Question

Green Grow Inc. (GGI) manufactures lawn fertilizer. Because of the products very high quality, GGI often receives special orders from agricultural research groups. For each

Green Grow Inc. (GGI) manufactures lawn fertilizer. Because of the products very high quality, GGI often receives special orders from agricultural research groups. For each type of fertilizer sold, each bag is carefully filled to have the precise mix of components advertised for that type of fertilizer. GGIs operating capacity is 29,000 one-hundred-pound bags per month, and it currently is selling 27,000 bags manufactured in 27 batches of 1,000 bags each. The firm just received a request for a special order of 6,400 one-hundred-pound bags of fertilizer for $161,000 from APAC, a research organization. The production costs would be the same, but there would be no variable selling costs. Delivery and other packaging and distribution services would cause a one-time $4,000 cost for GGI. The special order would be processed in two batches of 3,200 bags each. (No incremental batch-level costs are anticipated. Most of the batch-level costs in this case are short-term fixed costs, such as salaries and depreciation.) The following information is provided about GGIs current operations:

| Sales and production cost data for 27,000 bags, per bag: | |||

| Sales price | $ | 47 | |

| Variable manufacturing costs | 23 | ||

| Variable selling costs | 6 | ||

| Fixed manufacturing costs | 10 | ||

| Fixed marketing costs | 7 | ||

No marketing costs would be associated with the special order. Because the order would be used in research and consistency is critical, APAC requires that GGI fill the entire order of 6,400 bags.

REQUIRED:

1. What is the total relevant cost of filling this special sales order?

2. What would be the change in operating income if the special order is accepted?

3. What is the break-even selling price per unit for the special sales order (i.e., what is the selling price that would result in a zero effect on operating income)?

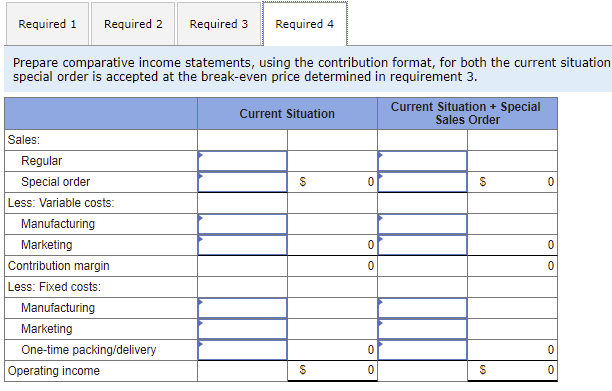

4. Prepare comparative income statements, using the contribution format, for both the current situation and assuming the special order is accepted at the break-even price determined in requirement 3.

Required 1 Required 2 Required 3 Required 4 What is the total relevant cost of filling this special sales order? Total relevant cost Required 1 Required 2 Required 3 Required 4 What would be the change in operating income if the special order is accepted? Operating income would by increase Required 1 Required 2 Required 3 Required 4 What is the break-even selling price per unit for the special sales zero effect on operating income)? (Round your answer to 2 decima Breakeven selling price per unit Required 1 Required 2 Required 3 Required 4 Prepare comparative income statements, using the contribution format, for both the current situation special order is accepted at the break-even price determined in requirement 3. Current Situation Current Situation + Special Sales Order S 0 $ 0 0 0 Sales: Regular Special order Less: Variable costs: Manufacturing Marketing Contribution margin Less: Fixed costs: Manufacturing Marketing One-time packing/delivery Operating income 0 0 0 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started