Answered step by step

Verified Expert Solution

Question

1 Approved Answer

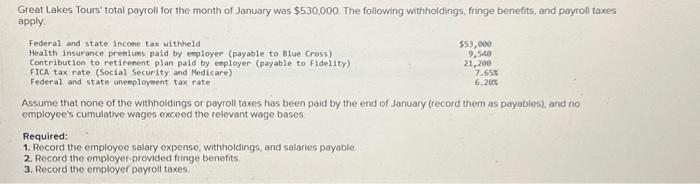

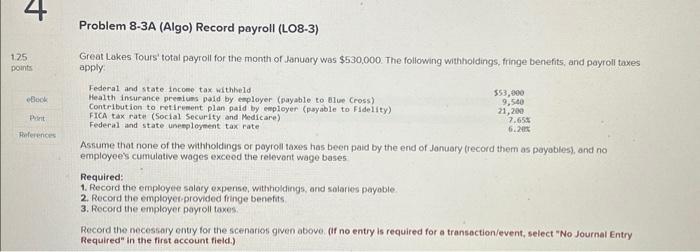

Great Lakes Tours' total payroll for the month of January was $530,000. The following withholdings, fringe benefits, and payroll taxes apply: Federal and state income

Great Lakes Tours' total payroll for the month of January was $530,000. The following withholdings, fringe benefits, and payroll taxes apply: Federal and state income tax withheld Health insurance premiums paid by employer (payable to Blue Cross) Contribution to retirement plan paid by employer (payable to Fidelity) FICA tax rate (Social Security and Medicare) Federal and state unemployment tax rate $53,000 9,540 21,200 Required: 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes. 7.65% 6.20% Assume that none of the withholdings or payroll taxes has been paid by the end of January (record them as payables), and no employee's cumulative wages exceed the relevant wage bases.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started