Answered step by step

Verified Expert Solution

Question

1 Approved Answer

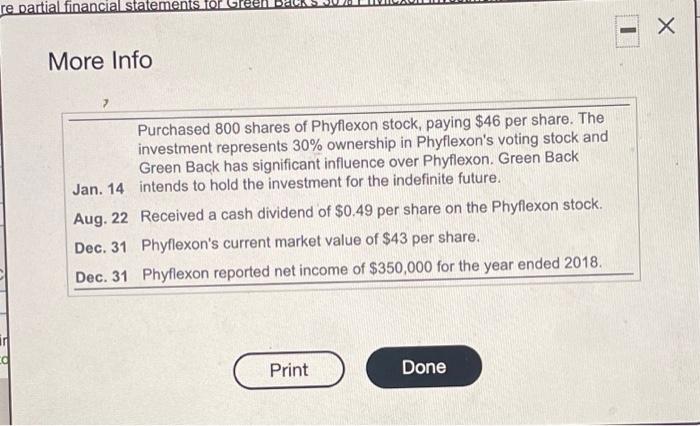

Green Back Investments completed the following transactions during 2018: (Click the icon to view the transactions.) Requirements 1. Journalize Green Back's transactions. Explanations are

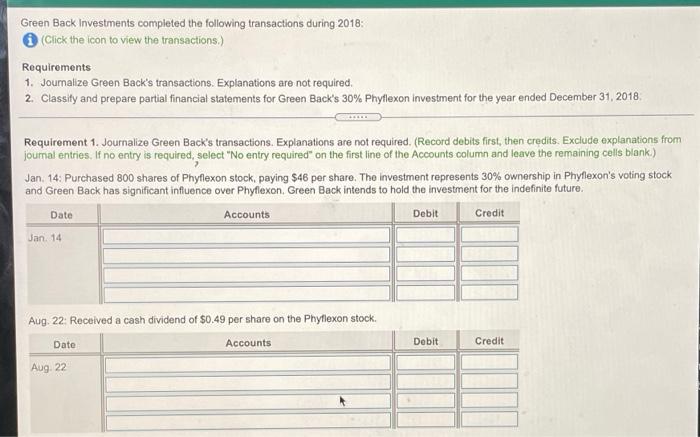

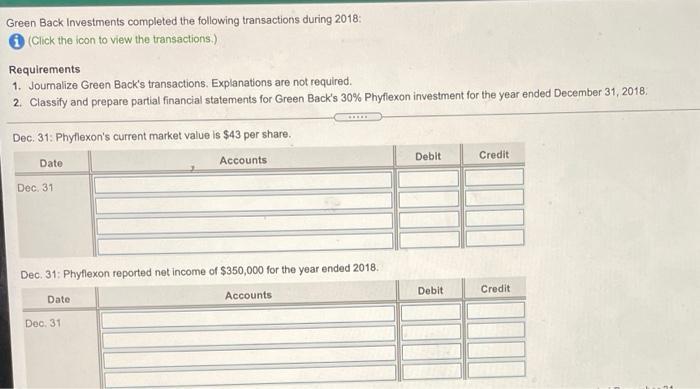

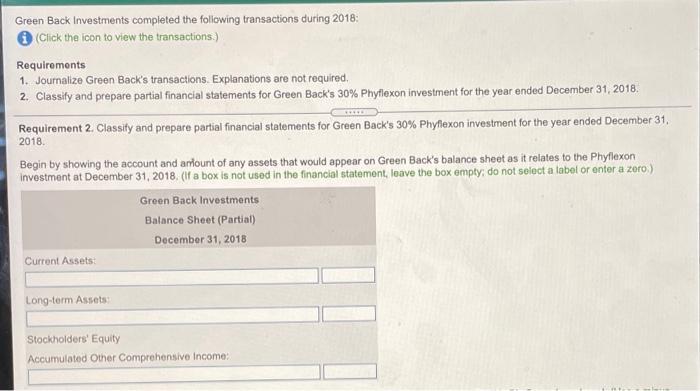

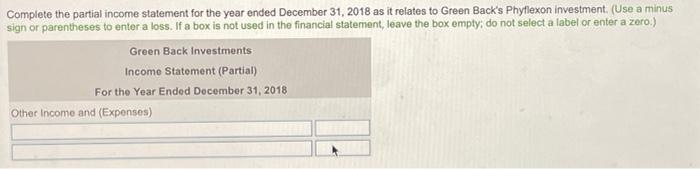

Green Back Investments completed the following transactions during 2018: (Click the icon to view the transactions.) Requirements 1. Journalize Green Back's transactions. Explanations are not required. 2. Classify and prepare partial financial statements for Green Back's 30% Phyflexon investment for the year ended December 31, 2018. Requirement 1. Journalize Green Back's transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. If no entry is required, select "No entry required" on the first line of the Accounts column and leave the remaining cells blank.) Jan. 14: Purchased 800 shares of Phyflexon stock, paying $46 per share. The investment represents 30% ownership in Phyflexon's voting stock and Green Back has significant influence over Phyflexon. Green Back intends to hold the investment for the indefinite future. Date Jan. 14 Accounts Aug. 22: Received a cash dividend of $0.49 per share on the Phyflexon stock. Date Aug. 22 Accounts Debit Credit Debit Credit Green Back Investments completed the following transactions during 2018: (Click the icon to view the transactions.) Requirements 1. Journalize Green Back's transactions. Explanations are not required. 2. Classify and prepare partial financial statements for Green Back's 30% Phyflexon investment for the year ended December 31, 2018. Dec. 31: Phyflexon's current market value is $43 per share. Date Dec. 31 Accounts Dec. 31: Phyflexon reported net income of $350,000 for the year ended 2018. Date Dec. 31 Accounts Debit Credit Debit Credit Green Back Investments completed the following transactions during 2018: (Click the icon to view the transactions.) Requirements 1. Journalize Green Back's transactions. Explanations are not required. 2. Classify and prepare partial financial statements for Green Back's 30% Phyflexon investment for the year ended December 31, 2018. Requirement 2. Classify and prepare partial financial statements for Green Back's 30% Phyflexon investment for the year ended December 31, 2018. Begin by showing the account and anlount of any assets that would appear on Green Back's balance sheet as it relates to the Phyflexon investment at December 31, 2018. (If a box is not used in the financial statement, leave the box empty; do not select a label or enter a zero.) Current Assets: Long-term Assets: Green Back Investments Balance Sheet (Partial) December 31, 2018 Stockholders' Equity Accumulated Other Comprehensive Income: Complete the partial income statement for the year ended December 31, 2018 as it relates to Green Back's Phyflexon investment. (Use a minus sign or parentheses to enter a loss. If a box is not used in the financial statement, leave the box empty; do not select a label or enter a zero.) Green Back Investments Income Statement (Partial) For the Year Ended December 31, 2018 Other Income and (Expenses) re partial financial statements for More Info Jan. 14 Aug. 22 Dec. 31 Purchased 800 shares of Phyflexon stock, paying $46 per share. The investment represents 30% ownership in Phyflexon's voting stock and Green Back has significant influence over Phyflexon. Green Back intends to hold the investment for the indefinite future. Received a cash dividend of $0.49 per share on the Phyflexon stock. Phyflexon's current market value of $43 per share. Dec. 31 Phyflexon reported net income of $350,000 for the year ended 2018. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started