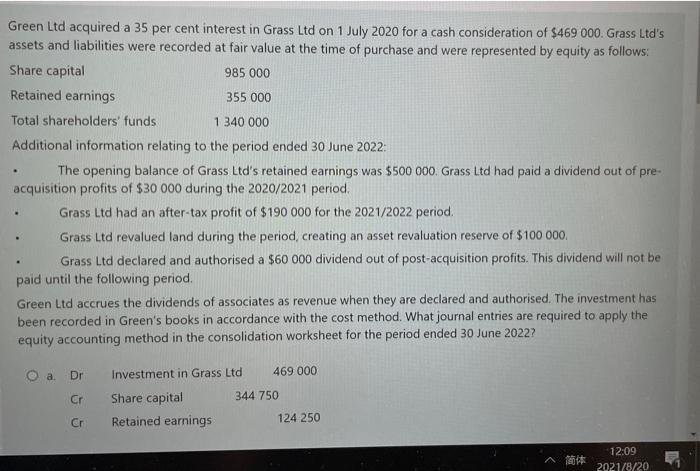

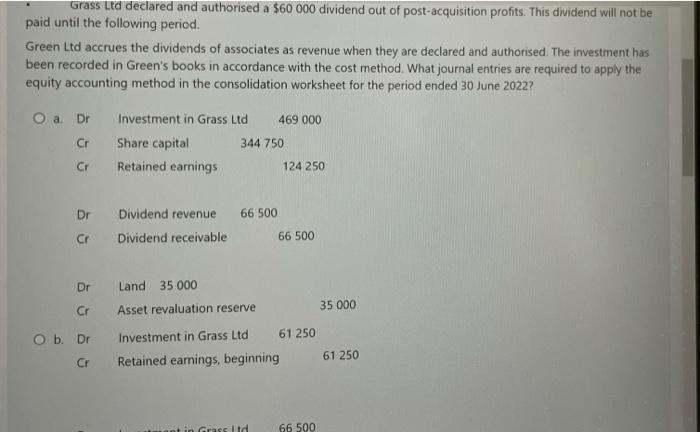

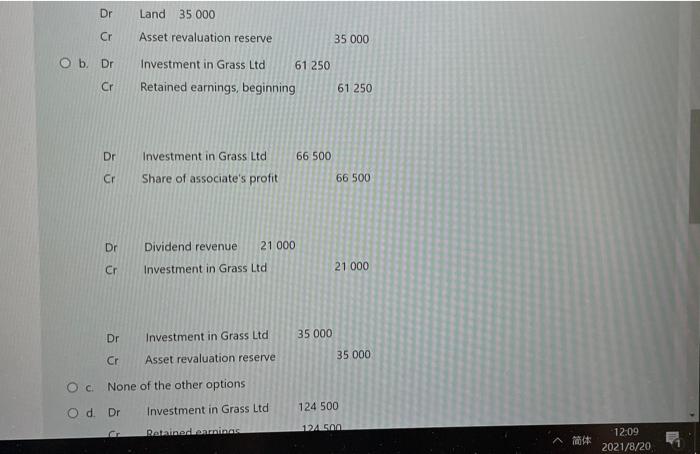

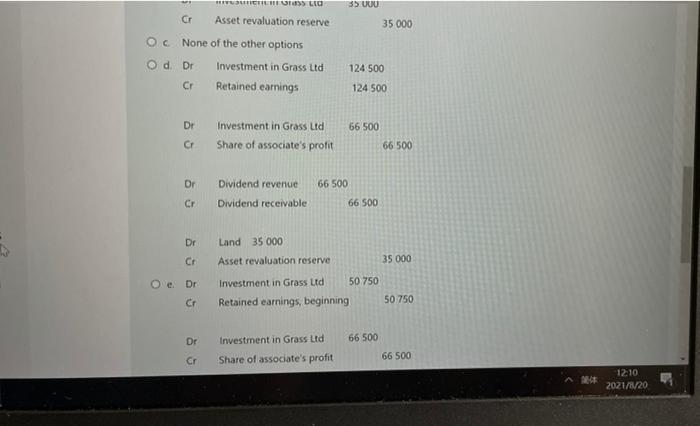

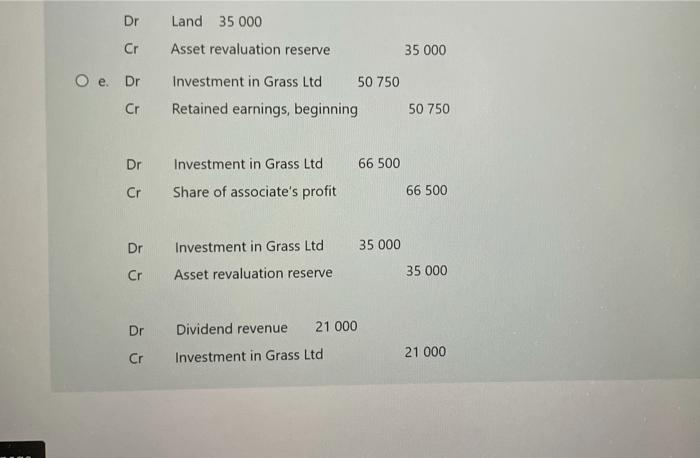

. Green Ltd acquired a 35 per cent interest in Grass Ltd on 1 July 2020 for a cash consideration of $469 000. Grass Ltd's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows: Share capital 985 000 Retained earnings 355 000 Total shareholders' funds 1 340 000 Additional information relating to the period ended 30 June 2022: The opening balance of Grass Ltd's retained earnings was $500 000. Grass Ltd had paid a dividend out of pre- acquisition profits of $30 000 during the 2020/2021 period. Grass Ltd had an after-tax profit of $190 000 for the 2021/2022 period. Grass Ltd revalued land during the period, creating an asset revaluation reserve of $100 000 Grass Ltd declared and authorised a $60 000 dividend out of post-acquisition profits. This dividend will not be paid until the following period. Green Ltd accrues the dividends of associates as revenue when they are declared and authorised. The investment has been recorded in Green's books in accordance with the cost method. What journal entries are required to apply the equity accounting method in the consolidation worksheet for the period ended 30 June 2022? O a. Dr Investment in Grass Ltd 469 000 Cr 344 750 Share capital Retained earnings Cr 124 250 A 12:09 2021/8/20 Grass Ltd declared and authorised a $60 000 dividend out of post-acquisition profits. This dividend will not be paid until the following period. Green Ltd accrues the dividends of associates as revenue when they are declared and authorised. The investment has been recorded in Green's books in accordance with the cost method. What journal entries are required to apply the equity accounting method in the consolidation worksheet for the period ended 30 June 20227 O a Dr Cr Cr Investment in Grass Ltd 469 000 Share capital 344 750 Retained earnings 124 250 Dr Dividend revenue 66 500 Cr Dividend receivable 66 500 Dr Land 35 000 Asset revaluation reserve 35 000 Cr O b. Dr Investment in Grass Ltd 61 250 Retained earnings, beginning 61 250 Cr in Grass Itd 66 500 Dr Land 35 000 Cr Asset revaluation reserve 35 000 O bDr Investment in Grass Ltd 61 250 Retained earnings, beginning Cr 61 250 Dr 66 500 Investment in Grass Ltd Share of associate's profit Cr 66 500 Dr Dividend revenue 21 000 Cr Investment in Grass Ltd 21 000 Dr Investment in Grass Ltd 35 000 Cr Asset revaluation reserve 35 000 Oc None of the other options Od Dr Investment in Grass Ltd 124 500 12LLC Roninedanning 12:09 2021/8/20 HIT LIO 35 UUU 35 000 Cr Asset revaluation reserve Oc None of the other options Od Dr Investment in Grass Ltd Cr Retained earnings 124 500 124 500 Dr Investment in Grass Ltd Share of associate's profit 66 500 66 500 C Dr 66 500 Dividend revenue Dividend receivable CF 66 500 Dr Land 35 000 Asset revaluation reserve CA 35 000 e Dr Investment in Grass Ltd 50 750 Retained earnings, beginning cr 50 750 Dr 66 500 Investment in Grass Ltd Share of associate's profit Cr 66 500 12.10 2021/120 Dr Land 35 000 Asset revaluation reserve Cr 35 000 O e Dr Cr Investment in Grass Ltd 50 750 Retained earnings, beginning 50 750 Dr 66 500 Investment in Grass Ltd Share of associate's profit Cr 66 500 Dr Investment in Grass Ltd 35 000 35 000 Cr Asset revaluation reserve Dr Dividend revenue 21 000 Investment in Grass Ltd 21 000 Cr