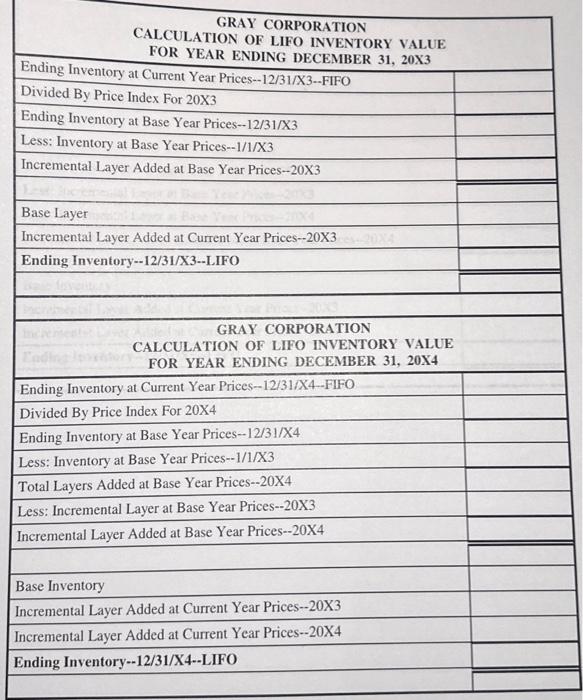

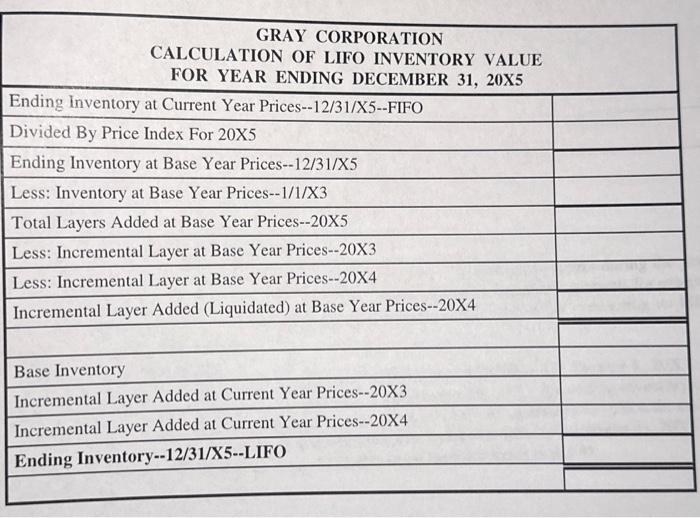

Gray Corporation uses the FIFO cost flow assumption for maintaining its books during the year. However, it uses the LIFO cost flow assumption for preparing its financial statements for external reporting purposes. The company uses the dollar value LIFO method for converting its FIFO inventory to LIFO. The company's base inventory as of January 1, 20X3 was $120,000. On January 1, 20X3, the general price index for the economy was 152. At December 31, 20X3, the ending inventory on a FIFO basis was $150,000. On that date the price index was 157. At December 31, 20X4, the ending inventory on a FIFO basis was $170,000 when the price index was 163. At December 31, 20X5, the ending inventory on a FIFO basis was $172,000 when the price index was 170. 12/ALIXA REQUIRED: Using the attached schedules and using the dollar value LIFO method, determine the To amount the company should record for its inventory for financial reporting purposes. for the years ended December 31, 20X3, 20X4, and 20X5. Round all price year indexes in your calculations to one decimal place and all other amounts to the nearest whole dollar. lea TIMELION GRAY CORPORATION CALCULATION OF LIFO INVENTORY VALUE FOR YEAR ENDING DECEMBER 31, 20X3 Ending Inventory at Current Year Prices--12/31/X3--FIFO Divided By Price Index For 20X3 Ending Inventory at Base Year Prices--12/31/X3 Less: Inventory at Base Year Prices--1/1/X3 Incremental Layer Added at Base Year Prices--20X3 Base Layer Incremental Layer Added at Current Year Prices--20X3 Ending Inventory--12/31/X3--LIFO GRAY CORPORATION CALCULATION OF LIFO INVENTORY VALUE FOR YEAR ENDING DECEMBER 31, 20X4 Ending Inventory at Current Year Prices-12/31/X4--FIFO Divided By Price Index For 20X4 Ending Inventory at Base Year Prices--12/31/X4 Less: Inventory at Base Year Prices--1/1/X3 Total Layers Added at Base Year Prices--20X4 Less: Incremental Layer at Base Year Prices--20X3 Incremental Layer Added at Base Year Prices--20X4 Base Inventory Incremental Layer Added at Current Year Prices--20X3 Incremental Layer Added at Current Year Prices--20X4 Ending Inventory--12/31/X4--LIFO GRAY CORPORATION CALCULATION OF LIFO INVENTORY VALUE FOR YEAR ENDING DECEMBER 31, 20X5 Ending Inventory at Current Year Prices--12/31/X5--FIFO Divided By Price Index For 20X5 Ending Inventory at Base Year Prices--12/31/X5 Less: Inventory at Base Year Prices--1/1/X3 Total Layers Added at Base Year Prices--20X5 Less: Incremental Layer at Base Year Prices--20X3 Less: Incremental Layer at Base Year Prices--20X4 Incremental Layer Added (Liquidated) at Base Year Prices--20X4 Base Inventory Incremental Layer Added at Current Year Prices--20X3 Incremental Layer Added at Current Year Prices--20X4 Ending Inventory--12/31/X5--LIFO

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started