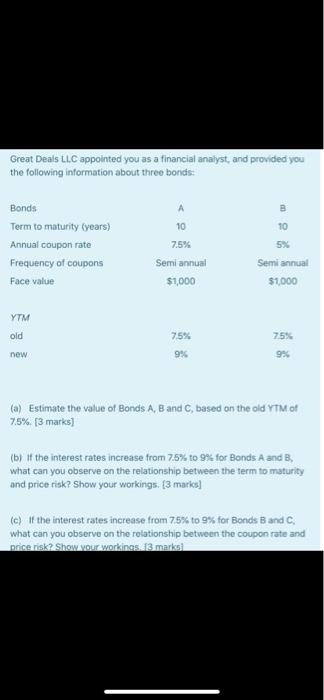

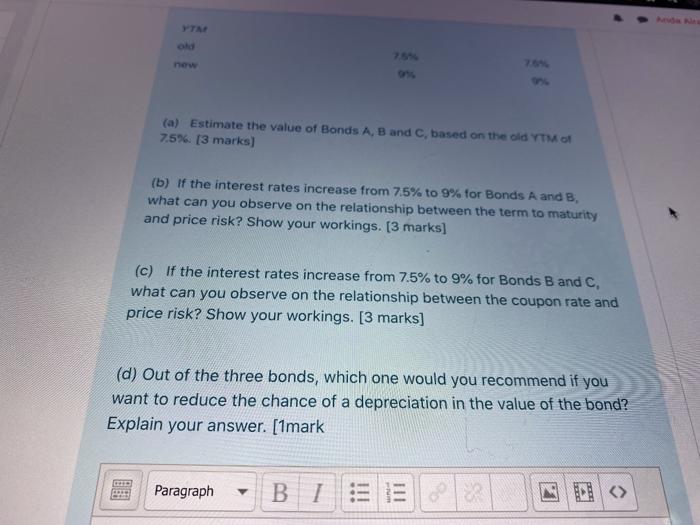

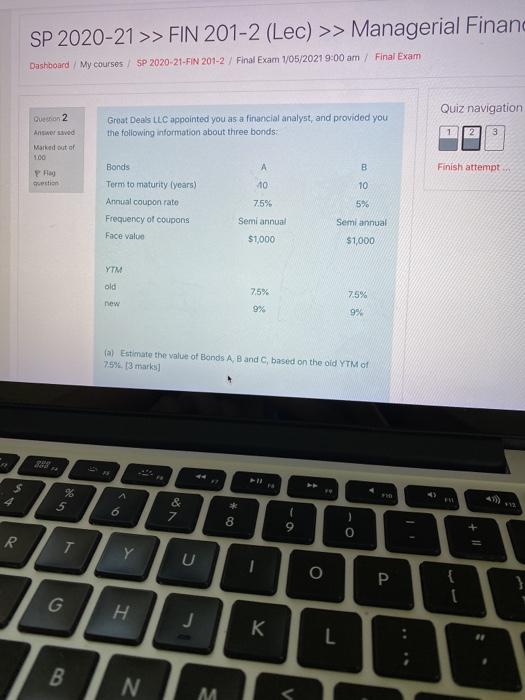

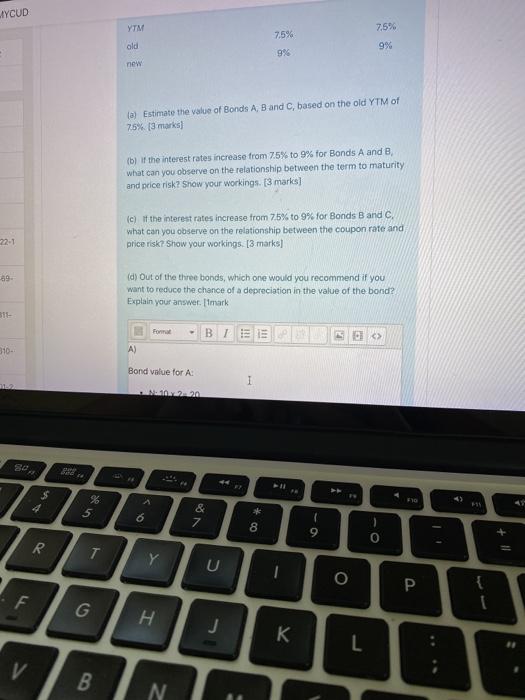

Great Deals LLC appointed you as a financial analyst, and provided you the following information about three bonds: A B 10 Bonds Term to maturity (years) Annual coupon rate Frequency of coupons Face value 7.5% 10 5% Semiannual Semi annual $1,000 $1,000 YTM old 75% 9% 75% 9% new (a) Estimate the value of Bonds A, B and C, based on the old YTM of 7.5% [3 marks) (b) of the interest rates increase from 7.5% to 9% for Bonds A and B, what can you observe on the relationship between the term to maturity and price risk? Show your workings. [3 marks] (c) of the interest rates increase from 75% to 9% for Bonds B and C. what can you observe on the relationship between the coupon rate and mirikShow our workines marka (a) Estimate the value of Bonds A, B and C, based on the old YTM 7.5% [3 marks) (b) If the interest rates increase from 7.5% to 9% for Bonds A and B, what can you observe on the relationship between the term to maturity and price risk? Show your workings. [3 marks] (c) If the interest rates increase from 7.5% to 9% for Bonds B and C, what can you observe on the relationship between the coupon rate and price risk? Show your workings. [3 marks] (d) Out of the three bonds, which one would you recommend if you want to reduce the chance of a depreciation in the value of the bond? Explain your answer. [1mark Paragraph BI ... III III CO SP 2020-21 >> FIN 201-2 (Lec) >> Managerial Finand Dashboard My courses SP 2020-21-FIN 201-2/ Final Exam 1/05/20219:00 am/ Final Exam Quiz navigation Question 2 Antigrad Great Deals LLC appointed you as a financial analyst, and provided you the following information about three bonds: 3 Marked out of 100 B Finish attempt PRO 10 Bonds Term to maturity (years) Annual coupon rato Frequency of coupons Face value 10 7.5% 5% Semi annual Semiannual $1,000 $1,000 YTM old 75% new 7.5% 99. 9% (a) Estimate the value of Bonds A B and C, based on the old YTM of 75%.3 mars % 4 EN 5 7 * o 9 0 R T Y U o { G H 1 L B N M YCUD YTM 7.59 7.5% old 9% 9% now a) Estimate the value of Bonds A, B and C, based on the old YTM of 75% [3 marks) (b) if the interest rates increase from 7.5% to 9% for Bonds A and B what can you observe on the relationship between the term to maturity and price risk? Show your workings. [3 marks] c) If the interest rates increase from 75% to 9% for Bonds B and C. what can you observe on the relationship between the coupon rate and price risk? Show your workings. [3 marks) 22-1 89. (d) Out of the three bonds, which one would you recommend if you want to reduce the chance of a depreciation in the value of the bond? Explain your answer. Ifmark Forma BI 110- A) Bond value for A 220 re 4 $ & A 50 % 5 6 & 7 8 0 R T Y U O F G J L V B N Great Deals LLC appointed you as a financial analyst, and provided you the following information about three bonds: A B 10 Bonds Term to maturity (years) Annual coupon rate Frequency of coupons Face value 7.5% 10 5% Semiannual Semi annual $1,000 $1,000 YTM old 75% 9% 75% 9% new (a) Estimate the value of Bonds A, B and C, based on the old YTM of 7.5% [3 marks) (b) of the interest rates increase from 7.5% to 9% for Bonds A and B, what can you observe on the relationship between the term to maturity and price risk? Show your workings. [3 marks] (c) of the interest rates increase from 75% to 9% for Bonds B and C. what can you observe on the relationship between the coupon rate and mirikShow our workines marka (a) Estimate the value of Bonds A, B and C, based on the old YTM 7.5% [3 marks) (b) If the interest rates increase from 7.5% to 9% for Bonds A and B, what can you observe on the relationship between the term to maturity and price risk? Show your workings. [3 marks] (c) If the interest rates increase from 7.5% to 9% for Bonds B and C, what can you observe on the relationship between the coupon rate and price risk? Show your workings. [3 marks] (d) Out of the three bonds, which one would you recommend if you want to reduce the chance of a depreciation in the value of the bond? Explain your answer. [1mark Paragraph BI ... III III CO SP 2020-21 >> FIN 201-2 (Lec) >> Managerial Finand Dashboard My courses SP 2020-21-FIN 201-2/ Final Exam 1/05/20219:00 am/ Final Exam Quiz navigation Question 2 Antigrad Great Deals LLC appointed you as a financial analyst, and provided you the following information about three bonds: 3 Marked out of 100 B Finish attempt PRO 10 Bonds Term to maturity (years) Annual coupon rato Frequency of coupons Face value 10 7.5% 5% Semi annual Semiannual $1,000 $1,000 YTM old 75% new 7.5% 99. 9% (a) Estimate the value of Bonds A B and C, based on the old YTM of 75%.3 mars % 4 EN 5 7 * o 9 0 R T Y U o { G H 1 L B N M YCUD YTM 7.59 7.5% old 9% 9% now a) Estimate the value of Bonds A, B and C, based on the old YTM of 75% [3 marks) (b) if the interest rates increase from 7.5% to 9% for Bonds A and B what can you observe on the relationship between the term to maturity and price risk? Show your workings. [3 marks] c) If the interest rates increase from 75% to 9% for Bonds B and C. what can you observe on the relationship between the coupon rate and price risk? Show your workings. [3 marks) 22-1 89. (d) Out of the three bonds, which one would you recommend if you want to reduce the chance of a depreciation in the value of the bond? Explain your answer. Ifmark Forma BI 110- A) Bond value for A 220 re 4 $ & A 50 % 5 6 & 7 8 0 R T Y U O F G J L V B N