Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Green Thumb Landscaping (GTL) provides landscaping and lawn care service to both residential and commercial customers. Its landscaping service designs lawns, which can result

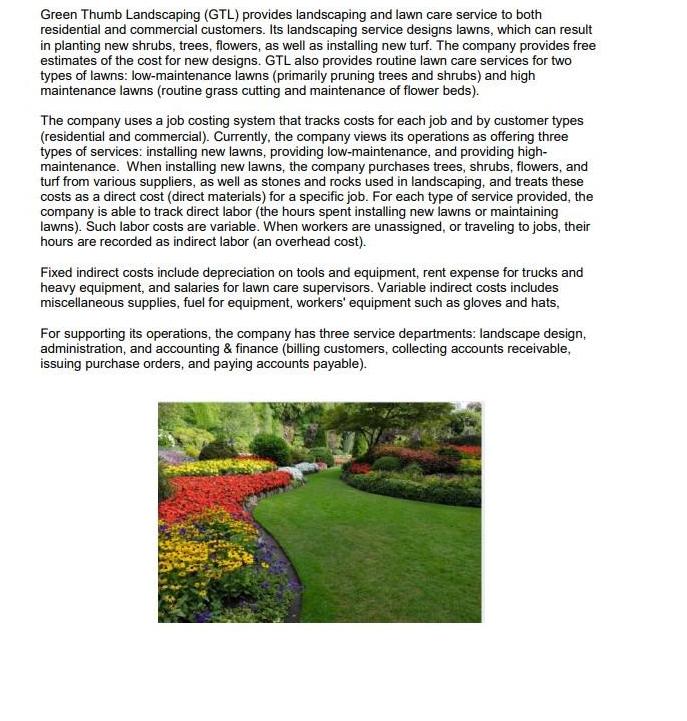

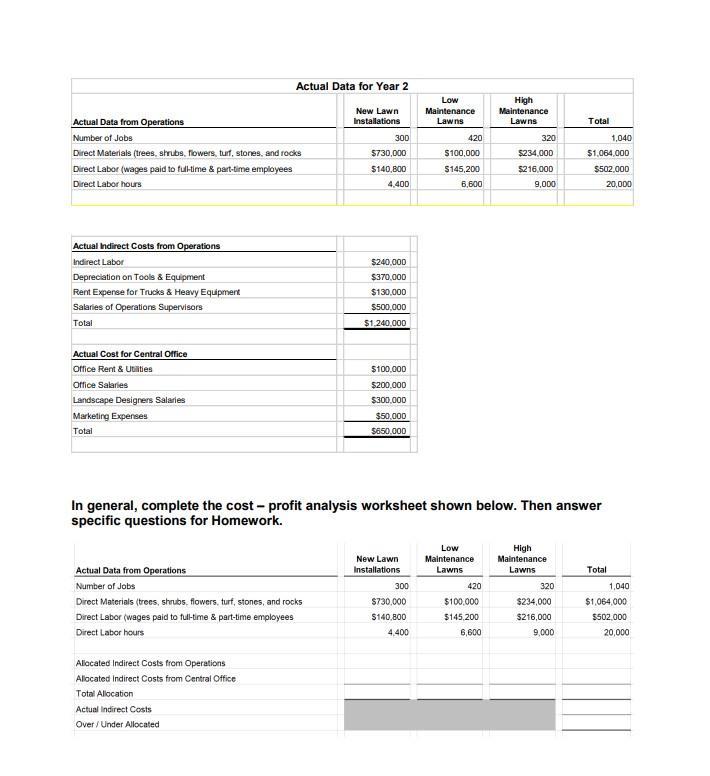

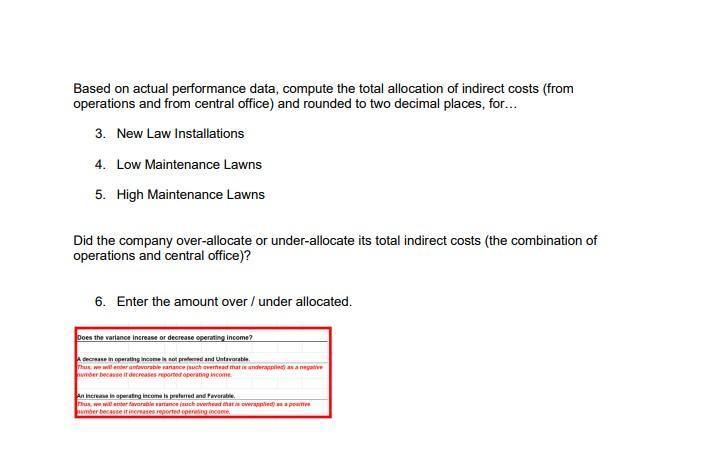

Green Thumb Landscaping (GTL) provides landscaping and lawn care service to both residential and commercial customers. Its landscaping service designs lawns, which can result in planting new shrubs, trees, flowers, as well as installing new turf. The company provides free estimates of the cost for new designs. GTL also provides routine lawn care services for two types of lawns: low-maintenance lawns (primarily pruning trees and shrubs) and high maintenance lawns (routine grass cutting and maintenance of flower beds). The company uses a job costing system that tracks costs for each job and by customer types (residential and commercial). Currently, the company views its operations as offering three types of services: installing new lawns, providing low-maintenance, and providing high- maintenance. When installing new lawns, the company purchases trees, shrubs, flowers, and turf from various suppliers, as well as stones and rocks used in landscaping, and treats these costs as a direct cost (direct materials) for a specific job. For each type of service provided, the company is able to track direct labor (the hours spent installing new lawns or maintaining lawns). Such labor costs are variable. When workers are unassigned, or traveling to jobs, their hours are recorded as indirect labor (an overhead cost). Fixed indirect costs include depreciation on tools and equipment, rent expense for trucks and heavy equipment, and salaries for lawn care supervisors. Variable indirect costs includes miscellaneous supplies, fuel for equipment, workers' equipment such as gloves and hats, For supporting its operations, the company has three service departments: landscape design, administration, and accounting & finance (billing customers, collecting accounts receivable, issuing purchase orders, and paying accounts payable). Below is budgeted data for the company's 3 types of services. Budgeted Data for Operations Number of Jobs Direct Materials (trees, shrubs, flowers, turf, stones, and rocks Direct Labor (wages paid to full-time & part-time employees Direct Labor hours Budgeted Indirect Costs for Operations Indirect Labor Green Thumb Landscaping Depreciation on Tools & Equipment Rent Expense for Trucks & Heavy Equipment Salaries of Operations Supervisors Total Budgeted Cost for Central Office Office Rent & Utilities Office Salaries Green Thumb Landscaping Budgeted Data for Year 2 New Lawn Installations Landscape Designers Salaries Marketing Expenses Total 250 $630,000 $120,000 4,000 $216,000 $400,000 $110,000 $540,000 $1,266,000 $108,000 $240,000 Low Maintenance Lawns $280,000 $60,000 $688.000 450 $90,000 $144,000 7,200 Budgeted Indirect Costs include both indirect costs from operations (indirect labor, depreciation on tools & equipment, etc.) and indirect costs from the central office (office rent & utilities, office salaries, etc.). High Maintenance Lawns 300 $180.000 $216,000 8,640 Total 1,000 $900,000 $480.000 19,840 1. Compute the predetermine rate for operations indirect costs, using direct labor hours as the allocations basis (round to 4 decimal places). 2. Compute the predetermined rate for central office costs, using number of jobs as the allocation basis (round to 4 decimal places). Actual Data from Operations Number of Jobs Direct Materials (trees, shrubs, flowers, turf, stones, and rocks Direct Labor (wages paid to full-time & part-time employees Direct Labor hours Actual Indirect Costs from Operations Indirect Labor Depreciation on Tools & Equipment Rent Expense for Trucks & Heavy Equipment Salaries of Operations Supervisors Total Actual Cost for Central Office Office Rent & Utilities Office Salaries Landscape Designers Salaries Marketing Expenses Total Actual Data for Year 2 New Lawn Installations Actual Data from Operations Number of Jobs Direct Materials (trees, shrubs, flowers, turf, stones, and rocks Direct Labor (wages paid to full-time & part-time employees Direct Labor hours Allocated Indirect Costs from Operations Allocated indirect Costs from Central Office Total Allocation Actual Indirect Costs Over/Under Allocated 300 $730,000 $140,800 4,400 $240,000 $370,000 $130,000 $500,000 $1,240,000 $100,000 $200,000 $300,000 $50,000 $650.000 New Lawn Installations 300 Low Maintenance Lawns $730,000 $140,800 4,400 420 In general, complete the cost-profit analysis worksheet shown below. Then answer specific questions for Homework. $100,000 $145,200 6,600 Low Maintenance Lawns 420 High Maintenance Lawns $100,000 $145,200 6,600 320 $234,000 $216,000 9,000 High Maintenance Lawns Total 320 $234,000 $216,000 9,000 $1,064,000 $502,000 20,000 1,040 Total 1,040 $1,064,000 $502,000 20,000 Based on actual performance data, compute the total allocation of indirect costs (from operations and from central office) and rounded to two decimal places, for... 3. New Law Installations 4. Low Maintenance Lawns 5. High Maintenance Lawns Did the company over-allocate or under-allocate its total indirect costs (the combination of operations and central office)? 6. Enter the amount over / under allocated. Does the variance increase or decrease operating income? A decrease in operating income is not profeened and Untavorable Thus, we will ender antavorable variance puch overhead that is anderapped) as a negativ umber because it decreases reported operating income. An increase in operating income is preferred and Favorable Thus, we will aber favorable arrance (sch overhead that is overled) as a pote umber because it increases reported operating income

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Please hit like button if this helped The predetermine rate for operations indirect costs Total indi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started