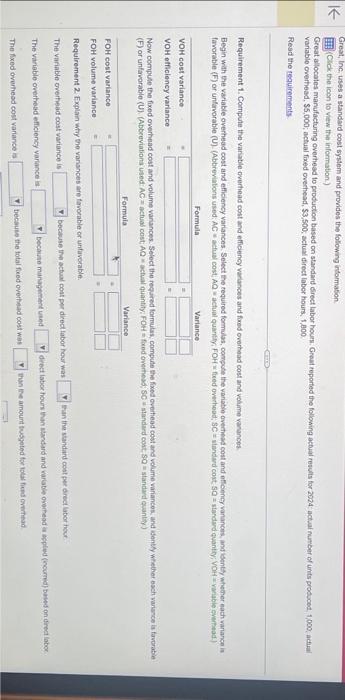

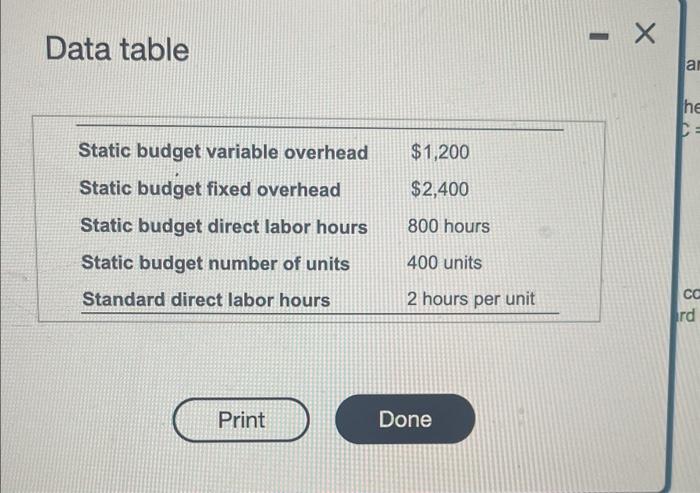

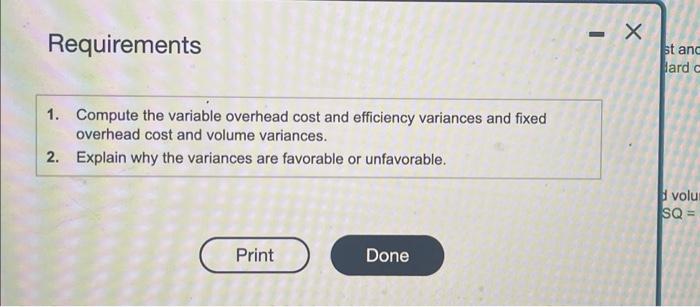

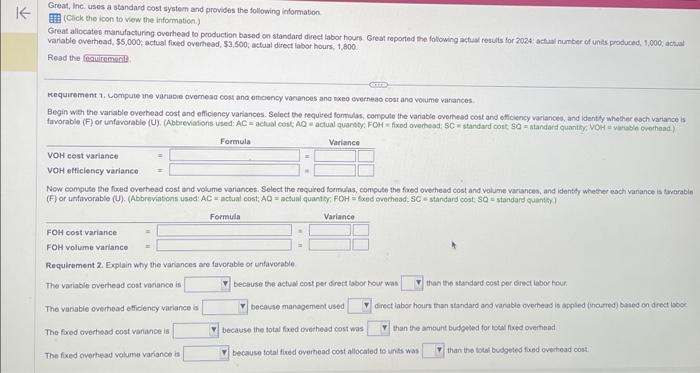

Great, Inc, uses a standard cost system and provides the following information (Clok the icon to view the information) Great allocotes manufacturing overhead to production based on standard Erect labor houn. Great reported the following actual resulls for 2024 actual mumber of unts produced. 1,000 , actial variable overhead, $5,000; actual fixed ovechead, $3,500, actual direct laber hours, 1,800 Resd the requirements Requirement 1. Compute the varable overhead cost and efficency verances and ford ovortead cost and velume varances Requirement 2. Explan why te varisnoes are tavomable or urfaverable. The variable overfead cost variance is beckuse the actual coat per drect tabor hour was dreat iaboc houn than itandard and variable ovipeod ia sppted (noumed) bawed on cret labor The variable overthead efficiency vartance is The fixed overheod cost variance is becaues the total ficed overthad cost was Data table Requirements 1. Compute the variable overhead cost and efficiency variances and fixed overhead cost and volume variances. 2. Explain why the variances are favorable or unfavorable. Great, Inci uses a standard cost system and provides the following information Will (Cick the ioon to view the infomation.) Great allocates manufacturing ovorhead to production based on standard direct labor hours. Great reported the following achual results for zoas: actuai number of units produced, 1,000, achat varlable overhead, $5,000, actual fored overhead, $3,500, actual direct labar hours, 1,800 Read the kequirement 7. Lompute the variabe overnead cost and emcency vanances ano nxeq overnead coat ano vorume vanances Begin with the variable overhead cost and efficiency variances. Select the fequited formulas, compole the variable overted cost and officiency variances, and identty whedrer each variance is Now conpute the foxed overhead cost and volume variances. Select the required formulas, compote the fixed ovemhead cost and volume varances, and idents whether each vanance is tararabin Requirement 2. Explain why the variances are favorable or unfavorable. The variabio overhead cost variance is The varabie overthead efficiency variance is The fored overtoed cost variance is because the total fixed crothesd cost was than the amount budgwed for tocel fxed onerthead The foxed cvorheat volume varianoe is because tocal fiked overtead cost allocaled to unts was than the tolal budgeted fored ovortoad cost