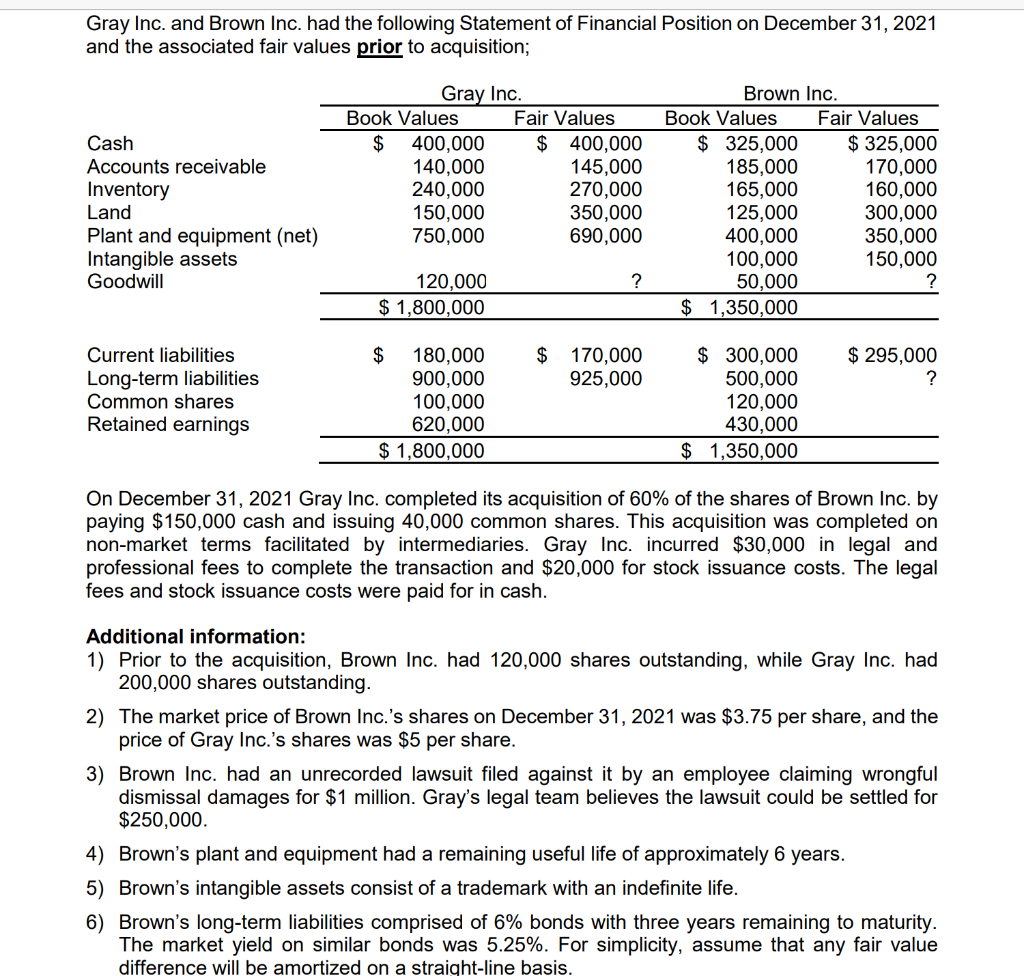

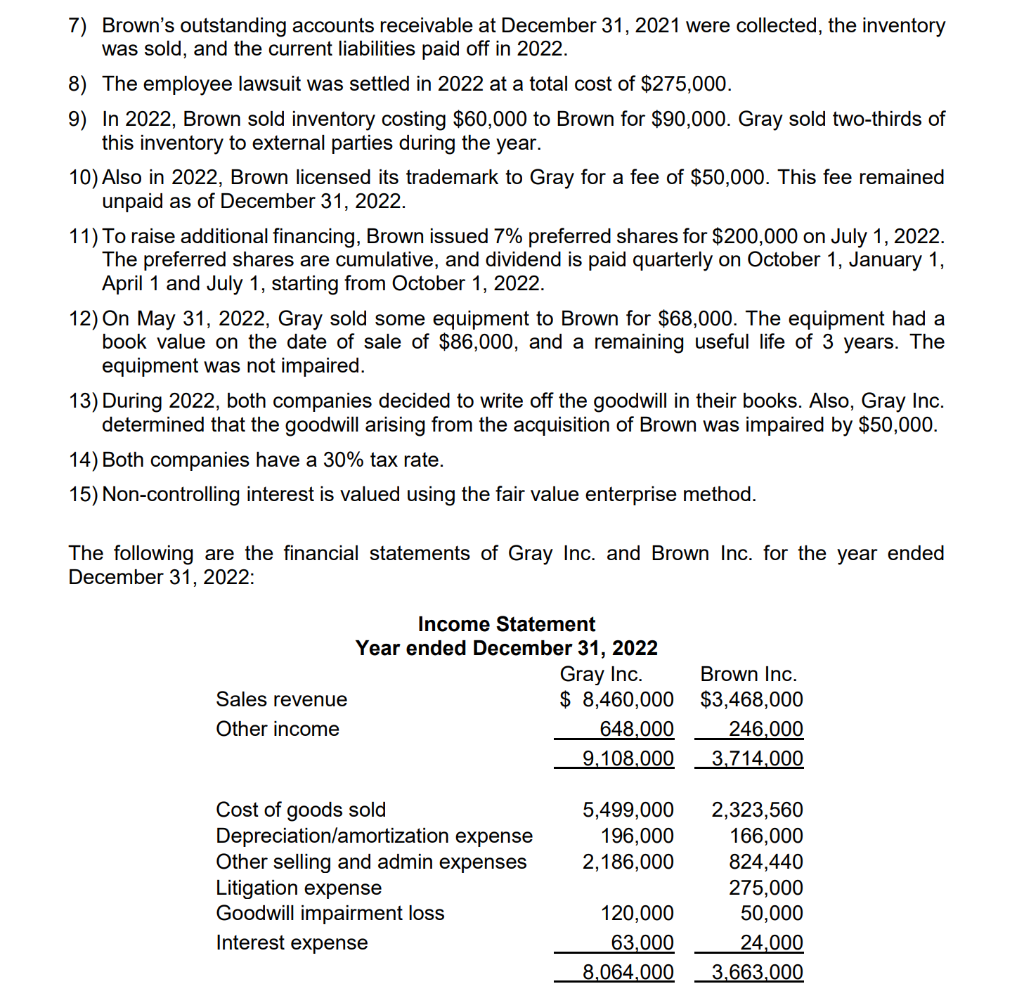

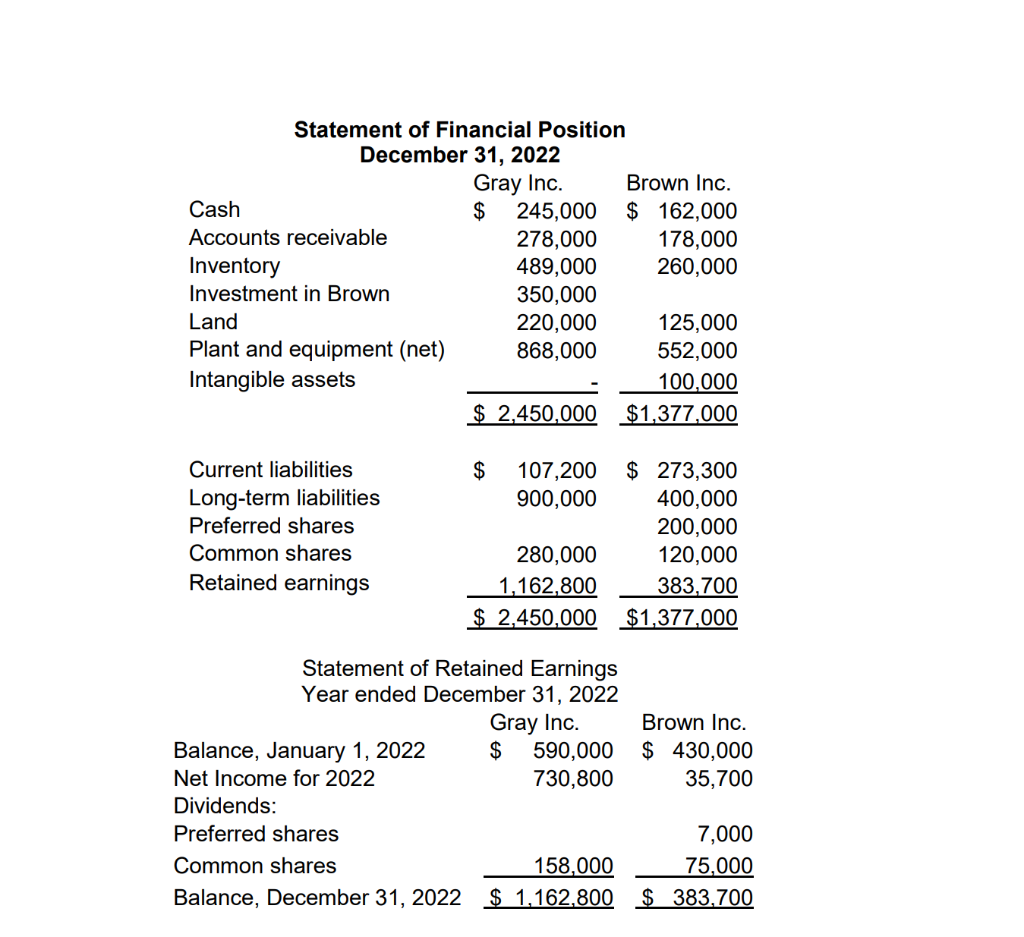

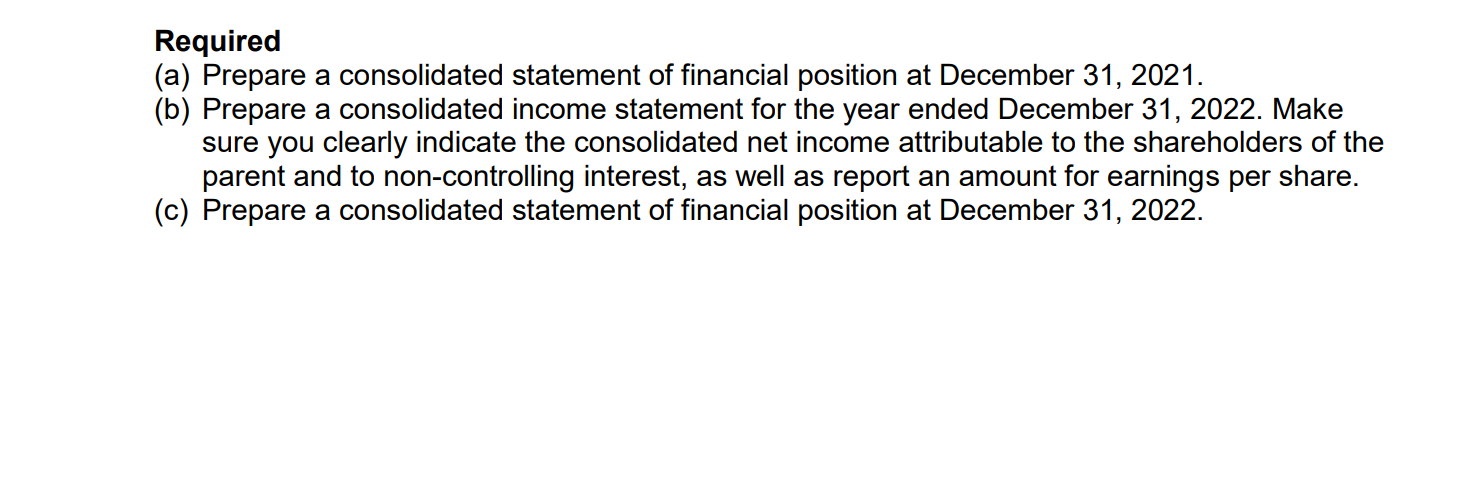

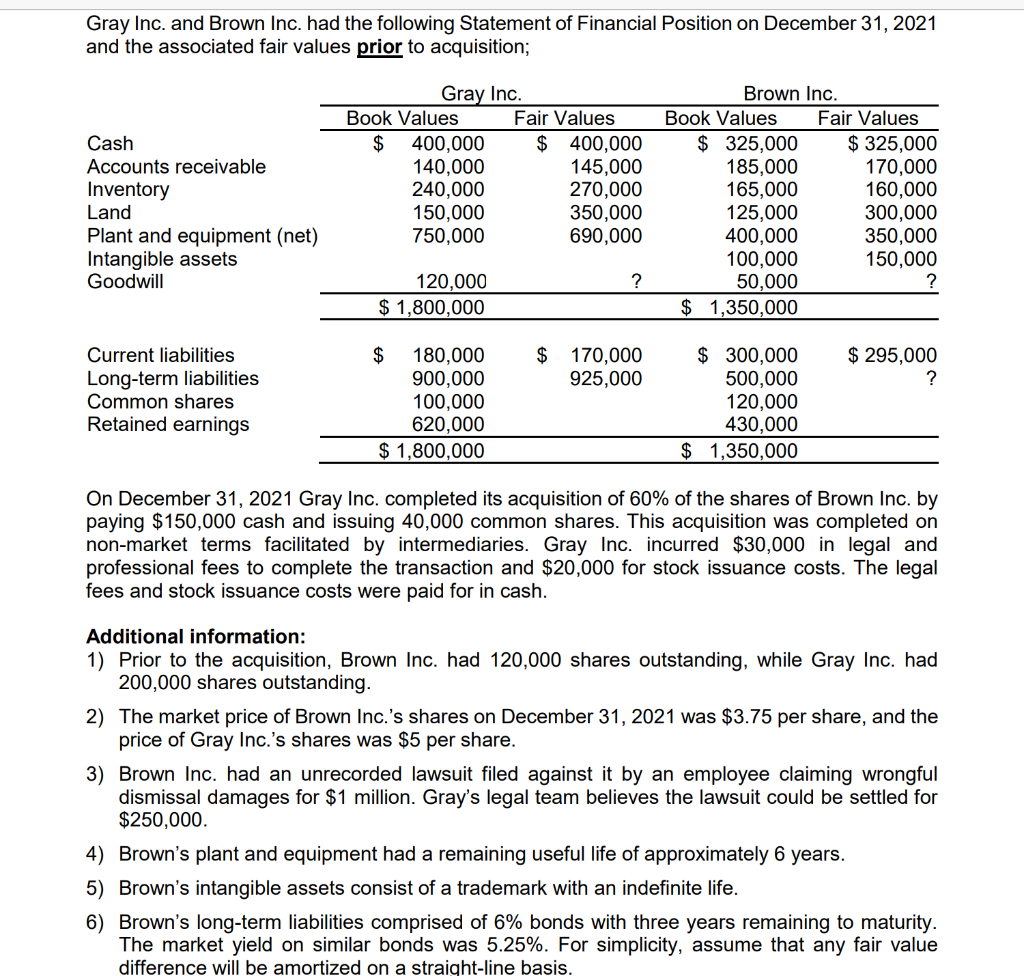

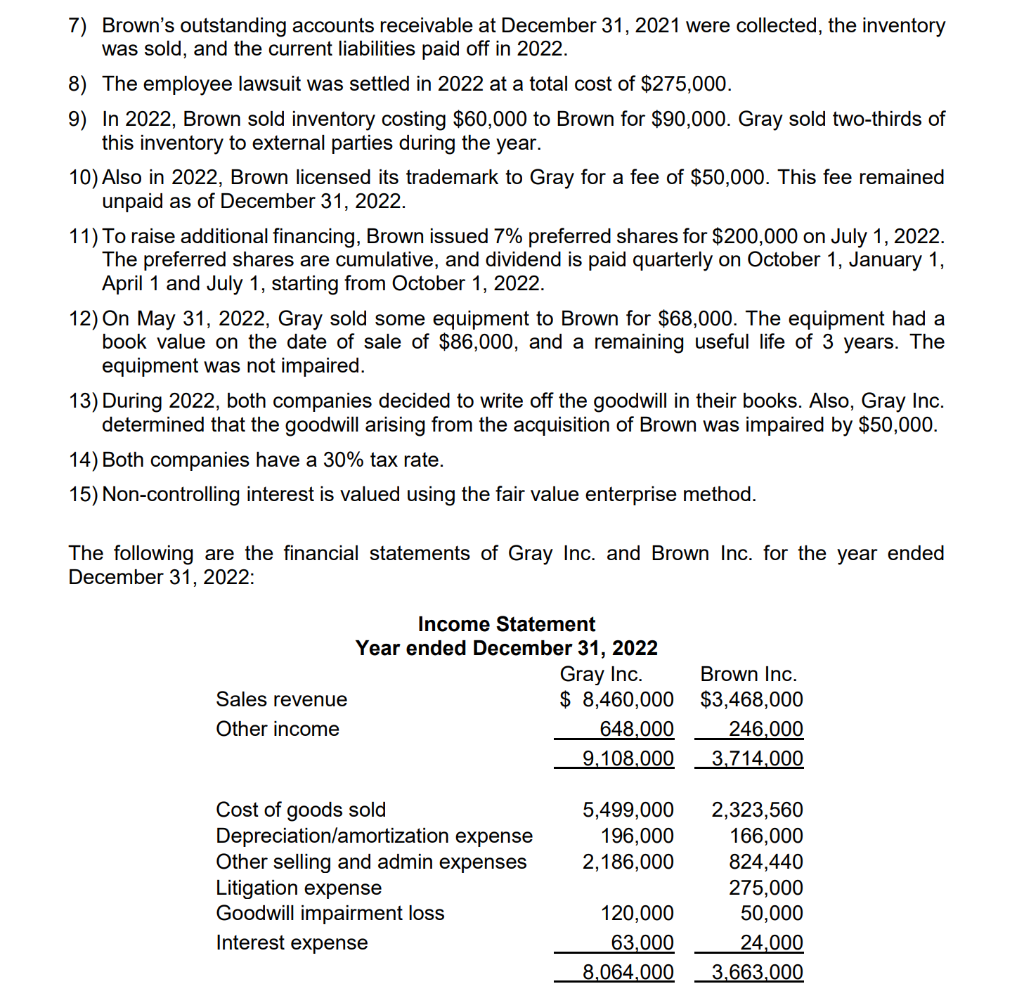

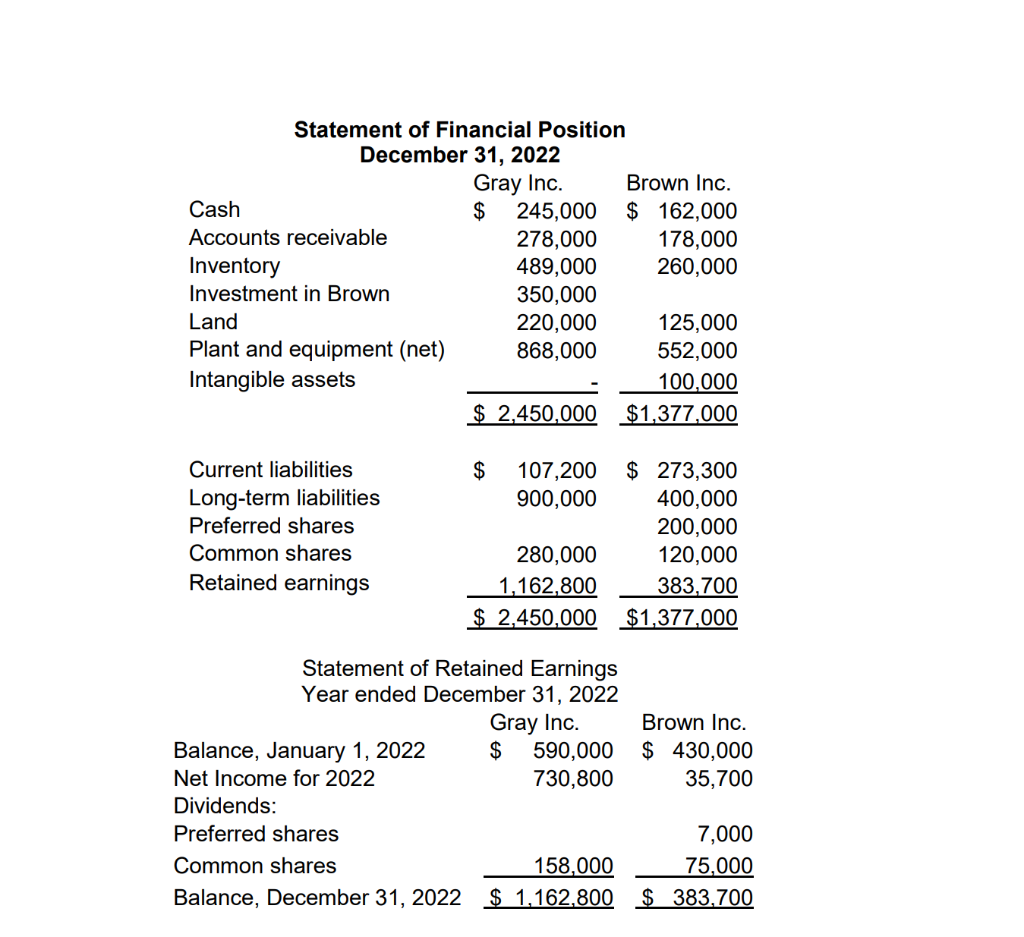

Gray Inc. and Brown Inc. had the following Statement of Financial Position on December 31, 2021 and the associated fair values prior to acquisition; Cash Accounts receivable Inventory Land Plant and equipment (net) Intangible assets Goodwill Gray Inc. Book Values Fair Values $ 400,000 $ 400,000 140,000 145,000 240,000 270,000 150,000 350,000 750,000 690,000 Brown Inc. Book Values Fair Values $ 325,000 $ 325,000 185,000 170,000 165,000 160,000 125,000 300,000 400,000 350,000 100,000 150,000 50,000 $ 1,350,000 ? 120,000 $ 1,800,000 $ 170,000 925,000 $ 295,000 ? Current liabilities Long-term liabilities Common shares Retained earnings $ 180,000 900,000 100,000 620,000 $ 1,800,000 $ 300,000 500,000 120,000 430,000 $ 1,350,000 On December 31, 2021 Gray Inc. completed its acquisition of 60% of the shares of Brown Inc. by paying $150,000 cash and issuing 40,000 common shares. This acquisition was completed on non-market terms facilitated by intermediaries. Gray Inc. incurred $30,000 in legal and professional fees to complete the transaction and $20,000 for stock issuance costs. The legal fees and stock issuance costs were paid for in cash. Additional information: 1) Prior to the acquisition, Brown Inc. had 120,000 shares outstanding, while Gray Inc. had 200,000 shares outstanding. 2) The market price of Brown Inc.'s shares on December 31, 2021 was $3.75 per share, and the price of Gray Inc.'s shares was $5 per share. 3) Brown Inc. had an unrecorded lawsuit filed against it by an employee claiming wrongful dismissal damages for $1 million. Gray's legal team believes the lawsuit could be settled for $250,000. 4) Brown's plant and equipment had a remaining useful life of approximately 6 years. 5) Brown's intangible assets consist of a trademark with an indefinite life. 6) Brown's long-term liabilities comprised of 6% bonds with three years remaining to maturity. The market yield on similar bonds was 5.25%. For simplicity, assume that any fair value difference will be amortized on a straight-line basis. 7) Brown's outstanding accounts receivable at December 31, 2021 were collected, the inventory was sold, and the current liabilities paid off in 2022. 8) The employee lawsuit was settled in 2022 at a total cost of $275,000. 9) In 2022, Brown sold inventory costing $60,000 to Brown for $90,000. Gray sold two-thirds of this inventory to external parties during the year. 10) Also in 2022, Brown licensed its trademark to Gray for a fee of $50,000. This fee remained unpaid as of December 31, 2022. 11) To raise additional financing, Brown issued 7% preferred shares for $200,000 on July 1, 2022. The preferred shares are cumulative, and dividend is paid quarterly on October 1, January 1, April 1 and July 1, starting from October 1, 2022. 12) On May 31, 2022, Gray sold some equipment to Brown for $68,000. The equipment had a book value on the date of sale of $86,000, and a remaining useful life of 3 years. The equipment was not impaired. 13) During 2022, both companies decided to write off the goodwill in their books. Also, Gray Inc. determined that the goodwill arising from the acquisition of Brown was impaired by $50,000. 14) Both companies have a 30% tax rate. 15) Non-controlling interest is valued using the fair value enterprise method. The following are the financial statements of Gray Inc. and Brown Inc. for the year ended December 31, 2022: Income Statement Year ended December 31, 2022 Gray Inc. Sales revenue $ 8,460,000 Other income 648,000 9,108,000 Brown Inc. $3,468,000 246,000 3,714,000 5,499,000 196,000 2,186,000 Cost of goods sold Depreciation/amortization expense Other selling and admin expenses Litigation expense Goodwill impairment loss Interest expense 2,323,560 166,000 824,440 275,000 50,000 24,000 3,663.000 120,000 63,000 8,064,000 Statement of Financial Position December 31, 2022 Gray Inc. Brown Inc. Cash $ 245,000 $ 162,000 Accounts receivable 278,000 178,000 Inventory 489,000 260,000 Investment in Brown 350,000 Land 220,000 125,000 Plant and equipment (net) 868,000 552,000 Intangible assets 100,000 $ 2,450,000 $1,377,000 $ 107,200 900,000 Current liabilities Long-term liabilities Preferred shares Common shares Retained earnings 280,000 1,162,800 $ 2,450,000 $ 273,300 400,000 200,000 120,000 383,700 $1,377,000 Statement of Retained Earnings Year ended December 31, 2022 Gray Inc. Brown Inc. Balance, January 1, 2022 $ 590,000 $ 430,000 Net Income for 2022 730,800 35,700 Dividends: Preferred shares 7,000 Common shares 158,000 75,000 Balance, December 31, 2022 $ 1,162,800 $ 383,700 Required (a) Prepare a consolidated statement of financial position at December 31, 2021. (b) Prepare a consolidated income statement for the year ended December 31, 2022. Make sure you clearly indicate the consolidated net income attributable to the shareholders of the parent and to non-controlling interest, as well as report an amount for earnings per share. (c) Prepare a consolidated statement of financial position at December 31, 2022. Gray Inc. and Brown Inc. had the following Statement of Financial Position on December 31, 2021 and the associated fair values prior to acquisition; Cash Accounts receivable Inventory Land Plant and equipment (net) Intangible assets Goodwill Gray Inc. Book Values Fair Values $ 400,000 $ 400,000 140,000 145,000 240,000 270,000 150,000 350,000 750,000 690,000 Brown Inc. Book Values Fair Values $ 325,000 $ 325,000 185,000 170,000 165,000 160,000 125,000 300,000 400,000 350,000 100,000 150,000 50,000 $ 1,350,000 ? 120,000 $ 1,800,000 $ 170,000 925,000 $ 295,000 ? Current liabilities Long-term liabilities Common shares Retained earnings $ 180,000 900,000 100,000 620,000 $ 1,800,000 $ 300,000 500,000 120,000 430,000 $ 1,350,000 On December 31, 2021 Gray Inc. completed its acquisition of 60% of the shares of Brown Inc. by paying $150,000 cash and issuing 40,000 common shares. This acquisition was completed on non-market terms facilitated by intermediaries. Gray Inc. incurred $30,000 in legal and professional fees to complete the transaction and $20,000 for stock issuance costs. The legal fees and stock issuance costs were paid for in cash. Additional information: 1) Prior to the acquisition, Brown Inc. had 120,000 shares outstanding, while Gray Inc. had 200,000 shares outstanding. 2) The market price of Brown Inc.'s shares on December 31, 2021 was $3.75 per share, and the price of Gray Inc.'s shares was $5 per share. 3) Brown Inc. had an unrecorded lawsuit filed against it by an employee claiming wrongful dismissal damages for $1 million. Gray's legal team believes the lawsuit could be settled for $250,000. 4) Brown's plant and equipment had a remaining useful life of approximately 6 years. 5) Brown's intangible assets consist of a trademark with an indefinite life. 6) Brown's long-term liabilities comprised of 6% bonds with three years remaining to maturity. The market yield on similar bonds was 5.25%. For simplicity, assume that any fair value difference will be amortized on a straight-line basis. 7) Brown's outstanding accounts receivable at December 31, 2021 were collected, the inventory was sold, and the current liabilities paid off in 2022. 8) The employee lawsuit was settled in 2022 at a total cost of $275,000. 9) In 2022, Brown sold inventory costing $60,000 to Brown for $90,000. Gray sold two-thirds of this inventory to external parties during the year. 10) Also in 2022, Brown licensed its trademark to Gray for a fee of $50,000. This fee remained unpaid as of December 31, 2022. 11) To raise additional financing, Brown issued 7% preferred shares for $200,000 on July 1, 2022. The preferred shares are cumulative, and dividend is paid quarterly on October 1, January 1, April 1 and July 1, starting from October 1, 2022. 12) On May 31, 2022, Gray sold some equipment to Brown for $68,000. The equipment had a book value on the date of sale of $86,000, and a remaining useful life of 3 years. The equipment was not impaired. 13) During 2022, both companies decided to write off the goodwill in their books. Also, Gray Inc. determined that the goodwill arising from the acquisition of Brown was impaired by $50,000. 14) Both companies have a 30% tax rate. 15) Non-controlling interest is valued using the fair value enterprise method. The following are the financial statements of Gray Inc. and Brown Inc. for the year ended December 31, 2022: Income Statement Year ended December 31, 2022 Gray Inc. Sales revenue $ 8,460,000 Other income 648,000 9,108,000 Brown Inc. $3,468,000 246,000 3,714,000 5,499,000 196,000 2,186,000 Cost of goods sold Depreciation/amortization expense Other selling and admin expenses Litigation expense Goodwill impairment loss Interest expense 2,323,560 166,000 824,440 275,000 50,000 24,000 3,663.000 120,000 63,000 8,064,000 Statement of Financial Position December 31, 2022 Gray Inc. Brown Inc. Cash $ 245,000 $ 162,000 Accounts receivable 278,000 178,000 Inventory 489,000 260,000 Investment in Brown 350,000 Land 220,000 125,000 Plant and equipment (net) 868,000 552,000 Intangible assets 100,000 $ 2,450,000 $1,377,000 $ 107,200 900,000 Current liabilities Long-term liabilities Preferred shares Common shares Retained earnings 280,000 1,162,800 $ 2,450,000 $ 273,300 400,000 200,000 120,000 383,700 $1,377,000 Statement of Retained Earnings Year ended December 31, 2022 Gray Inc. Brown Inc. Balance, January 1, 2022 $ 590,000 $ 430,000 Net Income for 2022 730,800 35,700 Dividends: Preferred shares 7,000 Common shares 158,000 75,000 Balance, December 31, 2022 $ 1,162,800 $ 383,700 Required (a) Prepare a consolidated statement of financial position at December 31, 2021. (b) Prepare a consolidated income statement for the year ended December 31, 2022. Make sure you clearly indicate the consolidated net income attributable to the shareholders of the parent and to non-controlling interest, as well as report an amount for earnings per share. (c) Prepare a consolidated statement of financial position at December 31, 2022