Question

Green technology Sdn. Bhd. started a business on 1 January 2019 by selling computer products. The company close the account on 31 December 2019. Use

Green technology Sdn. Bhd. started a business on 1 January 2019 by selling computer products. The company close the account on 31 December 2019. Use the following information to prepare the trial balance as at 31 December 2019.

Capital RM100,000

Motor vehicle RM50,000

Office equipment RM20,000

Furniture RM10,000

Cash RM15,000

Debtors RM5,000

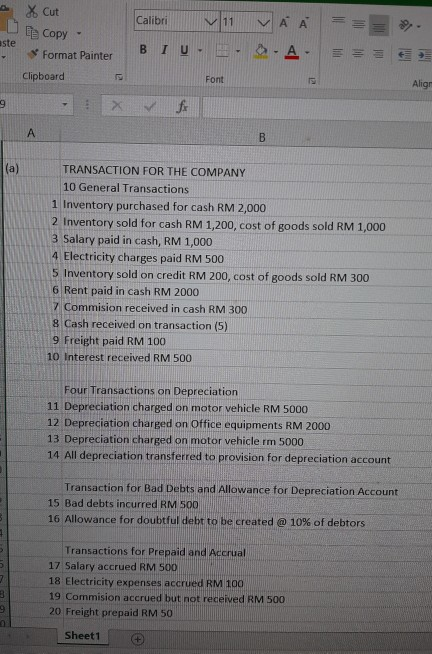

- Create the transactions for the company. (10 marks)

Create the transactions of:

- 10 general transactions

- 4 transactions in depreciation topic

- 2 transactions in bad debts and allowance for doubtful debts (AFDD) topic

- 4 transactions accrual and prepayment topic

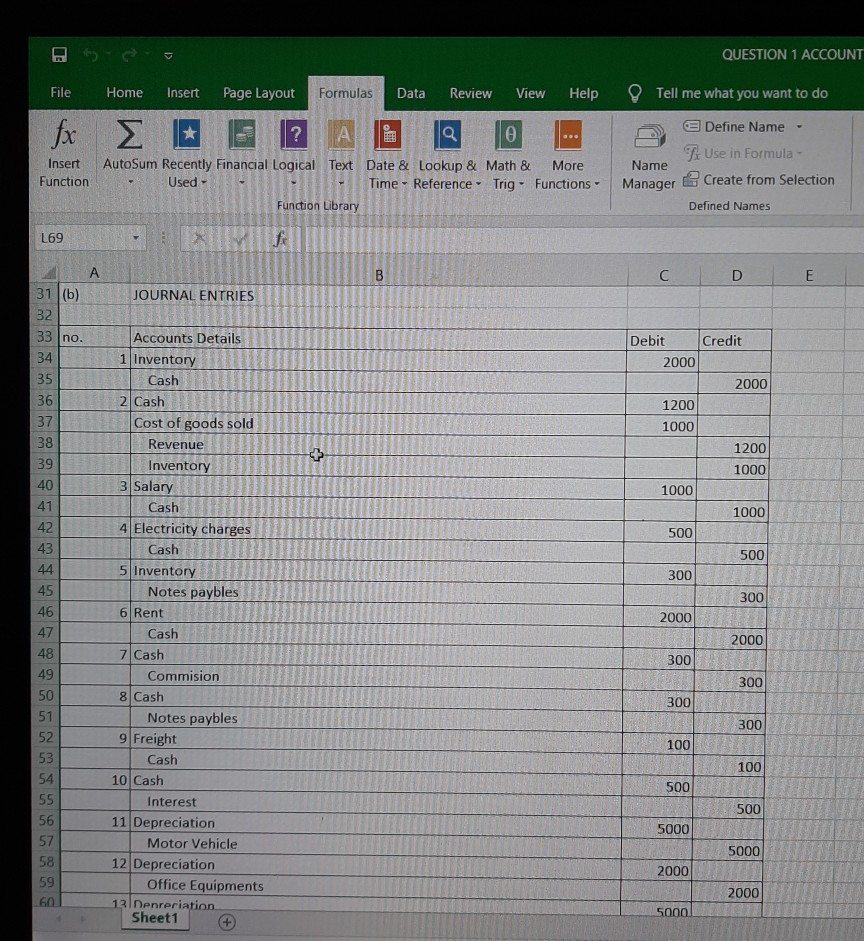

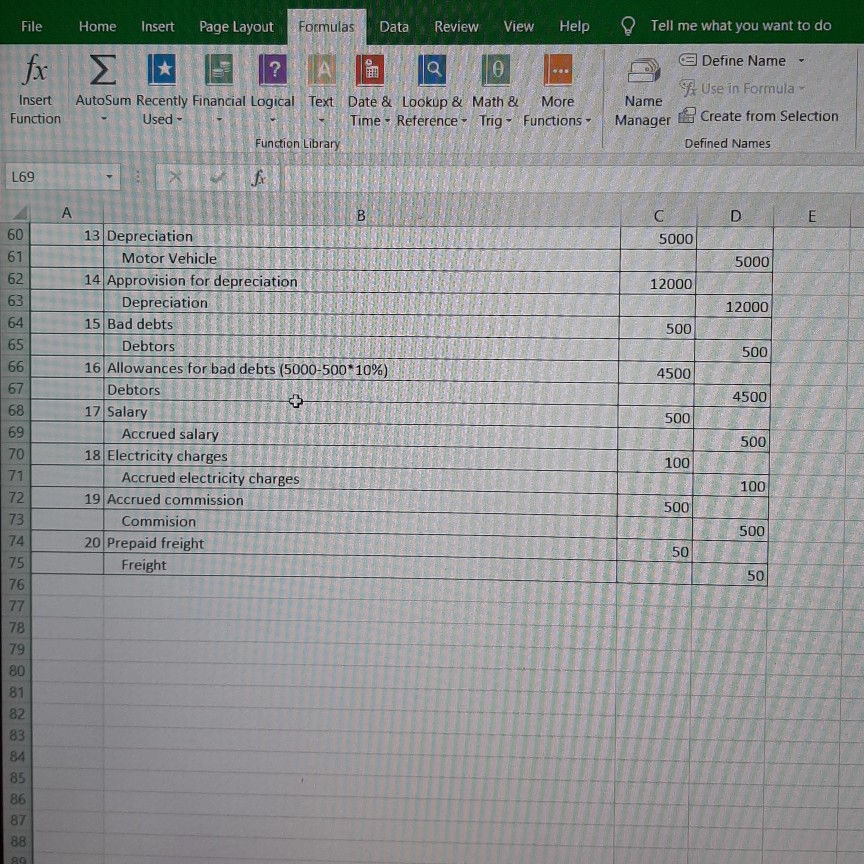

- Prepare the journal entries (10 marks)

Prepare journal entries for each transactions above.

- Prepare the ledger (20 marks)

Using the information in (a) to proceed to (b). Balancing-off the account and get the balance of each accounts.

- Prepare the trial balance (10 marks)

- Using the information in (c) to proceed to (d).

- Do include the beginning information in trial balance.

I just need help with question C and D, thanks!

Calibri V 11 V X Cut De Copy Format Painter este BIU- A. Clipboard Font Alig 9 f A B (a) TRANSACTION FOR THE COMPANY 10 General Transactions 1 Inventory purchased for cash RM 2,000 2 Inventory sold for cash RM 1,200, cost of goods sold RM 1,000 3 Salary paid in cash, RM 1,000 4 Electricity charges paid RM 500 5 Inventory sold on credit RM 200, cost of goods sold RM 300 6 Rent paid in cash RM 2000 7 Commision received in cash RM 300 8 Cash received on transaction (5) 9 Freight paid RM 100 10 Interest received RM 500 Four Transactions on Depreciation 11 Depreciation charged on motor vehicle RM 5000 12 Depreciation charged on Office equipments RM 2000 13 Depreciation charged on motor vehicle rm 5000 14 All depreciation transferred to provision for depreciation account Transaction for Bad Debts and Allowance for Depreciation Account 15 Bad debts incurred RM 500 16 Allowance for doubtful debt to be created @ 10% of debtors Transactions for Prepaid and Accrual 17 Salary accrued RM 500 18 Electricity expenses accrued RM 100 19 Commision accrued but not received RM 500 20 Freight prepaid RM 50 9 Sheet1 QUESTION 1 ACCOUNT E File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do fx ? A Q 0 Define Name T: Use in Formula Create from Selection Insert Function AutoSum Recently Financial Logical Text Date & Lookup & Math & More Used - Time - Reference - Trig - Functions Function Library Name Manager Defined Names L69 - f A B C D E JOURNAL ENTRIES Credit Debit 2000 2000 1200 1000 + 1200 1000 1000 1000 500 500 300 31 (b) 32 33 no. 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 300 2000 Accounts Details 1 Inventory Cash 2 Cash Cost of goods sold Revenue Inventory 3 Salary Cash 4 Electricity charges Cash 5 Inventory Notes paybles 6 Rent Cash 7 Cash Commision 8 Cash Notes paybles 9 Freight Cash 10 Cash Interest 11 Depreciation Motor Vehicle 12 Depreciation Office Equipments 131Denreriation Sheet1 2000 300 300 300 300 100 100 500 500 5000 5000 2000 2000 5000 File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do fx * ? A la 0 Define Name Use in Formula Create from Selection Insert Function AutoSum Recently Financial Logical Text Date & Lookup & Math & More Used - Time - Reference - Trig. Functions Function Library Name Manager Defined Names L69 fix A D E 5000 5000 12000 12000 500 500 4500 B 13 Depreciation Motor Vehicle 14 Approvision for depreciation Depreciation 15 Bad debts Debtors 16 Allowances for bad debts (5000-500*10%) Debtors 17 Salary Accrued salary 18 Electricity charges Accrued electricity charges 19 Accrued commission Commision 20 Prepaid freight Freight 4500 500 500 100 100 500 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 500 50 50 99 Calibri V 11 V X Cut De Copy Format Painter este BIU- A. Clipboard Font Alig 9 f A B (a) TRANSACTION FOR THE COMPANY 10 General Transactions 1 Inventory purchased for cash RM 2,000 2 Inventory sold for cash RM 1,200, cost of goods sold RM 1,000 3 Salary paid in cash, RM 1,000 4 Electricity charges paid RM 500 5 Inventory sold on credit RM 200, cost of goods sold RM 300 6 Rent paid in cash RM 2000 7 Commision received in cash RM 300 8 Cash received on transaction (5) 9 Freight paid RM 100 10 Interest received RM 500 Four Transactions on Depreciation 11 Depreciation charged on motor vehicle RM 5000 12 Depreciation charged on Office equipments RM 2000 13 Depreciation charged on motor vehicle rm 5000 14 All depreciation transferred to provision for depreciation account Transaction for Bad Debts and Allowance for Depreciation Account 15 Bad debts incurred RM 500 16 Allowance for doubtful debt to be created @ 10% of debtors Transactions for Prepaid and Accrual 17 Salary accrued RM 500 18 Electricity expenses accrued RM 100 19 Commision accrued but not received RM 500 20 Freight prepaid RM 50 9 Sheet1 QUESTION 1 ACCOUNT E File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do fx ? A Q 0 Define Name T: Use in Formula Create from Selection Insert Function AutoSum Recently Financial Logical Text Date & Lookup & Math & More Used - Time - Reference - Trig - Functions Function Library Name Manager Defined Names L69 - f A B C D E JOURNAL ENTRIES Credit Debit 2000 2000 1200 1000 + 1200 1000 1000 1000 500 500 300 31 (b) 32 33 no. 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 300 2000 Accounts Details 1 Inventory Cash 2 Cash Cost of goods sold Revenue Inventory 3 Salary Cash 4 Electricity charges Cash 5 Inventory Notes paybles 6 Rent Cash 7 Cash Commision 8 Cash Notes paybles 9 Freight Cash 10 Cash Interest 11 Depreciation Motor Vehicle 12 Depreciation Office Equipments 131Denreriation Sheet1 2000 300 300 300 300 100 100 500 500 5000 5000 2000 2000 5000 File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do fx * ? A la 0 Define Name Use in Formula Create from Selection Insert Function AutoSum Recently Financial Logical Text Date & Lookup & Math & More Used - Time - Reference - Trig. Functions Function Library Name Manager Defined Names L69 fix A D E 5000 5000 12000 12000 500 500 4500 B 13 Depreciation Motor Vehicle 14 Approvision for depreciation Depreciation 15 Bad debts Debtors 16 Allowances for bad debts (5000-500*10%) Debtors 17 Salary Accrued salary 18 Electricity charges Accrued electricity charges 19 Accrued commission Commision 20 Prepaid freight Freight 4500 500 500 100 100 500 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 500 50 50 99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started