Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gamestart is a videogame retailer that operates mainly in the US. The company has issued common stock equity, partly owned by institutional investors, and

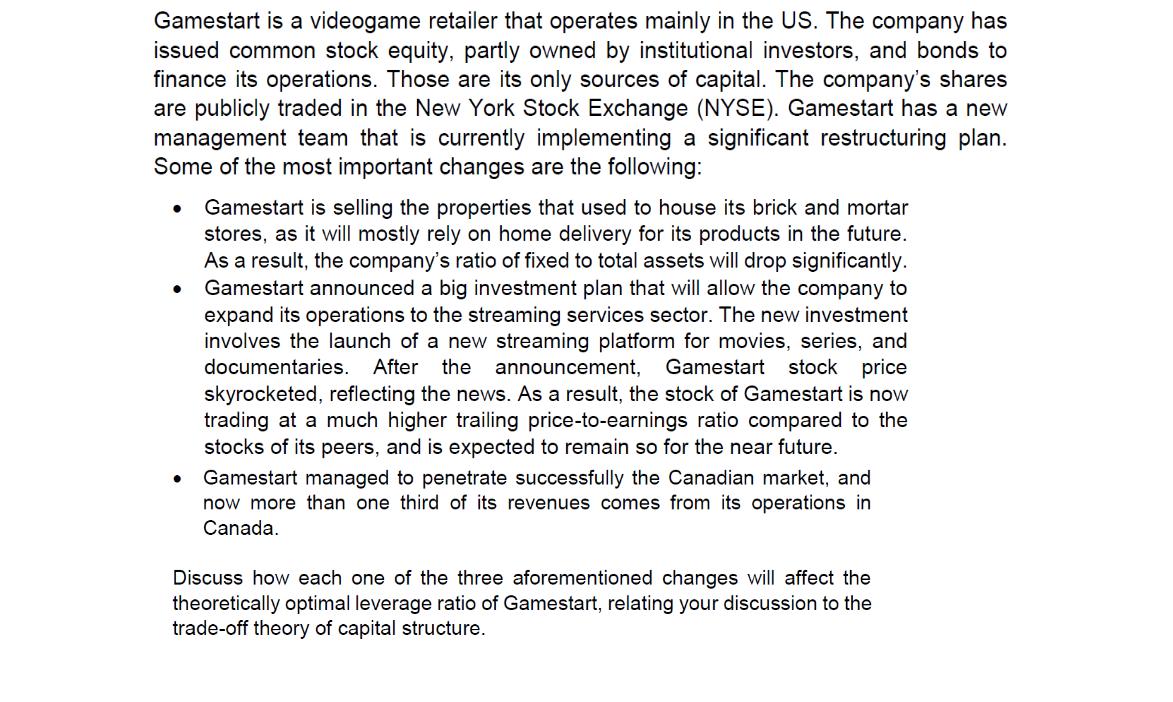

Gamestart is a videogame retailer that operates mainly in the US. The company has issued common stock equity, partly owned by institutional investors, and bonds to finance its operations. Those are its only sources of capital. The company's shares are publicly traded in the New York Stock Exchange (NYSE). Gamestart has a new management team that is currently implementing a significant restructuring plan. Some of the most important changes are the following: Gamestart is selling the properties that used to house its brick and mortar stores, as it will mostly rely on home delivery for its products in the future. As a result, the company's ratio of fixed to total assets will drop significantly. Gamestart announced a big investment plan that will allow the company to expand its operations to the streaming services sector. The new investment involves the launch of a new streaming platform for movies, series, and documentaries. After the announcement, Gamestart stock price skyrocketed, reflecting the news. As a result, the stock of Gamestart is now trading at a much higher trailing price-to-earnings ratio compared to the stocks of its peers, and is expected to remain so for the near future. Gamestart managed to penetrate successfully the Canadian market, and now more than one third of its revenues comes from its operations in Canada. Discuss how each one of the three aforementioned changes will affect the theoretically optimal leverage ratio of Gamestart, relating your discussion to the trade-off theory of capital structure.

Step by Step Solution

★★★★★

3.53 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The changes that Gam est art is making will likely lead to a decrease in its optimal leverage ratio This is because the company will have fewer assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started