Answered step by step

Verified Expert Solution

Question

1 Approved Answer

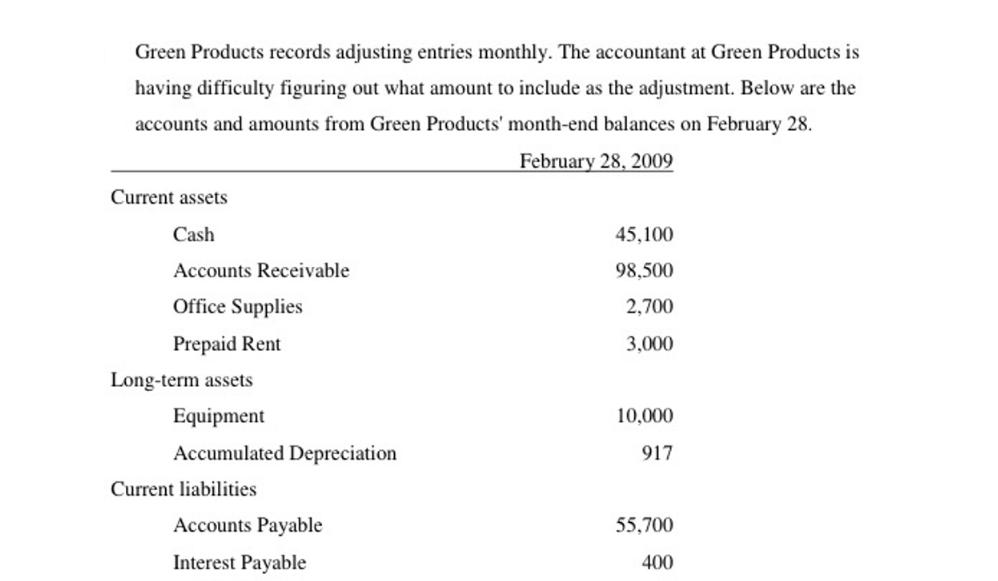

Green Products records adjusting entries monthly. The accountant at Green Products is having difficulty figuring out what amount to include as the adjustment. Below

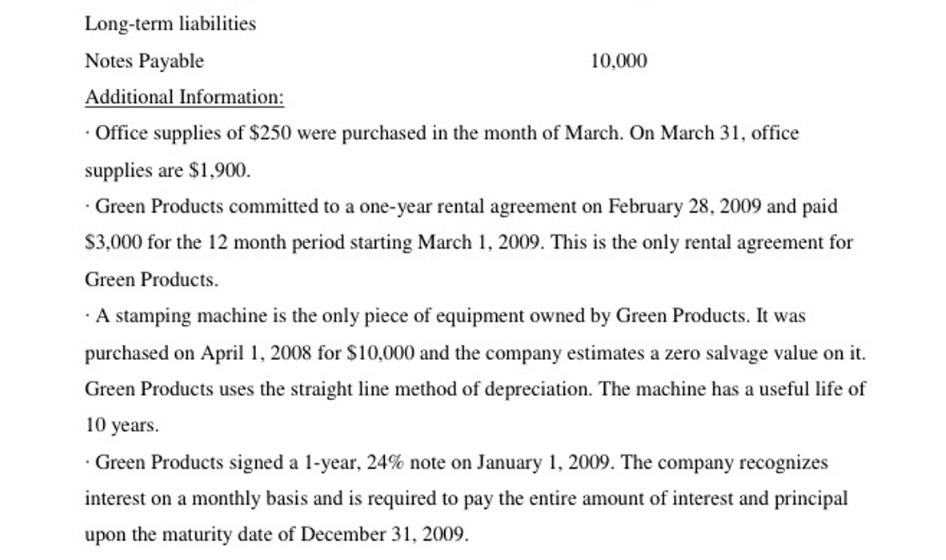

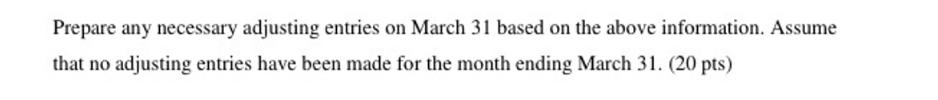

Green Products records adjusting entries monthly. The accountant at Green Products is having difficulty figuring out what amount to include as the adjustment. Below are the accounts and amounts from Green Products' month-end balances on February 28. February 28, 2009 Current assets Cash Accounts Receivable Office Supplies Prepaid Rent Long-term assets Equipment Accumulated Depreciation Current liabilities Accounts Payable Interest Payable 45,100 98,500 2,700 3,000 10,000 917 55,700 400 Long-term liabilities Notes Payable Additional Information: Office supplies of $250 were purchased in the month of March. On March 31, office supplies are $1,900. Green Products committed to a one-year rental agreement on February 28, 2009 and paid $3,000 for the 12 month period starting March 1, 2009. This is the only rental agreement for Green Products. 10,000 A stamping machine is the only piece of equipment owned by Green Products. It was purchased on April 1, 2008 for $10,000 and the company estimates a zero salvage value on it. Green Products uses the straight line method of depreciation. The machine has a useful life of 10 years. Green Products signed a 1-year, 24% note on January 1, 2009. The company recognizes interest on a monthly basis and is required to pay the entire amount of interest and principal upon the maturity date of December 31, 2009. Prepare any necessary adjusting entries on March 31 based on the above information. Assume that no adjusting entries have been made for the month ending March 31. (20 pts)

Step by Step Solution

★★★★★

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the necessary adjusting entries on March 31 we need to consider the following adjustments ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started