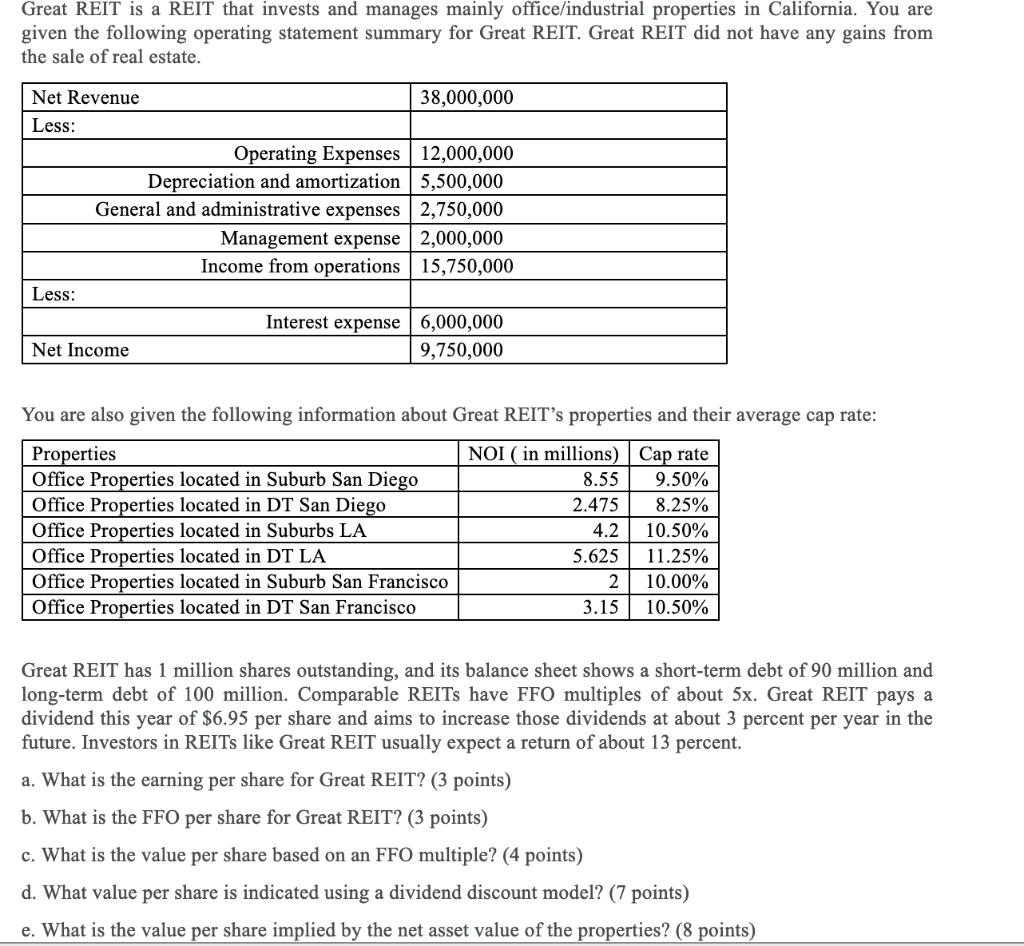

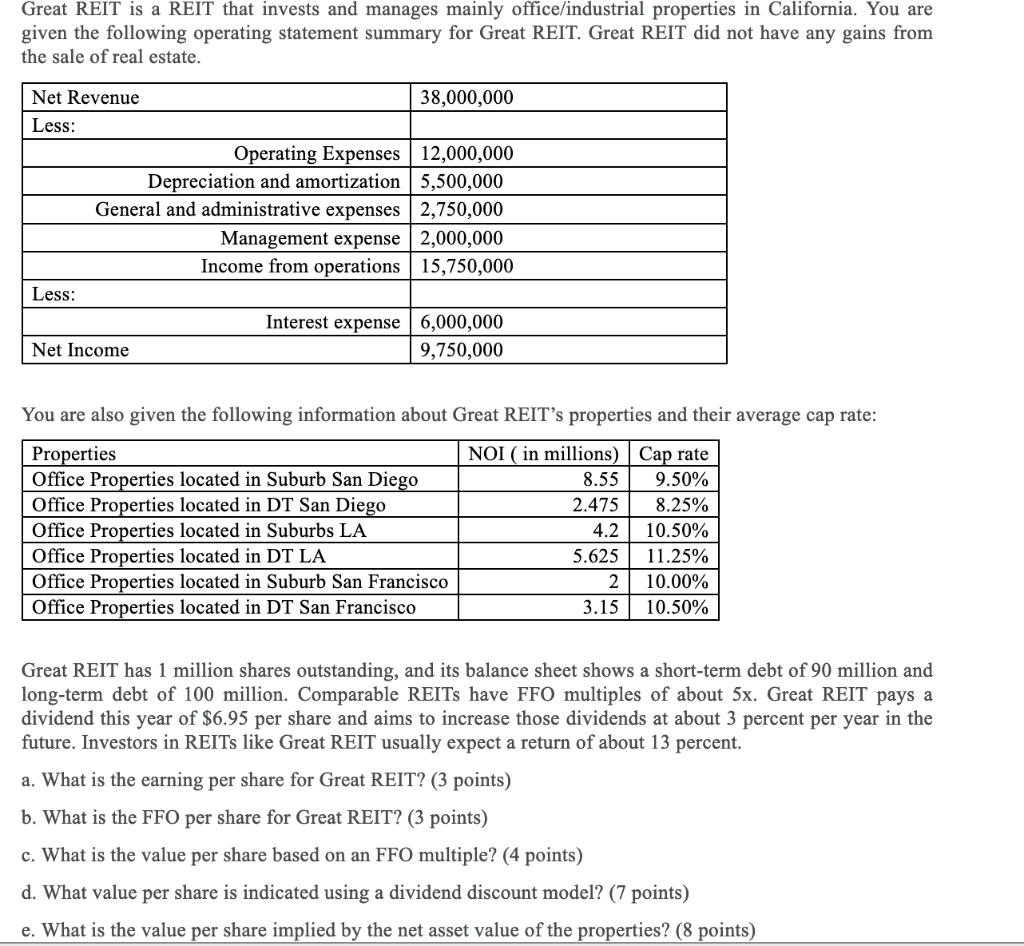

Great REIT is a REIT that invests and manages mainly office/industrial properties in California. You are given the following operating statement summary for Great REIT. Great REIT did not have any gains from the sale of real estate. Net Revenue 38,000,000 Less: Operating Expenses 12,000,000 Depreciation and amortization 5,500,000 General and administrative expenses 2,750,000 Management expense 2,000,000 Income from operations 15,750,000 Less: Interest expense 6,000,000 Net Income 9,750,000 You are also given the following information about Great REIT's properties and their average cap rate: Properties NOI ( in millions) Cap rate Office Properties located in Suburb San Diego 8.55 9.50% Office Properties located in DT San Diego 2.475 8.25% Office Properties located in Suburbs LA 4.2 10.50% Office Properties located in DT LA 5.625 11.25% Office Properties located in Suburb San Francisco 2 10.00% Office Properties located in DT San Francisco 3.15 10.50% Great REIT has 1 million shares outstanding, and its balance sheet shows a short-term debt of 90 million and long-term debt of 100 million. Comparable REITs have FFO multiples of about 5x. Great REIT pays a dividend this year of $6.95 per share and aims to increase those dividends at about 3 percent per year in the future. Investors in REITs like Great REIT usually expect a return of about 13 percent. a. What is the earning per share for Great REIT? (3 points) b. What is the FFO per share for Great REIT? (3 points) c. What is the value per share based on an FFO multiple? (4 points) d. What value per share is indicated using a dividend discount model? (7 points) e. What is the value per share implied by the net asset value of the properties? (8 points) Great REIT is a REIT that invests and manages mainly office/industrial properties in California. You are given the following operating statement summary for Great REIT. Great REIT did not have any gains from the sale of real estate. Net Revenue 38,000,000 Less: Operating Expenses 12,000,000 Depreciation and amortization 5,500,000 General and administrative expenses 2,750,000 Management expense 2,000,000 Income from operations 15,750,000 Less: Interest expense 6,000,000 Net Income 9,750,000 You are also given the following information about Great REIT's properties and their average cap rate: Properties NOI ( in millions) Cap rate Office Properties located in Suburb San Diego 8.55 9.50% Office Properties located in DT San Diego 2.475 8.25% Office Properties located in Suburbs LA 4.2 10.50% Office Properties located in DT LA 5.625 11.25% Office Properties located in Suburb San Francisco 2 10.00% Office Properties located in DT San Francisco 3.15 10.50% Great REIT has 1 million shares outstanding, and its balance sheet shows a short-term debt of 90 million and long-term debt of 100 million. Comparable REITs have FFO multiples of about 5x. Great REIT pays a dividend this year of $6.95 per share and aims to increase those dividends at about 3 percent per year in the future. Investors in REITs like Great REIT usually expect a return of about 13 percent. a. What is the earning per share for Great REIT? (3 points) b. What is the FFO per share for Great REIT? (3 points) c. What is the value per share based on an FFO multiple? (4 points) d. What value per share is indicated using a dividend discount model? (7 points) e. What is the value per share implied by the net asset value of the properties? (8 points)