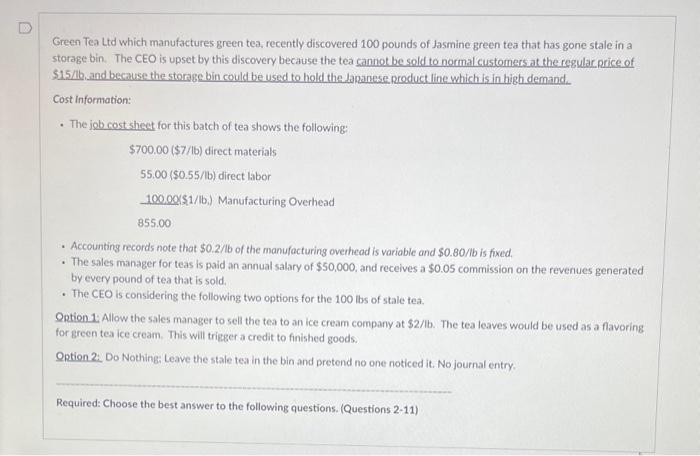

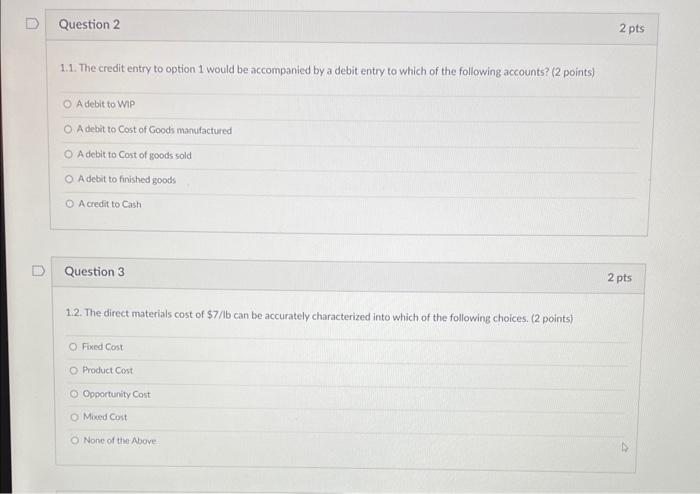

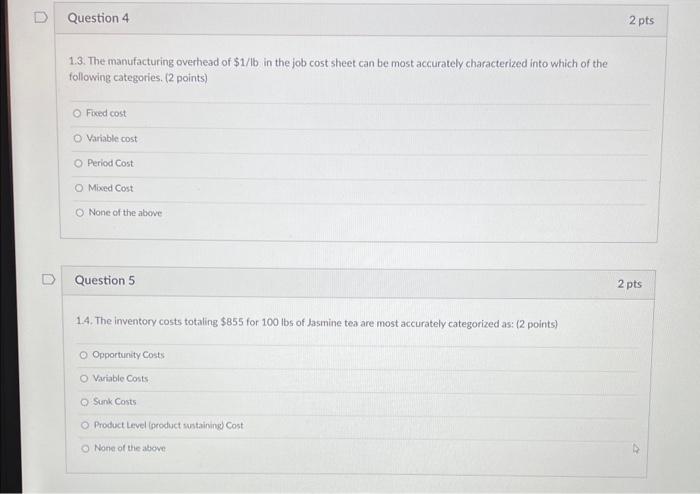

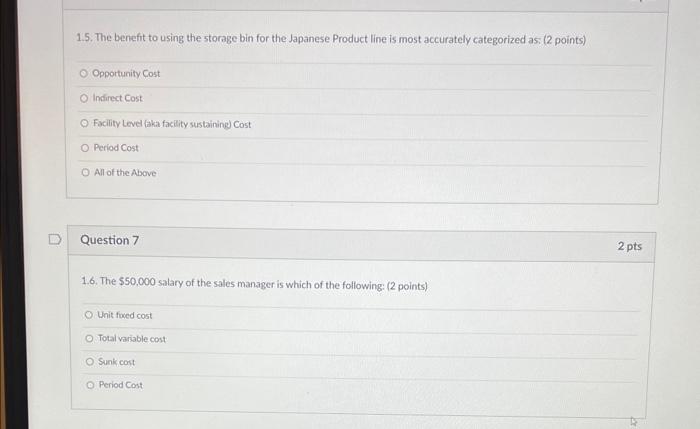

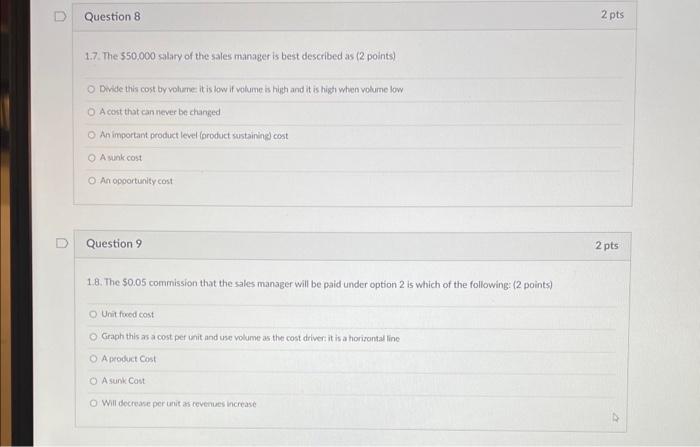

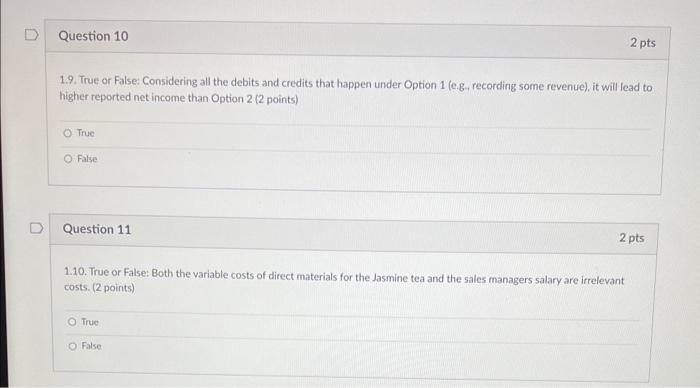

Green Tea Ltd which manufactures green tea, recently discovered 100 pounds of Jasmine green tea that has gone stale in a storage bin. The CEO is upset by this discovery because the tea sannot be sold to normal customers at the regular price of \$1.5/b, and because the storege bin could be used to hold the Lapanese product line which is in high demand Cost information: - The jeb cost sheet for this batch of tea shows the following: $700.00($7/lb)directmaterials55.00($0.55/lb)directlabor100.00($1/lb)ManufacturingOverhead855.00 - Accounting records note that $0.2/lb of the manufacturing oveihead is variable and $0.80/lb is fixed. - The sales manager for teas is paid an annual salary of $50,000, and receives a $0.05 commission on the revenues generated by every pound of tea that is sold. - The CEO is considering the following two options for the 100 lbs of stale tea. Qetion 1: Allow the sales manager to sell the tea to an ice cream company at $2/b. The tea leaves would be used as a flavoring for green tea ice cream. This will trizger a credit to finished goods. Qption 2: Do Nothing: Leave the stale tea in the bin and pretend no one noticed it. No journal entry. Required: Choose the best answer to the following questions. (Questions 2-11) 1.1. The credit entry to option 1 would be accompanied by a debit entry to which of the following accounts? ( 2 points) A debit to WiP A debit to Cost of Goods manufactured A debit to Cost of goods sold A detit to finished goods A credit to Cash Question 3 2 pts 1.2. The direct materials cost of $7/b can be accurately characterized into which of the following choices. (2 points) Fixed Cost Product Cost Cpportunity Cost Mosed Cost None of the Above 1.3. The manufacturing overhead of $1/lb in the job cost sheet can be most accurately characterized into which of the following categories. (2 points) Fored cost Variable cost Period Cost: Mised Cost None of the above Question 5 1.4. The inventory costs totaling $855 for 100lbs of lasmine tea are most accurately categorized as: (2 points) Opportunity Costs Variable Costs Sunk Costs Product Level (oroduct wataining Cost None of the abowe 1.5. The benefit to using the storage bin for the Japanese Product line is most accurately categorized as: ( 2 points) Opportunity Cost Indirect Cost Frcility Level (aka facility sustaining) Cost Period Cost All of the Above Question 7 1.6. The $50,000 satary of the sales manager is which of the following: ( 2 points) Unit foxed cost Total variable cost Sunkicost Period Cost 1.7. The 550.000 calary of the sales manager is best described as (2 points) Dinde this cost by volume it is low if volume is high and it is high when volume low A cest that annever be changed An important product level foroduct surtaining cost A sunk cost An opoortunity cost Question 9 1.8. The $0.05 commission that the sales manager will be paid under option 2 is which of the following: (2 points) Unit foed cost Graph thls as a cost per iait and use volume as the cost driver: it is a horizontal line Aproduct cost Asunk Cost Will decrease per unit as cevenues increase 1.9. True or False: Considering all the debits and credits that happen under Option 1 (e.g- recording some revenue), it will lead to higher reported net income than Option 2 (2 points) True False Question 11 1.10. True or False: Both the variable costs of direct materials for the Jasmine tea and the sales managers salary are irrelevant costs. (2 points) True False