Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Great Harvest Logistics Ltd is a fully-equity-funded company with a market value of $650 million and five million shares outstanding. The company's CFO Lewis

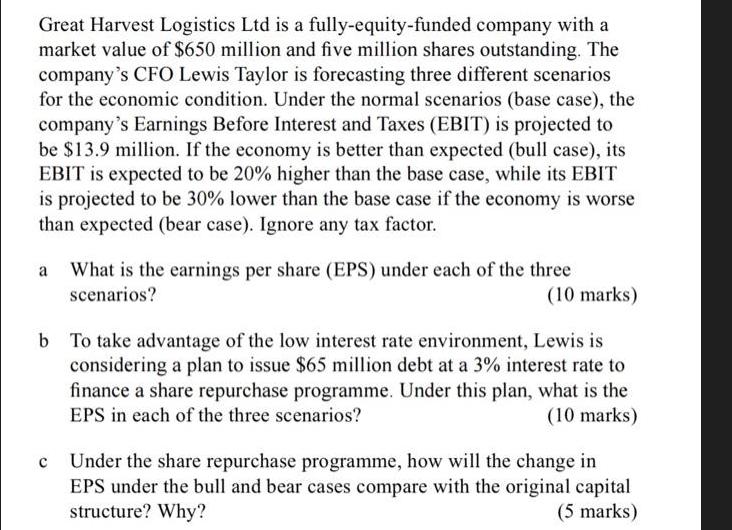

Great Harvest Logistics Ltd is a fully-equity-funded company with a market value of $650 million and five million shares outstanding. The company's CFO Lewis Taylor is forecasting three different scenarios for the economic condition. Under the normal scenarios (base case), the company's Earnings Before Interest and Taxes (EBIT) is projected to be $13.9 million. If the economy is better than expected (bull case), its EBIT is expected to be 20% higher than the base case, while its EBIT is projected to be 30% lower than the base case if the economy is worse than expected (bear case). Ignore any tax factor. What is the earnings per share (EPS) under each of the three scenarios? (10 marks) b To take advantage of the low interest rate environment, Lewis is considering a plan to issue $65 million debt at a 3% interest rate to finance a share repurchase programme. Under this plan, what is the EPS in each of the three scenarios? (10 marks) Under the share repurchase programme, how will the change in EPS under the bull and bear cases compare with the original capital structure? Why? (5 marks)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the earnings per share EPS under each of the three scenarios Base case EPS EBIT Numbe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started