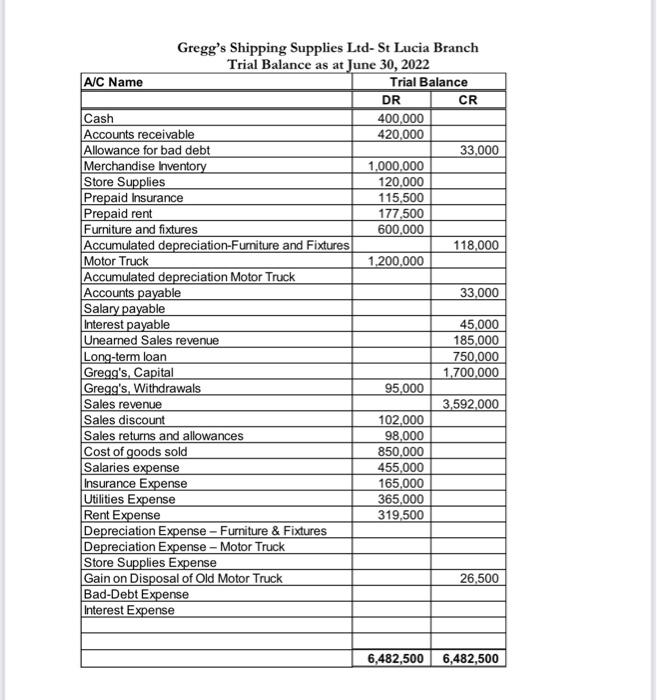

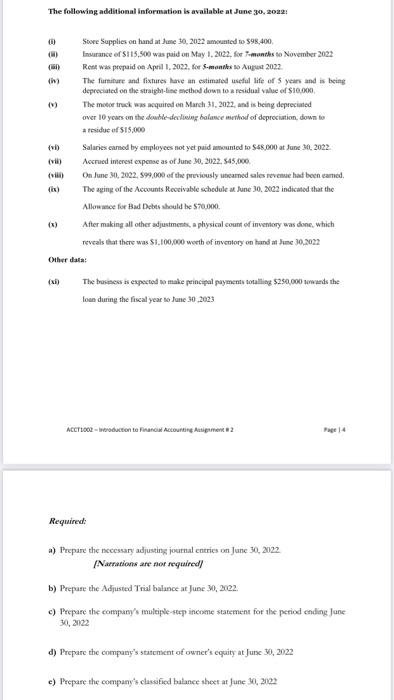

Gregg's Shipping Supplies Ltd- St Lucia Branch Trial Balance as at June 30,2022 \begin{tabular}{|l|c|r|} \hline A/C Name & \multicolumn{2}{|c|}{ Trial Balance } \\ \hline & \multicolumn{1}{|c|}{ DR } & \multicolumn{1}{|c|}{ CR } \\ \hline Cash & 400,000 & \\ \hline Accounts receivable & 420,000 & \\ \hline Allowance for bad debt & & 33,000 \\ \hline Merchandise Inventory & 1,000,000 & \\ \hline Store Supplies & 120,000 & \\ \hline Prepaid Insurance & 115,500 & \\ \hline Prepaid rent & 177,500 & \\ \hline Furniture and fixtures & 600,000 & \\ \hline Accumulated depreciation-Furniture and Fixtures & & 118,000 \\ \hline Motor Truck & 1,200,000 & \\ \hline Accumulated depreciation Motor Truck & & \\ \hline Accounts payable & & \\ \hline Salary payable & & \\ \hline Interest payable & & \\ \hline Unearned Sales revenue & & \\ \hline Long-term loan & & \\ \hline Gregg's, Capital & & \\ \hline Gregg's, Withdrawals & & \\ \hline Sales revenue & & \\ \hline Sales discount & & \\ \hline Sales returns and allowances & & \\ \hline Cost of goods sold & & \\ \hline Salaries expense & & \\ \hline Insurance Expense & & \\ \hline Utilities Expense & & \\ \hline Rent Expense & & \\ \hline Depreciation Expense - Furniture \& Fixtures & & \\ \hline Depreciation Expense - Motor Truck & & \\ \hline Store Supplies Expense & & \\ \hline Gain on Disposal of Old Motor Truck & & \\ \hline Bad-Debt Expense & & \\ \hline Interest Expense & & \\ \hline & & \\ \hline \end{tabular} The following additional Information is available at June 30,2022 : (i) Soore Supplies on hund at june 30,2022 amounted to 598,400 , (ia) Inarance of 5115,500 was paid on May 1, 2022, foe fowandis so November 202z (ii) Rene was prepuid on April 1. 2022, for 5 -menibs as Argaat 2022. (im) The furniture and fixtures lave an estimared useful life of 5 yearn and is being depreciated on the straigh-line method down to a revidual value of $10.000. (v) The motor track ass acquired on Manch 31, 2022, anat is being depreciated over 10 yoars on the dowbie declivieg balasce merthod of deprociation, down to a tesiduc of 515,000 (vi) Salarics camod by cmployees not yet paid amounted to $48,000 at June 30,2022. (vii) Aecrued imerest expense as of June 30,2022,845,000. (viia) On June 30,2022,599,000 of the previously unearned sales revenve had been camed. (b) The aging of the Acoounts Reccivable schodule at lune 30.2022 indicalod that the Allowasee for Bad Debes should be 570000 . (x) After making all other adjustments, a physical count of inveniory was done, which reveals that there was 51,100,000 werth of inventory on hand at Jeme 30,2022 Oiher data: (xi) The bruseses ss expected wo make feincipal payments aotalling $250,000 anmands the loan during the fiscal year wo June 30,2023 Accrtood - inboduction to fimanois Actounting Aatigament 2 Page 14 Required a) Pecpare the nccessary adjusting journal entries on June 30,2022 (Narrations are nor reqprained] b) Prepare the Adjusted Trial balance ar Junc 30,2022 . c) Prepare the company's truleiple-secp income statement fot the period ending Jane 30,222 d) Prepare the company's statenicnt of owner's coquity at Juse $0,2022 c) Pecpare the company's clasificd balance sheet at June 30,202