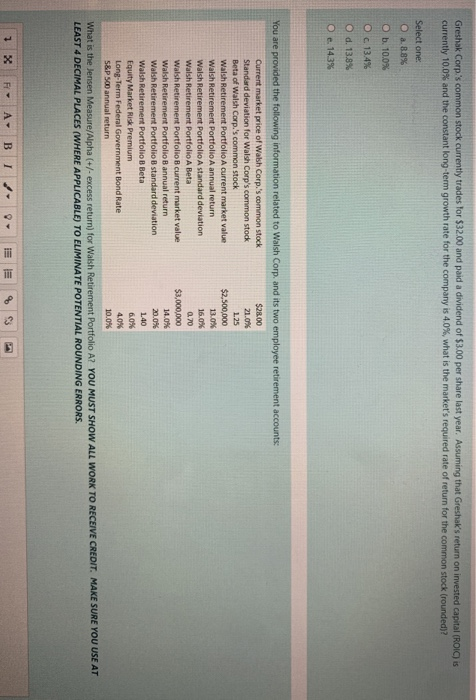

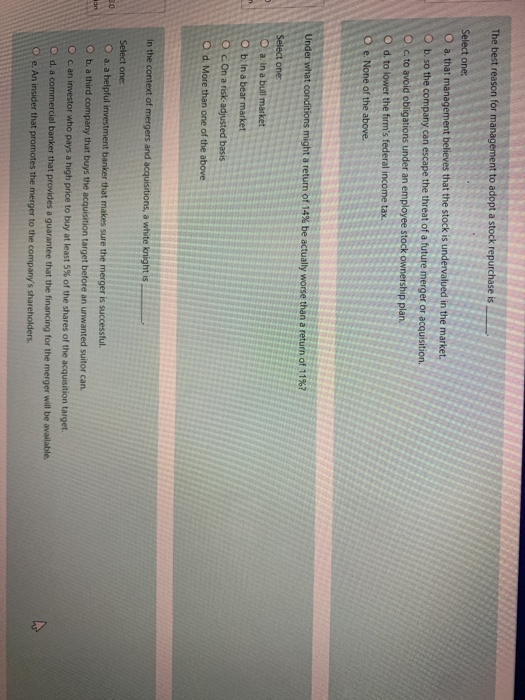

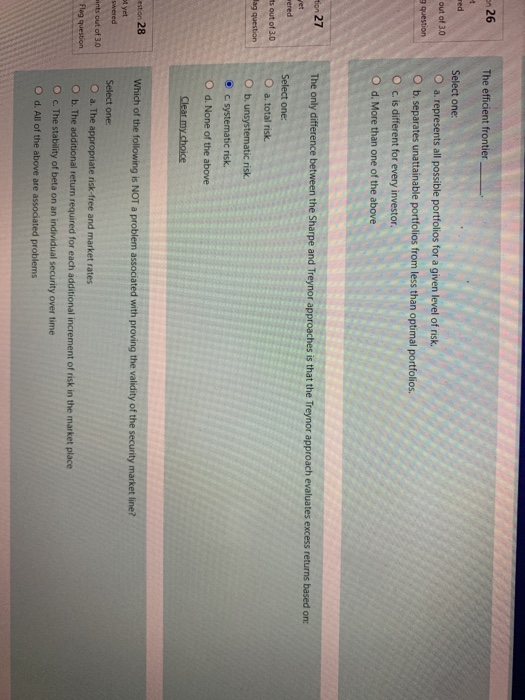

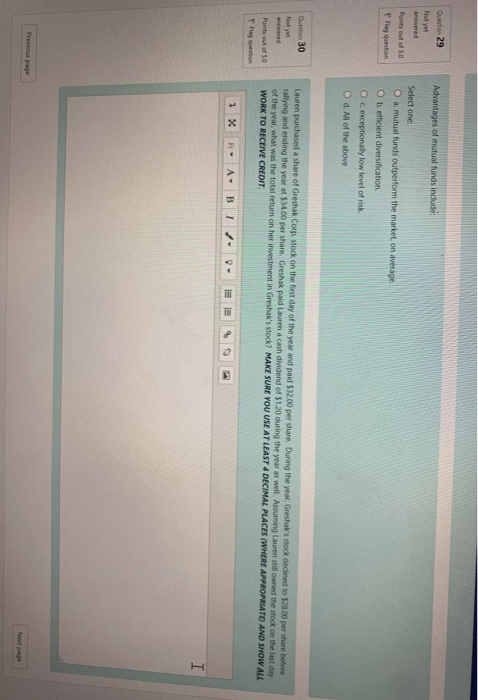

Greshak Corp's common stock currently trades for $32.00 and paid a dividend of $3.00 per share last year. Assuming that Greshak's return on invested capital (ROC) is currently 10.0% and the constant long-term growth rate for the company is 4.0%, what is the market's required rate of return for the common stock (rounded)? Select one: O a. 8.8% O b. 10.0% O c 13.4% O d. 13.8% O. e. 14.3% You are provided the following information related to Walsh Corp. and its two employee retirement accounts: Current market price of Walsh Corp.'s common stock $28.00 Standard deviation for Walsh Corp's common stock 21.0% Beta of Walsh Corp.'s common stock 125 Walsh Retirement Portfolio A current market value $2,500,000 Walsh Retirement Portfolio A annual return 13.0% Walsh Retirement Portfolio A standard deviation 16.0% Walsh Retirement Portfolio A Beta 0.70 Walsh Retirement Portfolio B current market value $3,000,000 Walsh Retirement Portfolio B annual return 14.0% Walsh Retirement Portfolio B standard deviation 20.0% Walsh Retirement Portfolio B Beta 1.40 Equity Market Risk Premium 6.0% Long-Term Federal Government Bond Rate 4.0% S&P 500 annual return 10.0% What is the Jensen Measure/Alpha (+/- excess return) for Walsh Retirement Portfolio A? YOU MUST SHOW ALL WORK TO RECEIVE CREDIT. MAKE SURE YOU USE AT LEAST 4 DECIMAL PLACES (WHERE APPLICABLE) TO ELIMINATE POTENTIAL ROUNDING ERRORS. X " F B 1 iii TIT $ The best reason for management to adopt a stock repurchase is Select one: O a. that management believes that the stock is undervalued in the market. O b. so the company can escape the threat of a future merger or acquisition O c. to avoid obligations under an employee stock ownership plan O d. to lower the firm's federal income tax. O e None of the above. Under what conditions might a return of 14% be actually worse than a return of 11%? n Select one: O a. in a bull market O b. In a bear market O c. On a risk-adjusted basis O d. More than one of the above In the context of mergers and acquisitions, a white knight is 3.0 on Select one: O a. a helpful investment banker that makes sure the merger is successful. O b. a third company that buys the acquisition target before an unwanted suitor can. can investor who pays a high price to buy at least 5% of the shares of the acquisition target. O d. a commercial banker that provides a guarantee that the financing for the merger will be available, o e. An insider that promotes the merger to the company's shareholders. 26 The efficient frontier red out of 30 question Select one: O a. represents all possible portfolios for a given level of risk. O b. separates unattainable portfolios from less than optimal portfolios. O cis different for every investor. O d. More than one of the above tion 27 The only difference between the Sharpe and Treynor approaches is that the Treynor approach evaluates excess returns based on wered Select one: O a. total risk. its out of 3.0 lag question O b.unsystematic risk. . c systematic risk. O d. None of the above Clear my choice eston 28 Which of the following is NOT a problem associated with proving the validity of the security market line? ot yet swered ints out of 3.0 Flag question Select one O a. The appropriate risk-free and market rates O b. The additional return required for each additional increment of risk in the market place O c. The stability of beta on an individual security over time O d. All of the above are associated problems Question 29 Advantages of mutual funds include: Nyt aniwered Points out of 30 la question Select one: O a mutual funds outperform the market on average Ob efficient diversification O c.exceptionally low level of risk O d. All of the above Quitton 30 Not yet wered Lauren purchased a share of Greshak Corp, stock on the first day of the year and paid $32.00 per share. During the year. Gresha's stock declined to $28.00 per share before rallying and ending the year at $34.00 per share. Greshak paid Lauren a cash dividend of $1.20 during the year as well. Assuming Lauren still owned the stock on the last day of the year, what was the total return on her investment in Greshak's stock? MAKE SURE YOU USE AT LEAST 4 DECIMAL PLACES (WHERE APPROPRIATE AND SHOW ALL WORK TO RECEIVE CREDIT Points out of 5.0 Flag question 1 x Fr A- I Previous page