Question

Green, Tan, and Brown decide to liquidate their partnership. The partnership agreement states that they share income and losses equally. Partner capital balances follow:

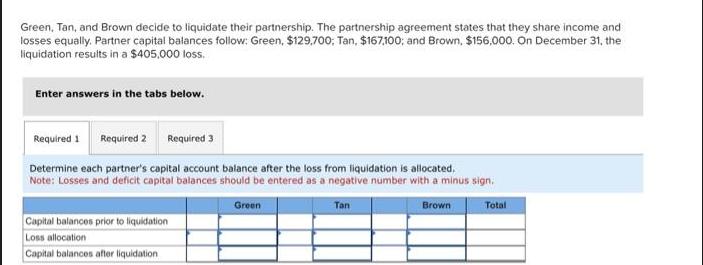

Green, Tan, and Brown decide to liquidate their partnership. The partnership agreement states that they share income and losses equally. Partner capital balances follow: Green, $129,700, Tan, $167.100; and Brown, $156,000. On December 31, the liquidation results in a $405,000 loss. Enter answers in the tabs below. Required 1 Required 2 Required 3 Determine each partner's capital account balance after the loss from liquidation is allocated. Note: Losses and deficit capital balances should be entered as a negative number with a minus sign. Brown Capital balances prior to liquidation Loss allocation Capital balances after liquidation Green Tan Total

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of the total capital balance before liquidation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles Volume 2

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

9th Canadian Edition

978-1119786634, 1119786630

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App