Question

Use the information and your calculations from the Balance Sheet and Statement of Cash Flows exercise posted on Canvas to answer the following questions: 34.

Use the information and your calculations from the Balance Sheet and Statement of Cash Flows exercise posted on Canvas to answer the following questions:

34. The corporation had cash flow from operating activities of: A) $9,000 B) $21,000 C) $33,000 D) $59,000

35. The corporation had cash outflow from investing activities of: A) $38,000 B) $35,000 C) $3,000 D) $0

36. The corporation had cash flow from financing activities of: A) $35,000 B) $32,000 C) $3,000 D) $49,000 Page 8

37. The corporation's cash _______________ by __________________.

A) increased, $30,000

B) increased, $18,000

C) decreased, $30,000

D) decreased $18,000

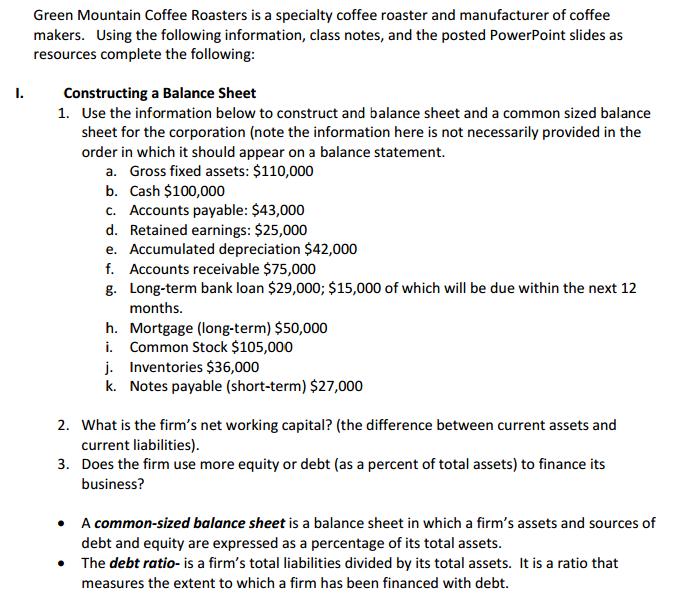

I. Green Mountain Coffee Roasters is a specialty coffee roaster and manufacturer of coffee makers. Using the following information, class notes, and the posted PowerPoint slides as resources complete the following: Constructing a Balance Sheet 1. Use the information below to construct and balance sheet and a common sized balance sheet for the corporation (note the information here is not necessarily provided in the order in which it should appear on a balance statement. a. Gross fixed assets: $110,000 b. Cash $100,000 c. Accounts payable: $43,000 d. Retained earnings: $25,000 e. Accumulated depreciation $42,000 f. Accounts receivable $75,000 g. Long-term bank loan $29,000; $15,000 of which will be due within the next 12 months. h. Mortgage (long-term) $50,000 i. Common Stock $105,000 j. Inventories $36,000 k. Notes payable (short-term) $27,000 2. What is the firm's net working capital? (the difference between current assets and current liabilities). 3. Does the firm use more equity or debt (as a percent of total assets) to finance its business? A common-sized balance sheet is a balance sheet in which a firm's assets and sources of debt and equity are expressed as a percentage of its total assets. The debt ratio- is a firm's total liabilities divided by its total assets. It is a ratio that measures the extent to which a firm has been financed with debt.

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Balance Sheet Assets Liabilities Equity Cash Accounts Payabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started