Answered step by step

Verified Expert Solution

Question

1 Approved Answer

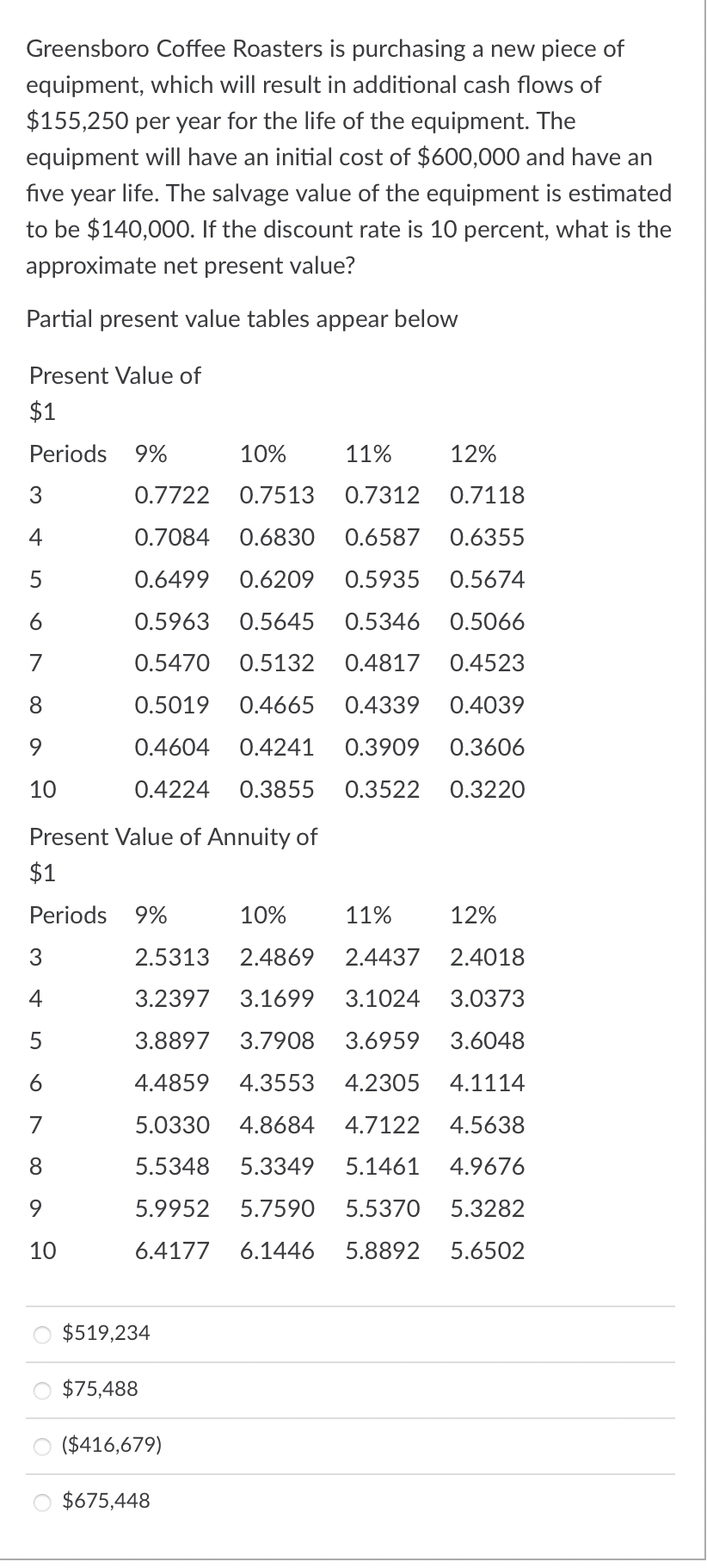

Greensboro Coffee Roasters is purchasing a new piece of equipment, which will result in additional cash flows of ( $ 155,250 ) per year for

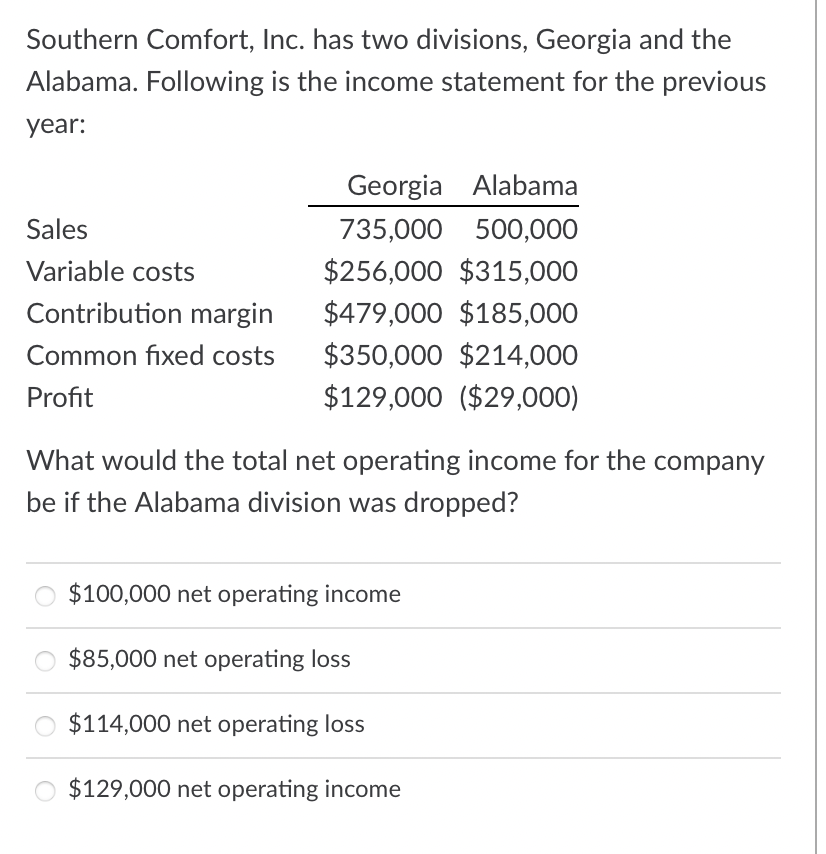

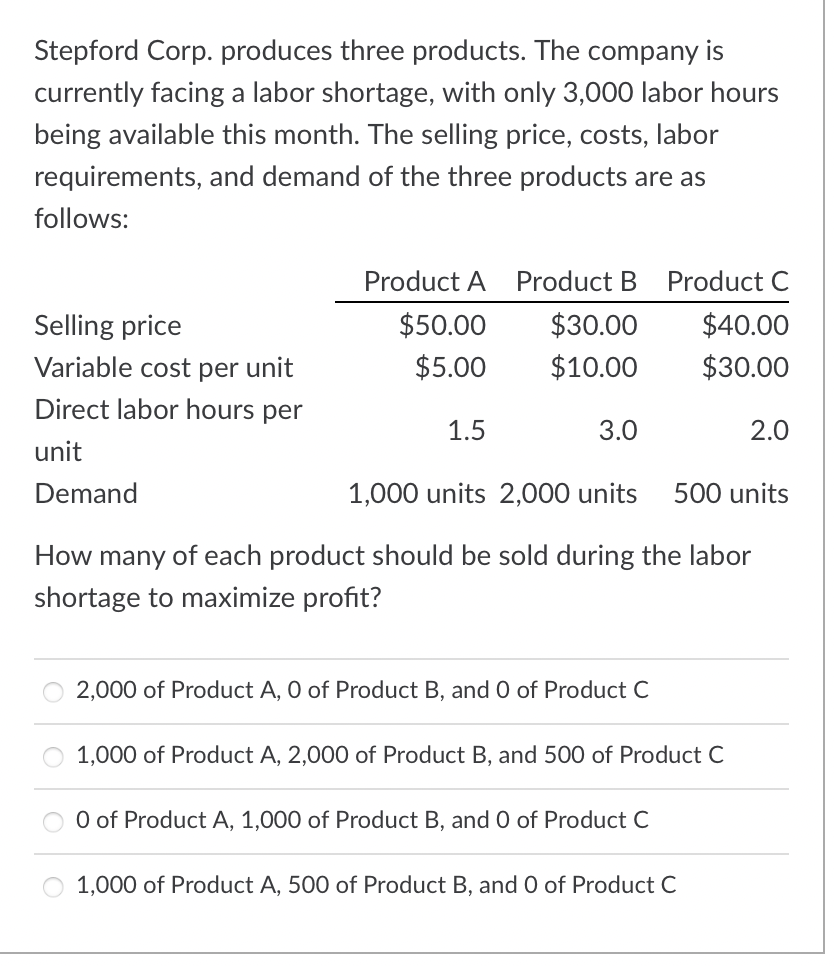

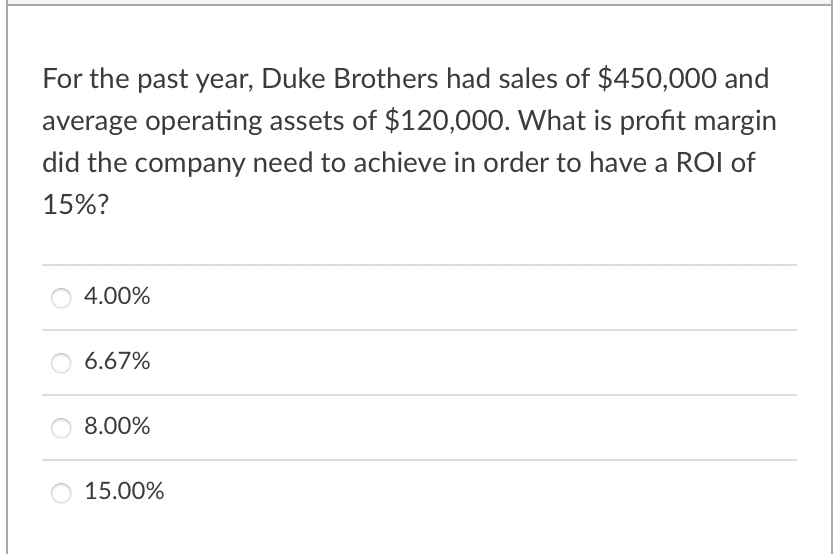

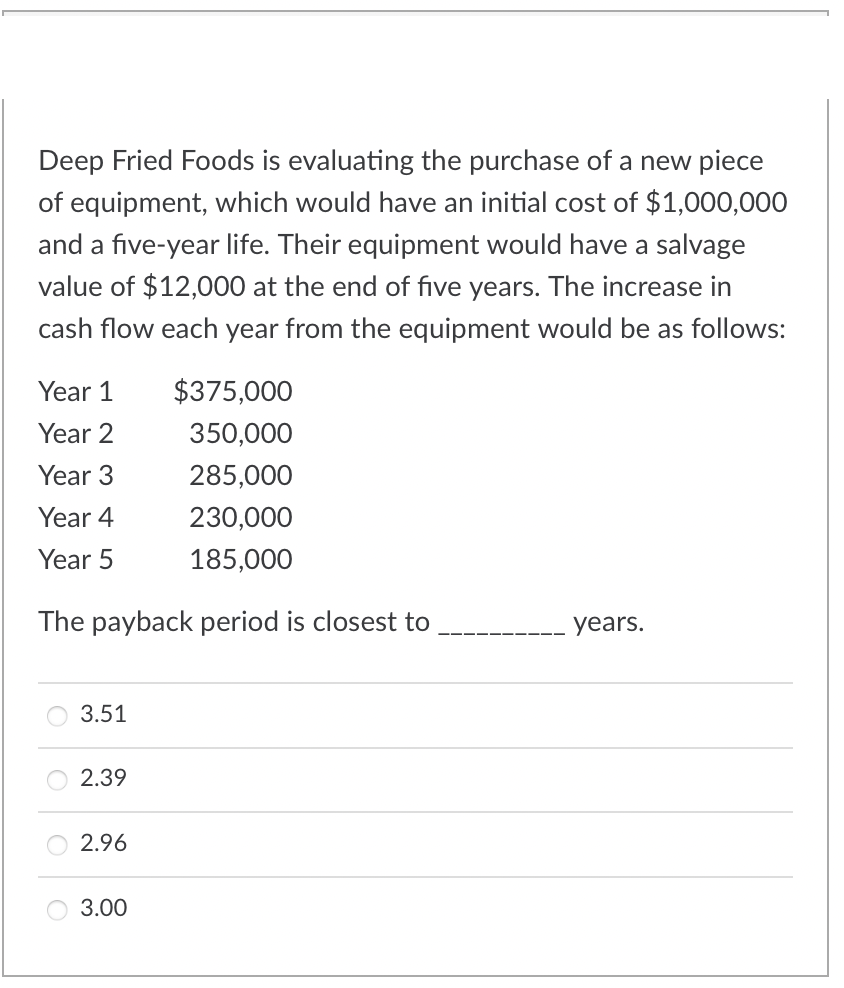

Greensboro Coffee Roasters is purchasing a new piece of equipment, which will result in additional cash flows of \\( \\$ 155,250 \\) per year for the life of the equipment. The equipment will have an initial cost of \\( \\$ 600,000 \\) and have an five year life. The salvage value of the equipment is estimated to be \\( \\$ 140,000 \\). If the discount rate is 10 percent, what is the approximate net present value? Partial present value tables appear below Present Value of \\$ 1 Present Value of Annuity of \\( \\$ 1 \\) \\( \\$ 519,234 \\) \\( \\$ 75,488 \\) \\( (\\$ 416,679) \\) \\( \\$ 675,448 \\) Deep Fried Foods is evaluating the purchase of a new piece of equipment, which would have an initial cost of \\( \\$ 1,000,000 \\) and a five-year life. Their equipment would have a salvage value of \\( \\$ 12,000 \\) at the end of five years. The increase in cash flow each year from the equipment would be as follows: The payback period is closest to years. 3.51 2.39 2.96 3.00 Stepford Corp. produces three products. The company is currently facing a labor shortage, with only 3,000 labor hours being available this month. The selling price, costs, labor requirements, and demand of the three products are as follows: How many of each product should be sold during the labor shortage to maximize profit? 2,000 of Product A, 0 of Product \\( B \\), and 0 of Product \\( C \\) 1,000 of Product A, 2,000 of Product B, and 500 of Product C 0 of Product A, 1,000 of Product \\( B \\), and 0 of Product \\( C \\) 1,000 of Product A, 500 of Product B, and 0 of Product C Southern Comfort, Inc. has two divisions, Georgia and the Alabama. Following is the income statement for the previous year: What would the total net operating income for the company be if the Alabama division was dropped? \\( \\$ 100,000 \\) net operating income \\( \\$ 85,000 \\) net operating loss \\( \\$ 114,000 \\) net operating loss \\( \\$ 129,000 \\) net operating income

Greensboro Coffee Roasters is purchasing a new piece of equipment, which will result in additional cash flows of \\( \\$ 155,250 \\) per year for the life of the equipment. The equipment will have an initial cost of \\( \\$ 600,000 \\) and have an five year life. The salvage value of the equipment is estimated to be \\( \\$ 140,000 \\). If the discount rate is 10 percent, what is the approximate net present value? Partial present value tables appear below Present Value of \\$ 1 Present Value of Annuity of \\( \\$ 1 \\) \\( \\$ 519,234 \\) \\( \\$ 75,488 \\) \\( (\\$ 416,679) \\) \\( \\$ 675,448 \\) Deep Fried Foods is evaluating the purchase of a new piece of equipment, which would have an initial cost of \\( \\$ 1,000,000 \\) and a five-year life. Their equipment would have a salvage value of \\( \\$ 12,000 \\) at the end of five years. The increase in cash flow each year from the equipment would be as follows: The payback period is closest to years. 3.51 2.39 2.96 3.00 Stepford Corp. produces three products. The company is currently facing a labor shortage, with only 3,000 labor hours being available this month. The selling price, costs, labor requirements, and demand of the three products are as follows: How many of each product should be sold during the labor shortage to maximize profit? 2,000 of Product A, 0 of Product \\( B \\), and 0 of Product \\( C \\) 1,000 of Product A, 2,000 of Product B, and 500 of Product C 0 of Product A, 1,000 of Product \\( B \\), and 0 of Product \\( C \\) 1,000 of Product A, 500 of Product B, and 0 of Product C Southern Comfort, Inc. has two divisions, Georgia and the Alabama. Following is the income statement for the previous year: What would the total net operating income for the company be if the Alabama division was dropped? \\( \\$ 100,000 \\) net operating income \\( \\$ 85,000 \\) net operating loss \\( \\$ 114,000 \\) net operating loss \\( \\$ 129,000 \\) net operating income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started