Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Green Pea Organics (lessee) entered a lease agreement for a tractor, and prepared a lease schedule to enable them to produce their financial statements. Unfortunately

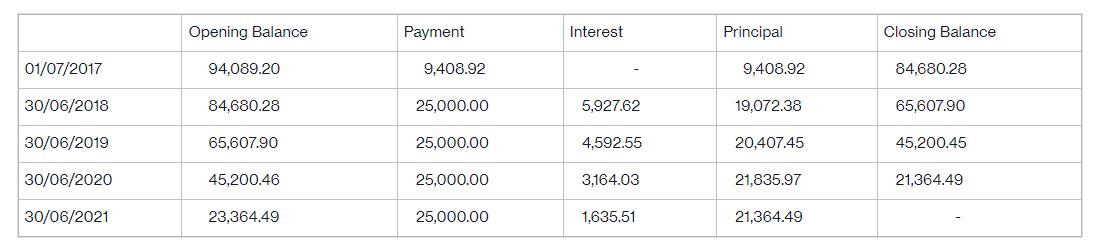

Green Pea Organics (lessee) entered a lease agreement for a tractor, and prepared a lease schedule to enable them to produce their financial statements.

Unfortunately someone deleted the electronic version of the schedule and the printed schedule was damaged and some figures are now illegible.

The implicit rate = 7%

Prepare the general journal entries that would have been required for the first year of the lease, the year ended 30 June 2018, assuming Green Pea Organics will return the tractor at the end of the lease.

Opening Balance Payment Interest Principal Closing Balance 01/07/2017 94,089.20 9,408.92 9,408.92 84,680.28 30/06/2018 84,680.28 25,000.00 5,927.62 19,072.38 65,607.90 30/06/2019 65,607.90 25,000.00 4,592.55 20,407.45 45,200.45 30/06/2020 45,200.46 25,000.00 3,164.03 21,835.97 21,364.49 30/06/2021 23,364.49 25,000.00 1,635.51 21,364.49

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Solution Solution General journal entries that would have been required for the first year o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started