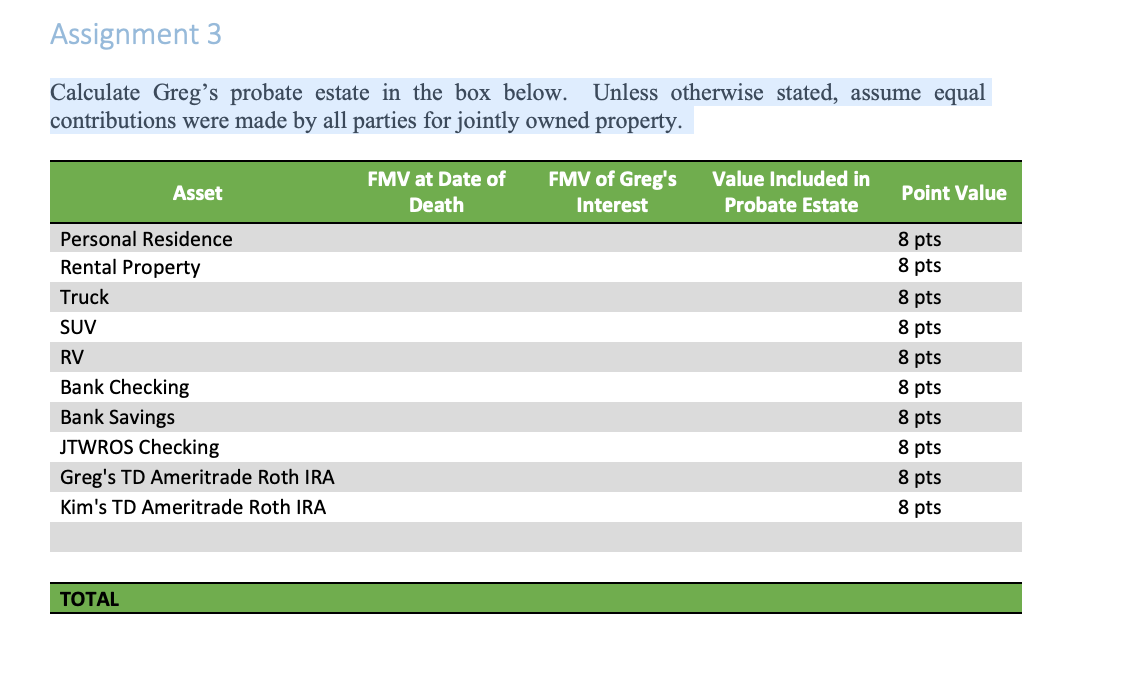

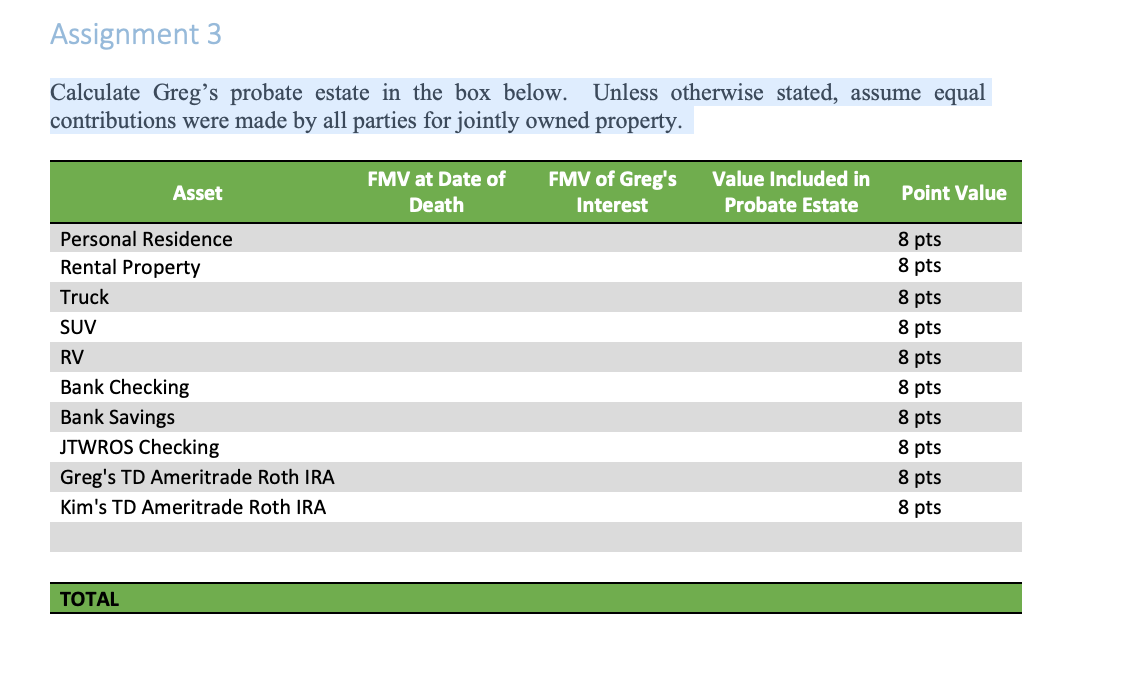

Greg and Kim met in College Station, Texas at a student investment club while attending college. They are now a married couple still living in Texas with two children, Katie, age 16, and Kyle, age 14. Greg and Kim are professionals who maintain a healthy and active lifestyle. Unfortunately Greg passed away unexpectedly from a heart attack while on a bike ride. On the day that Greg died, he and Kim owned the following assets. Fortunately Greg and Kim had recently worked with an attorney to draft a valid will. 1. Home and shop located on 20 acres valued at $750,000 owned as community property with Greg and Kim. 2. A 4-plex valued at $280,000 owned as Tenants in Common with Greg and his brother Dylan equally. 3. Greg's truck valued at $18,000 held in fee simple by Greg. 4. Kim's SUV valued at $26,000 held as joint tenants with right of survivorship (JTWROS) with Greg. 5. Recreational Vehicle (RV) for tailgating before every A&M home game. Valued at $66,000 owned as Tenants in Common between Greg and his brother Dylan equally. 6. Bank checking account held as joint tenants with right of survivorship (JTWROS) with Greg and Kim. Both Greg and Kim have their paycheck direct deposited into this account each pay period. Valued at $18,000. 7. Bank savings account that Greg accumulated prior to his marriage to Kim from earnings he made for years of showing animals at the local county fair. This account is held as POD to Greg's kids, Katie and Kyle equally. No deposits have been added to the account since Greg married Kim. Valued at $14,000. 8. $58,000 in a TD Ameritrade brokerage account owned JTWROS with Greg and Kim. They have an auto deposit from their checking account for $2,000 per month into this account. 9. Greg's TD Ameritrade Roth IRA that he started in college from earnings from his part- time job. He has been contributing to the account every year since then with money from the JTWROS checking account. He never got around to adding a beneficiary on the account. Valued at $72,000. 10. Kim's TD Ameritrade Roth IRA that she started in college from earnings from her part time job. She has been contributing to the account every year since then with money from the JTWROS checking account. She updated the beneficiary to Greg after they married. Valued at $82,000. Assignment 3 Calculate Greg's probate estate in the box below. Unless otherwise stated, assume equal contributions were made by all parties for jointly owned property. Asset FMV at Date of Death FMV of Greg's Interest Value Included in Probate Estate Point Value 8 pts 8 pts 8 pts Personal Residence Rental Property Truck SUV RV Bank Checking Bank Savings JTWROS Checking Greg's TD Ameritrade Roth IRA Kim's TD Ameritrade Roth IRA 8 pts 8 pts 8 pts 8 pts 8 pts 8 pts 8 pts TOTAL Greg and Kim met in College Station, Texas at a student investment club while attending college. They are now a married couple still living in Texas with two children, Katie, age 16, and Kyle, age 14. Greg and Kim are professionals who maintain a healthy and active lifestyle. Unfortunately Greg passed away unexpectedly from a heart attack while on a bike ride. On the day that Greg died, he and Kim owned the following assets. Fortunately Greg and Kim had recently worked with an attorney to draft a valid will. 1. Home and shop located on 20 acres valued at $750,000 owned as community property with Greg and Kim. 2. A 4-plex valued at $280,000 owned as Tenants in Common with Greg and his brother Dylan equally. 3. Greg's truck valued at $18,000 held in fee simple by Greg. 4. Kim's SUV valued at $26,000 held as joint tenants with right of survivorship (JTWROS) with Greg. 5. Recreational Vehicle (RV) for tailgating before every A&M home game. Valued at $66,000 owned as Tenants in Common between Greg and his brother Dylan equally. 6. Bank checking account held as joint tenants with right of survivorship (JTWROS) with Greg and Kim. Both Greg and Kim have their paycheck direct deposited into this account each pay period. Valued at $18,000. 7. Bank savings account that Greg accumulated prior to his marriage to Kim from earnings he made for years of showing animals at the local county fair. This account is held as POD to Greg's kids, Katie and Kyle equally. No deposits have been added to the account since Greg married Kim. Valued at $14,000. 8. $58,000 in a TD Ameritrade brokerage account owned JTWROS with Greg and Kim. They have an auto deposit from their checking account for $2,000 per month into this account. 9. Greg's TD Ameritrade Roth IRA that he started in college from earnings from his part- time job. He has been contributing to the account every year since then with money from the JTWROS checking account. He never got around to adding a beneficiary on the account. Valued at $72,000. 10. Kim's TD Ameritrade Roth IRA that she started in college from earnings from her part time job. She has been contributing to the account every year since then with money from the JTWROS checking account. She updated the beneficiary to Greg after they married. Valued at $82,000. Assignment 3 Calculate Greg's probate estate in the box below. Unless otherwise stated, assume equal contributions were made by all parties for jointly owned property. Asset FMV at Date of Death FMV of Greg's Interest Value Included in Probate Estate Point Value 8 pts 8 pts 8 pts Personal Residence Rental Property Truck SUV RV Bank Checking Bank Savings JTWROS Checking Greg's TD Ameritrade Roth IRA Kim's TD Ameritrade Roth IRA 8 pts 8 pts 8 pts 8 pts 8 pts 8 pts 8 pts TOTAL