Question

Greshak Company, Inc. is in the business of producing and marketing high-tech widgets. Assume you are a financial analyst at Greshak and have been charged

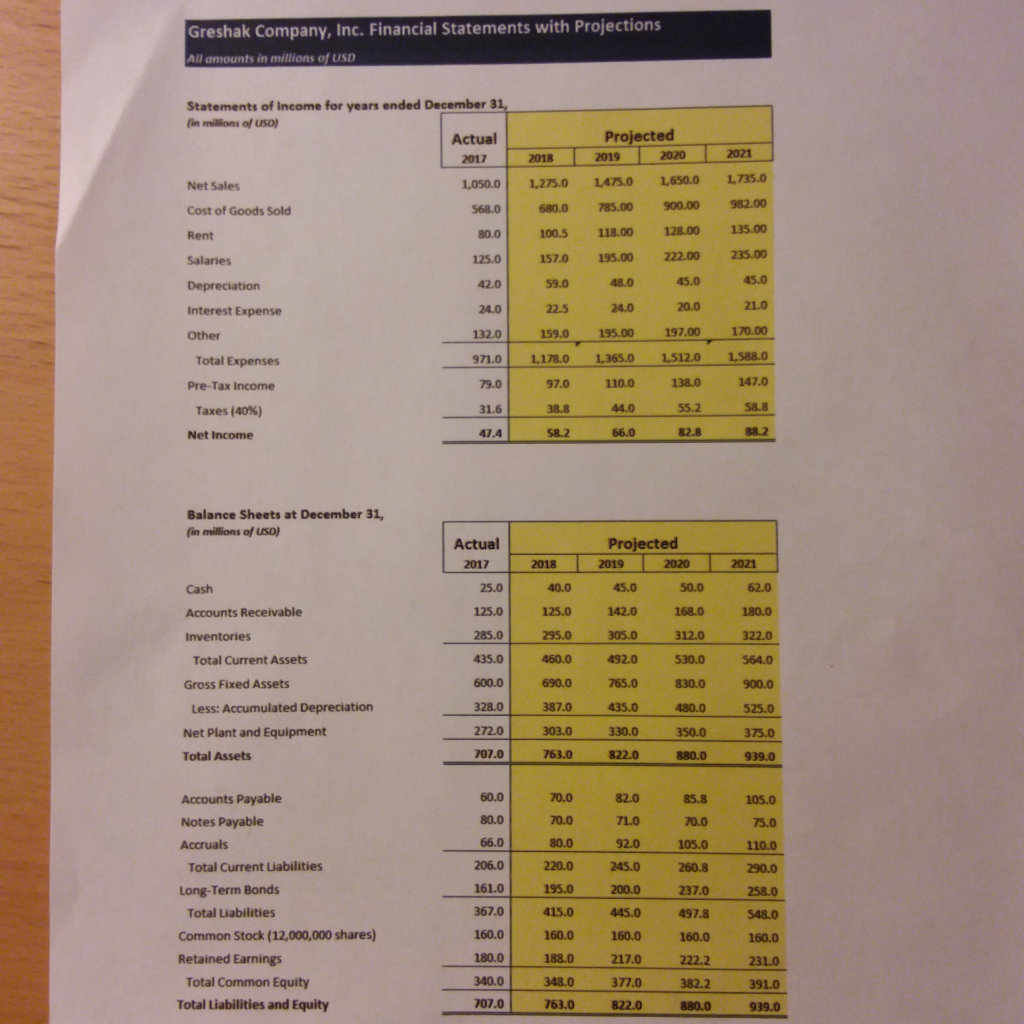

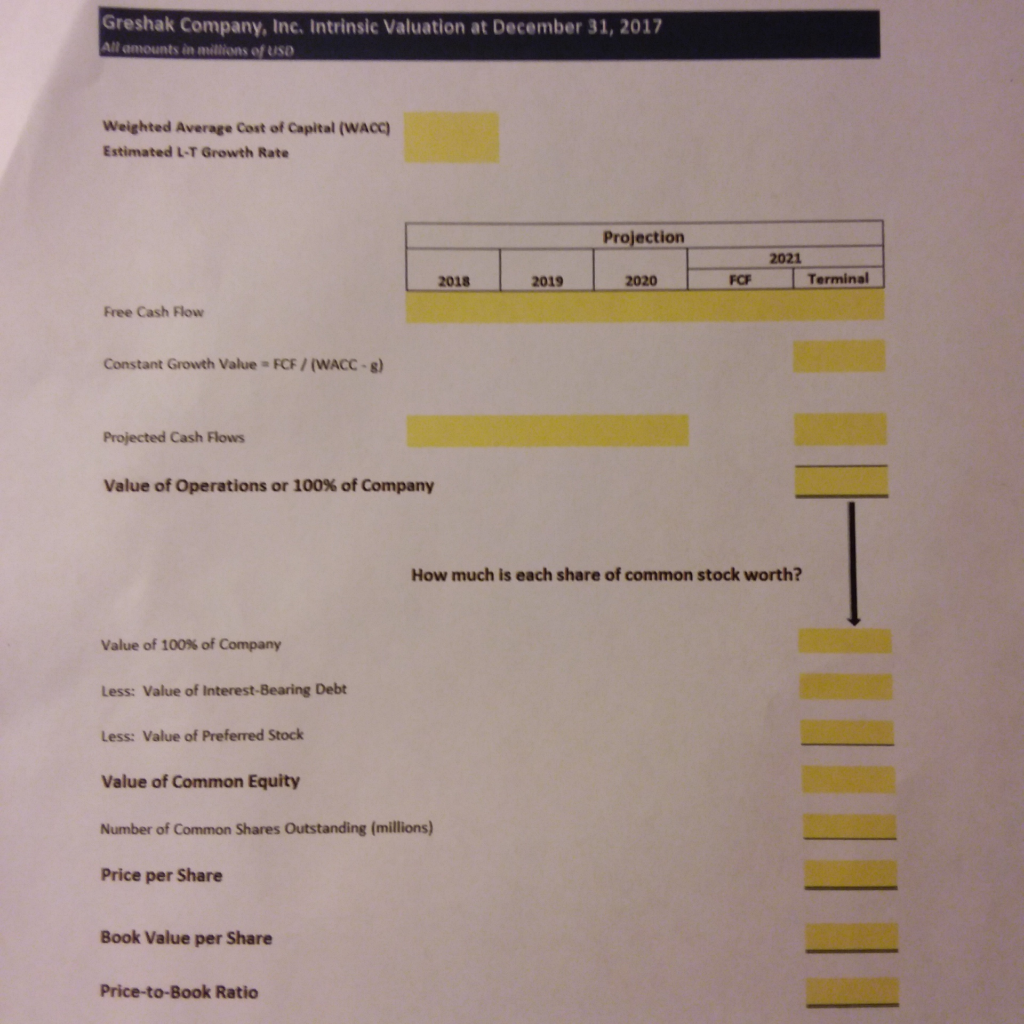

Greshak Company, Inc. is in the business of producing and marketing high-tech widgets. Assume you are a financial analyst at Greshak and have been charged with the task of estimating the value (i.e., intrinsic value) of the company's outstanding common stock at December 31, 2017. As part of that analysis, management has provided you with the company's most recent income statement and balance sheet for 2017 as well as financial projections of each for the next 4 years. Assume Greshak's applicable tax rate is 40% and that management has determined its weighted average cost of capital (WACC or discount rate) to be 14.0%. Further, assume Greshak has estimated its long-term sustainable growth rate (g) for its free cash flows (FCF) to be 3% upon reaching earnings stabilization after 2021 (the last year in the projection period).

Using MS-Excel and the template on the following pages, calculate the Intrinsic Value of Greshaks operations (i.e., the estimated value of the company) using the data above (hint see Supernormal Growth methodology in Chapter 6 and combine with Free Cash Flow methodology).

-

Projected Free Cash Flow Particulars Actual Projected Projected Projected Projected 2017 2018 2019 2020 2021 NOPAT: EBIT 79+24=103 119.5 134 158 168 tax @40% 41.2 47.8 53.6 63.2 67.2 NOPAT 61.8 71.7 80.4 94.8 100.8 Add: Depreciation 42 59 48 45 45 Operating Cash Flow 103.8 130.7 128.4 139.8 145.8 Total Operating Capital: Operating Current Assets: 435 460 492 530 564 Less: Operating Current Liabilities 206 220 245 260.8 290 Net Operating Working Capital 229 240 247 269.2 274 Investment in Net Working Capital NA 11 7 22.2 4.8 Annual Capital Expenditures NA 690-600=90 75 65 70 Total Investment in Operating Capital 101 82 87.2 74.8 Free Cash Flow: Operating Cash Flow NA 130.7 128.4 139.8 145.8 Less: Total Investment in Operating Capital NA 101 82 87.2 74.8 Projected Free Cash Flow NA 29.7 46.4 52.6 71

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started