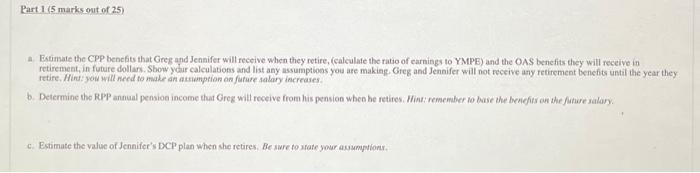

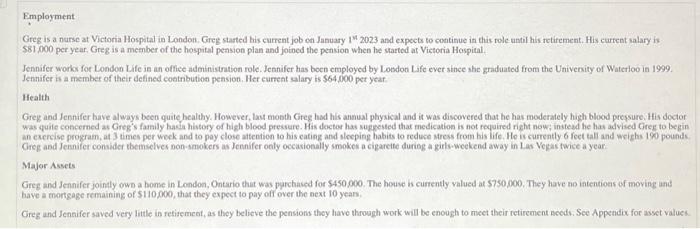

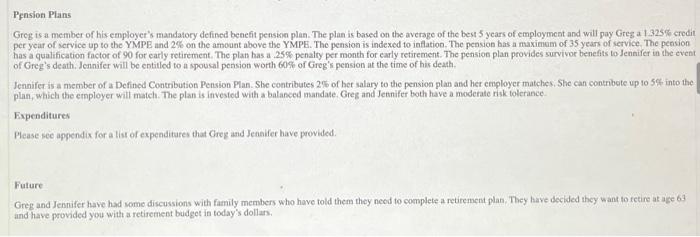

Greg is a nurse at Victoria Hospital in London. Greg started his current job on January 1n2023 and expects to continue in this role until his retifement. His current salary is $81,000 per year. Greg is a member of the hospital pension plan and joined the pension when he started at Victoria Hospital. Jennifer works for London Life in an office adeinistration role. Jennifer has been employed by Loodon Life ever since she graduated from the University of Waterioo in 1999. Jennifer is a member of their defined coetnbution pension. Her eurnent salary is $64,000 per year Health Greg and Jennifer have always been quite healthy. However, last month Gireg had his annual physical and it was discovered that he has moderately high blood pressure. His doctor was quile concerned as Greg's farnily hasia history of high blood pressare. His doctor has suggested that medication is not fequired right now; insteed he has advised Gres to begin an exercise program, at 3 times per week and to pay close attention to his cating and sloeping habits to redece stress from his life. He is currently 6 feet tall and weighs 190 pounds. Greg abd Jennifer consider tbemselver non-smokers as Jennifer only occasionally smokes a cigaretie during a girls-weekend away in Las Vepas fwice a year: Major Assets Greg and Jennifer jointly ows a bome in London, Ontario that was purchased for $450,900. The houve is currently valued at $750,900. They have no intentioes of moving und have a mortgage remaining of $110,000, that they expect to pay off over the next 10 yean. Greg and Jennifer saved very little in fetisement, as they believe the pensions they have through work will be enough to meet their retirement needs. See Appendix for asset values. Greg is a member of his employer's mandatory defined benefit pension plan. The plan is based on the average of the best 5 years of employment and will pay Greg a 1.325% credit per year of service up to the YMPB and 2% on the amount above the YMPE. The pension is indexed to inflation. The pension bas a maximem of 35 years of service. The pension has a qualification factor of 90 for early retirement. The plan has a .25% penalty per month for early retirement. The pensios plan provides survivor benefits to Jennifer in the event of Greg's death. Jennifer will be entitled to a spousal pension worth 60% of Greg's pension at the time of his death. Jennifer is a member of a Defined Contribution Pension Plan. Stse contributes 2% of her salary to the pension plan and her employer matches, She can contribote up to 5% into the plan, which the employer will match. The plan is invested with a balanced mandate. Greg and Jetnifer both have a moderate risk tolerance. Expenditures Please see appendix for a list of expenditares that Greg and Jenaifer have provided. Future Greg and Jennifer have had some discussions with family members who have told them they neod to complete a retirement plas. They have decided they want to fetire at age 63 and have provided you with a retirement budget in today's dollars. a. Estimate the CPP bencfits that Greg and Jennifer will receive when they retire, (calculate the ratio of earnings to YMPE) and the OAS benefits they will receive in retiremeat, in future dollan. Stow your calculations and list any assumptioos you ase making. Greg and Jennifer will not receive any retirement benefits until the year they retife. Hint: you will need to mule an astumpeion an future salary increases. b. Determine the RPP anaual pensioe income that Greg will receive from his pension whes he retires. Wint; remember no base the berigfirs an the funure salary. c. Estimate the value of Jennifer's DCP plan when she retires. Be sure to state your asumptions