Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Green Life Sdn. Bhd. (GLSB) is a Malaysian resident company. As at 1 July 2019, the company had a paid-up capital of RM2.3 million

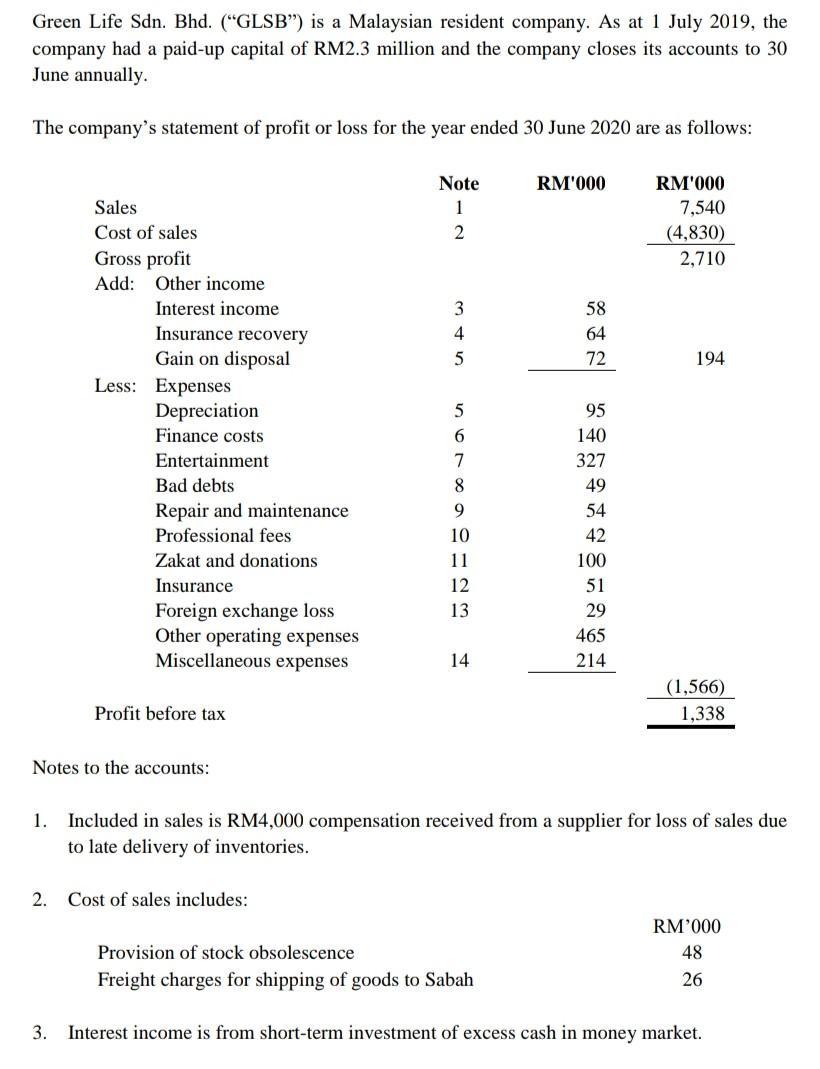

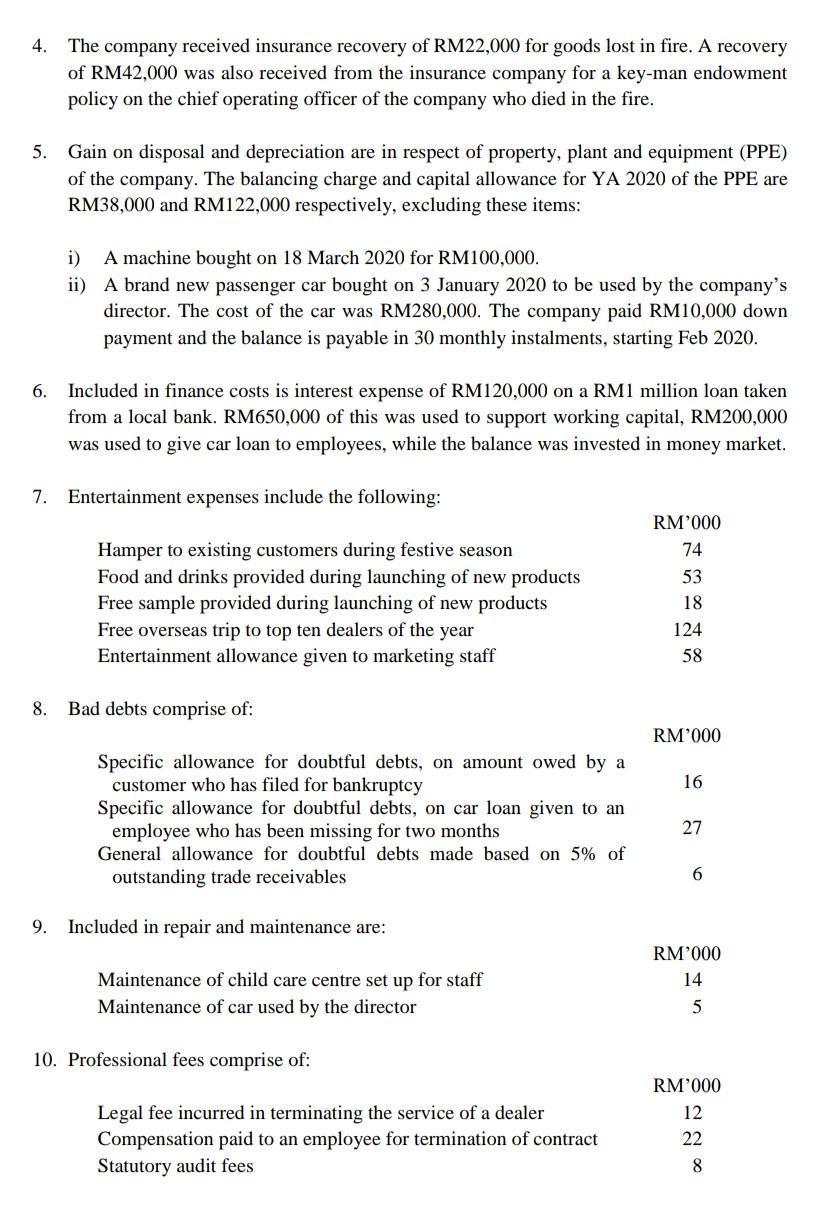

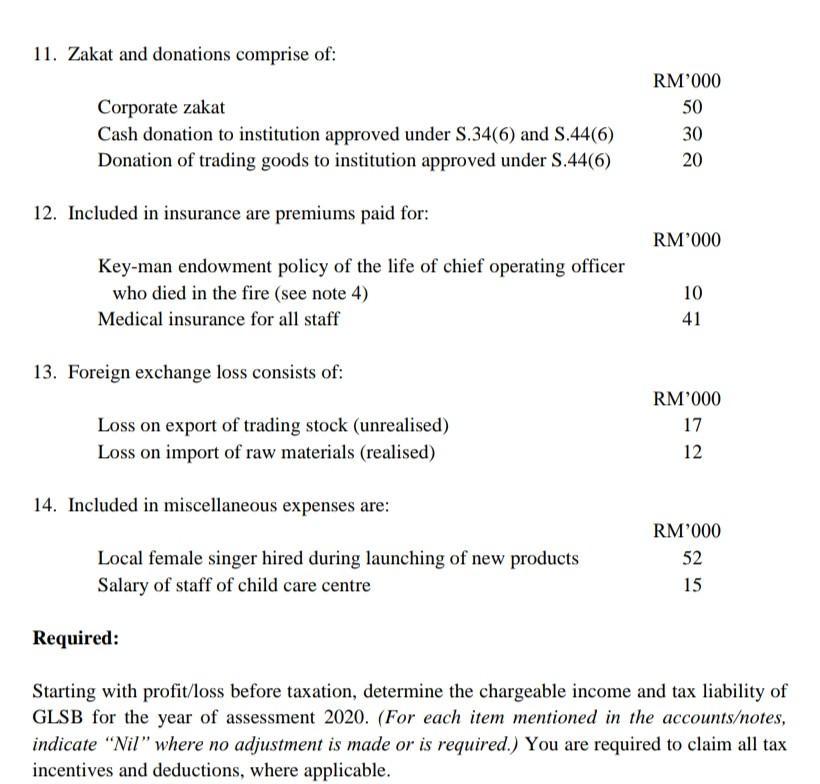

Green Life Sdn. Bhd. ("GLSB") is a Malaysian resident company. As at 1 July 2019, the company had a paid-up capital of RM2.3 million and the company closes its accounts to 30 June annually. The company's statement of profit or loss for the year ended 30 June 2020 are as follows: Sales Cost of sales Gross profit Add: Other income Interest income Insurance recovery Gain on disposal Less: Expenses Depreciation Finance costs Entertainment Bad debts Repair and maintenance Professional fees Zakat and donations Insurance Foreign exchange loss Other operating expenses Miscellaneous expenses Profit before tax Notes to the accounts: Note 1 2 2. Cost of sales includes: 3 4 5 5 6 7 8 9 10 11 12 13 14 RM'000 Provision of stock obsolescence Freight charges for shipping of goods to Sabah 58 64 72 95 140 327 49 54 42 100 51 29 465 214 RM'000 7,540 (4,830) 2,710 194 1. Included in sales is RM4,000 compensation received from a supplier for loss of sales due to late delivery of inventories. (1,566) 1,338 RM'000 48 26 3. Interest income is from short-term investment of excess cash in money market. 4. 5. Gain on disposal and depreciation are in respect of property, plant and equipment (PPE) of the company. The balancing charge and capital allowance for YA 2020 of the PPE are RM38,000 and RM122,000 respectively, excluding these items: The company received insurance recovery of RM22,000 for goods lost in fire. A recovery of RM42,000 was also received from the insurance company for a key-man endowment policy on the chief operating officer of the company who died in the fire. 6. Included in finance costs is interest expense of RM120,000 on a RM1 million loan taken from a local bank. RM650,000 of this was used to support working capital, RM200,000 was used to give car loan to employees, while the balance was invested in money market. 7. Entertainment expenses include the following: 8. i) A machine bought on 18 March 2020 for RM100,000. ii) A brand new passenger car bought on 3 January 2020 to be used by the company's director. The cost of the car was RM280,000. The company paid RM10,000 down payment and the balance is payable in 30 monthly instalments, starting Feb 2020. Hamper to existing customers during festive season Food and drinks provided during launching of new products Free sample provided during launching of new products Free overseas trip to top ten dealers of the year Entertainment allowance given to marketing staff Bad debts comprise of: Specific allowance for doubtful debts, on amount owed by a customer who has filed for bankruptcy Specific allowance for doubtful debts, on car loan given to an employee who has been missing for two months General allowance for doubtful debts made based on 5% of outstanding trade receivables 9. Included in repair and maintenance are: Maintenance of child care centre set up for staff Maintenance of car used by the director 10. Professional fees comprise of: Legal fee incurred in terminating the service of a dealer Compensation paid to an employee for termination of contract Statutory audit fees RM'000 74 53 18 124 58 RM'000 16 27 6 RM'000 14 5 RM'000 12 22 8 11. Zakat and donations comprise of: Corporate zakat Cash donation to institution approved under S.34(6) and S.44(6) Donation of trading goods to institution approved under S.44(6) 12. Included in insurance are premiums paid for: Key-man endowment policy of the life of chief operating officer who died in the fire (see note 4) Medical insurance for all staff 13. Foreign exchange loss consists of: Loss on export of trading stock (unrealised) Loss on import of raw materials (realised) 14. Included in miscellaneous expenses are: Local female singer hired during launching of new products Salary of staff of child care centre Required: RM'000 50 30 20 RM'000 10 41 RM'000 17 12 RM'000 52 15 Starting with profit/loss before taxation, determine the chargeable income and tax liability of GLSB for the year of assessment 2020. (For each item mentioned in the accounts/notes, indicate "Nil" where no adjustment is made or is required.) You are required to claim all tax incentives and deductions, where applicable.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

starting wille Profit llaze before Tazalca determine chargeable Income and tax lacity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started