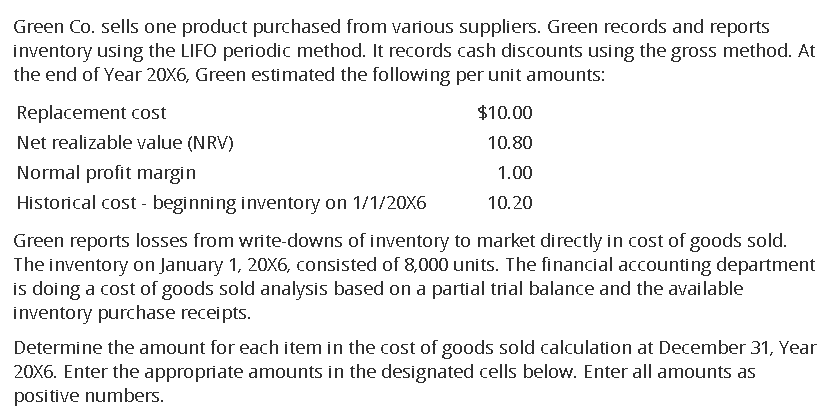

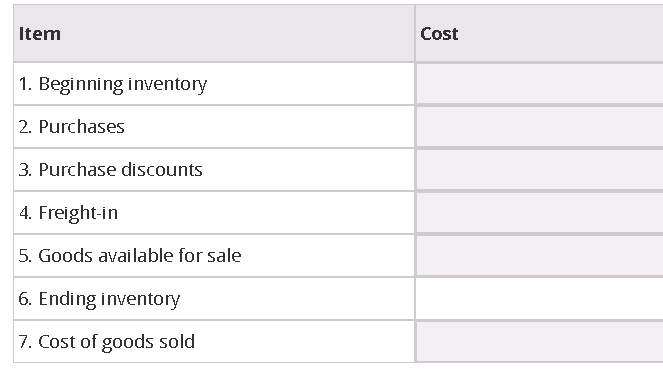

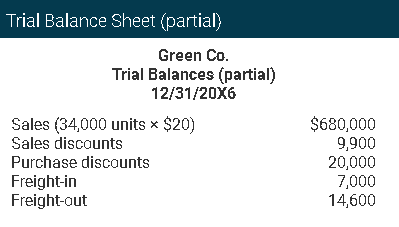

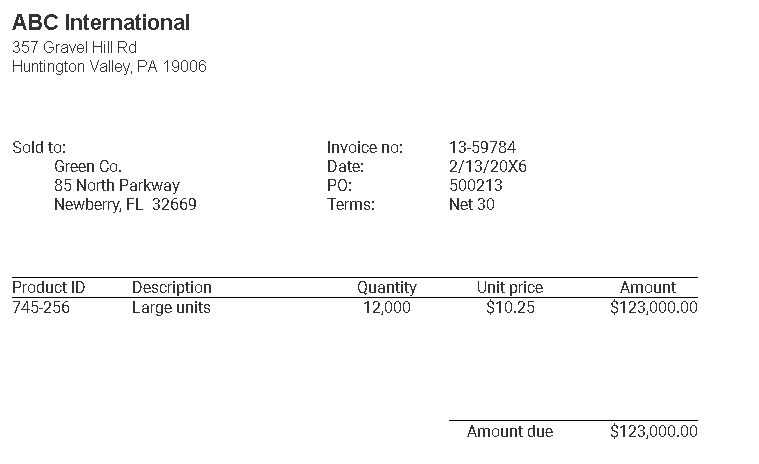

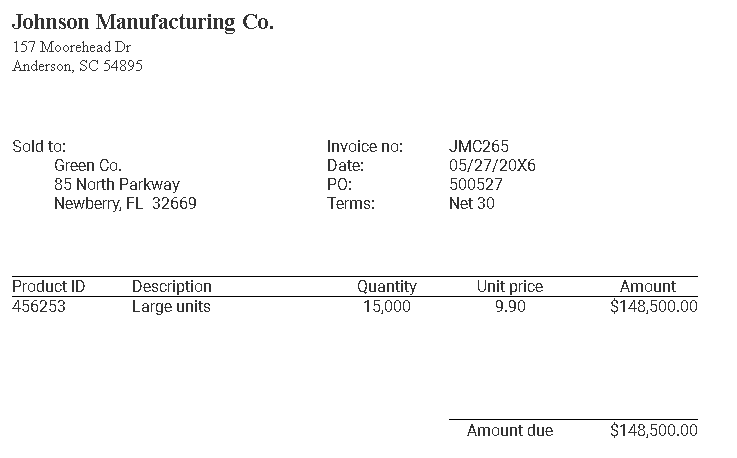

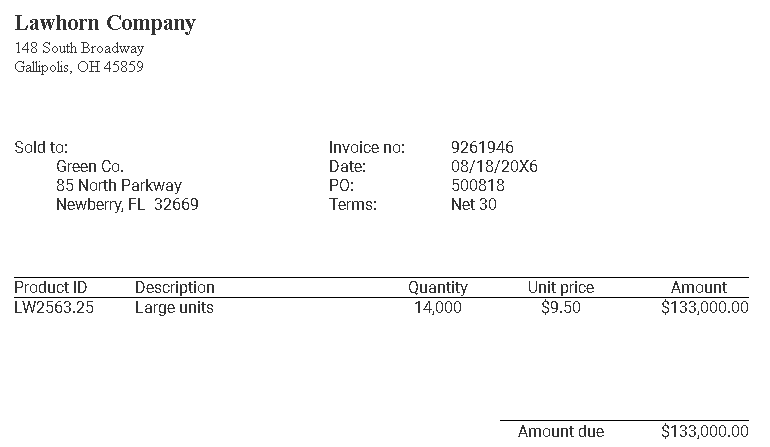

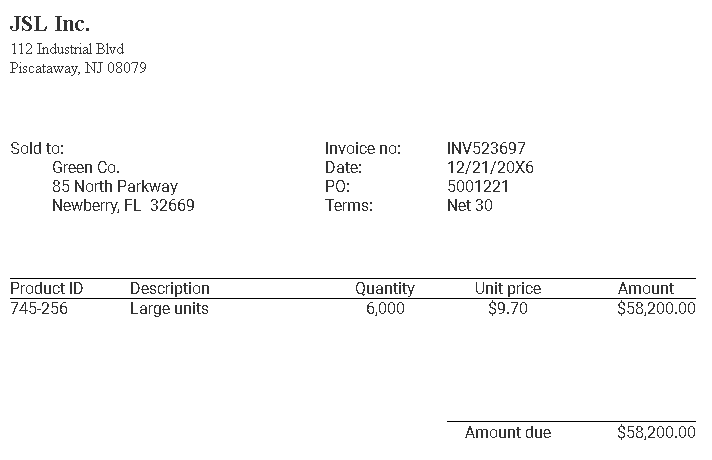

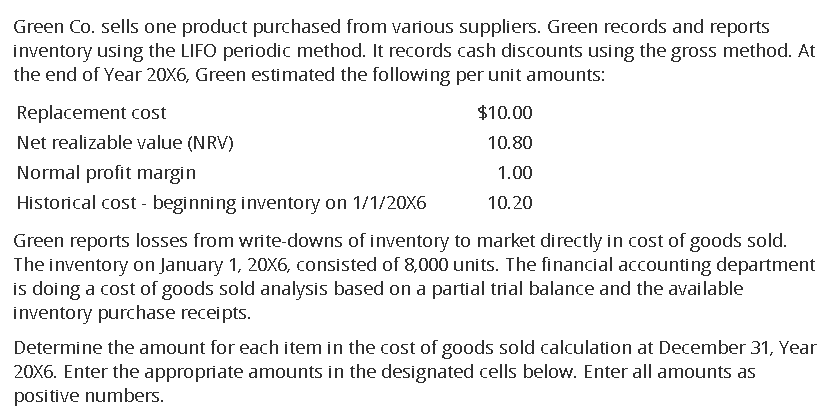

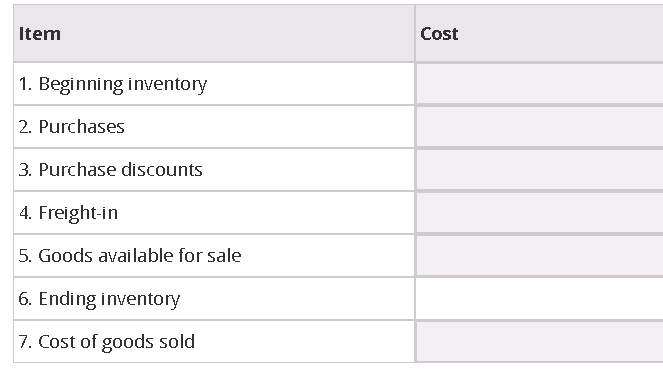

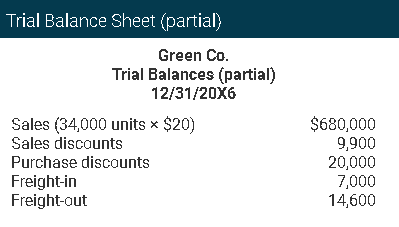

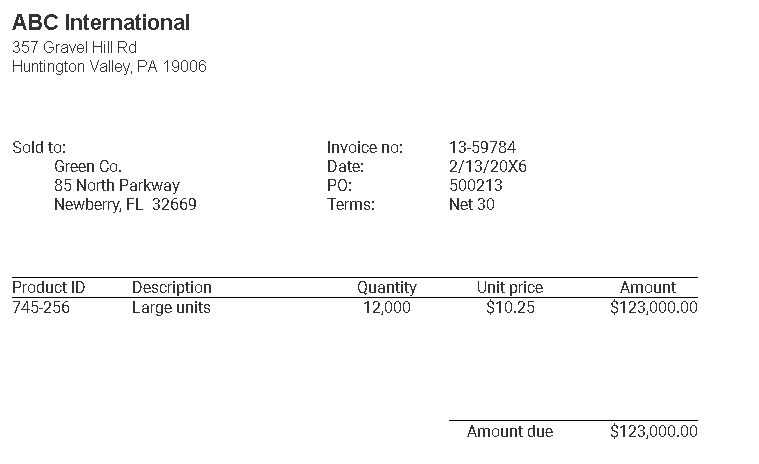

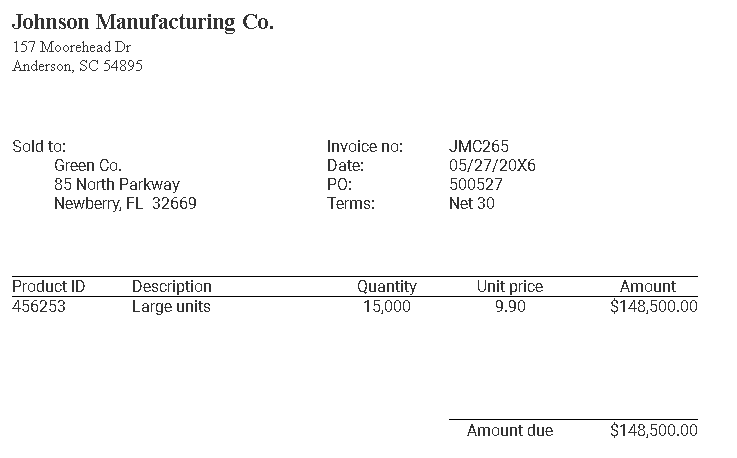

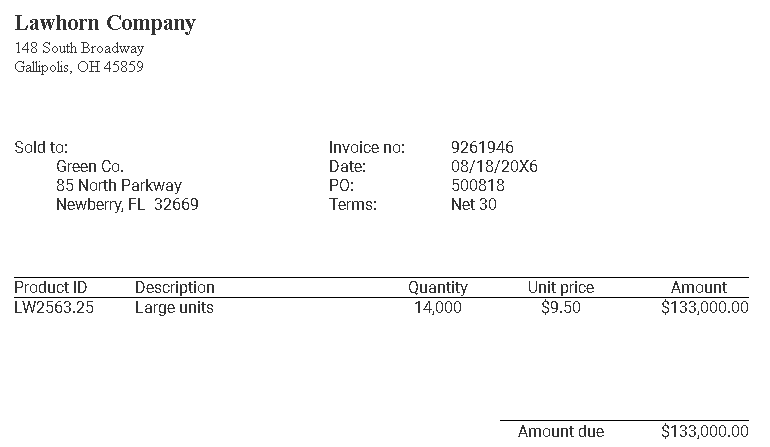

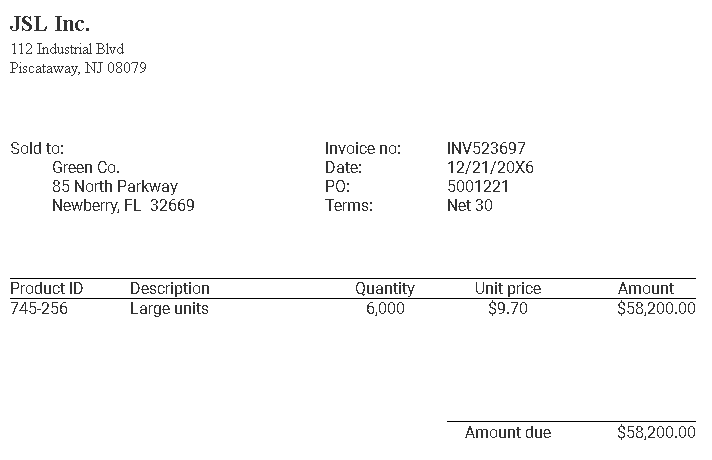

Green Co. sells one product purchased from various suppliers. Green records and reports inventory using the LIFO periodic method. It records cash discounts using the gross method. At the end of Year 20X6, Green estimated the following per unit amounts: Replacement cost $10.00 Net realizable value (NRV) 10.80 Normal profit margin 1.00 Historical cost - beginning inventory on 1/1/20x6 10.20 Green reports losses from write-downs of inventory to market directly in cost of goods sold. The inventory on January 1, 20X6, consisted of 8,000 units. The financial accounting department is doing a cost of goods sold analysis based on a partial trial balance and the available inventory purchase receipts. Determine the amount for each item in the cost of goods sold calculation at December 31, Year 20X6. Enter the appropriate amounts in the designated cells below. Enter all amounts as positive numbers. Item Cost 1. Beginning inventory 2. Purchases 3. Purchase discounts 4. Freight-in 5. Goods available for sale 6. Ending inventory 7. Cost of goods sold Trial Balance Sheet (partial) Green Co. Trial Balances (partial) 12/31/20X6 Sales (34,000 units $20) Sales discounts Purchase discounts Freight-in Freight-out $680,000 9,900 20,000 7,000 14,600 ABC International 357 Gravel Hill Rd Huntington Valley, PA 19006 Sold to: Green Co. 85 North Parkway Newberry, FL 32669 Invoice no: Date: PO: Terms: 13-59784 2/13/20X6 500213 Net 30 Product ID 745-256 Description Large units Quantity 12,000 Unit price $10.25 Amount $123,000.00 Amount due $123,000.00 Johnson Manufacturing Co. 157 Moorehead Dr Anderson, SC 54895 Sold to: Green Co. 85 North Parkway Newberry, FL 32669 Invoice no: Date: PO: Terms: JMC265 05/27/20X6 500527 Net 30 Product ID 456253 Description Large units Quantity 15,000 Unit price 9.90 Amount $148,500.00 Amount due due $148,500.00 Lawhorn Company 148 South Broadway Gallipolis, OH 45859 Sold to: Green Co. 85 North Parkway Newberry, FL 32669 Invoice no: Date: PO: Terms: 9261946 08/18/20X6 500818 Net 30 Product ID LW2563.25 Description Large units Quantity 14,000 Unit price $9.50 Amount $133,000.00 Amount due $133,000.00 JSL Inc. 112 Industrial Blvd Piscataway, NJ 08079 Sold to: Green Co. 85 North Parkway Newberry, FL 32669 Invoice no: Date: PO: Terms: INV523697 12/21/20X6 5001221 Net 30 Product ID 745-256 Description Large units Quantity 6,000 Unit price $9.70 Amount $58,200.00 Amount due $58,200.00 Green Co. sells one product purchased from various suppliers. Green records and reports inventory using the LIFO periodic method. It records cash discounts using the gross method. At the end of Year 20X6, Green estimated the following per unit amounts: Replacement cost $10.00 Net realizable value (NRV) 10.80 Normal profit margin 1.00 Historical cost - beginning inventory on 1/1/20x6 10.20 Green reports losses from write-downs of inventory to market directly in cost of goods sold. The inventory on January 1, 20X6, consisted of 8,000 units. The financial accounting department is doing a cost of goods sold analysis based on a partial trial balance and the available inventory purchase receipts. Determine the amount for each item in the cost of goods sold calculation at December 31, Year 20X6. Enter the appropriate amounts in the designated cells below. Enter all amounts as positive numbers. Item Cost 1. Beginning inventory 2. Purchases 3. Purchase discounts 4. Freight-in 5. Goods available for sale 6. Ending inventory 7. Cost of goods sold Trial Balance Sheet (partial) Green Co. Trial Balances (partial) 12/31/20X6 Sales (34,000 units $20) Sales discounts Purchase discounts Freight-in Freight-out $680,000 9,900 20,000 7,000 14,600 ABC International 357 Gravel Hill Rd Huntington Valley, PA 19006 Sold to: Green Co. 85 North Parkway Newberry, FL 32669 Invoice no: Date: PO: Terms: 13-59784 2/13/20X6 500213 Net 30 Product ID 745-256 Description Large units Quantity 12,000 Unit price $10.25 Amount $123,000.00 Amount due $123,000.00 Johnson Manufacturing Co. 157 Moorehead Dr Anderson, SC 54895 Sold to: Green Co. 85 North Parkway Newberry, FL 32669 Invoice no: Date: PO: Terms: JMC265 05/27/20X6 500527 Net 30 Product ID 456253 Description Large units Quantity 15,000 Unit price 9.90 Amount $148,500.00 Amount due due $148,500.00 Lawhorn Company 148 South Broadway Gallipolis, OH 45859 Sold to: Green Co. 85 North Parkway Newberry, FL 32669 Invoice no: Date: PO: Terms: 9261946 08/18/20X6 500818 Net 30 Product ID LW2563.25 Description Large units Quantity 14,000 Unit price $9.50 Amount $133,000.00 Amount due $133,000.00 JSL Inc. 112 Industrial Blvd Piscataway, NJ 08079 Sold to: Green Co. 85 North Parkway Newberry, FL 32669 Invoice no: Date: PO: Terms: INV523697 12/21/20X6 5001221 Net 30 Product ID 745-256 Description Large units Quantity 6,000 Unit price $9.70 Amount $58,200.00 Amount due $58,200.00