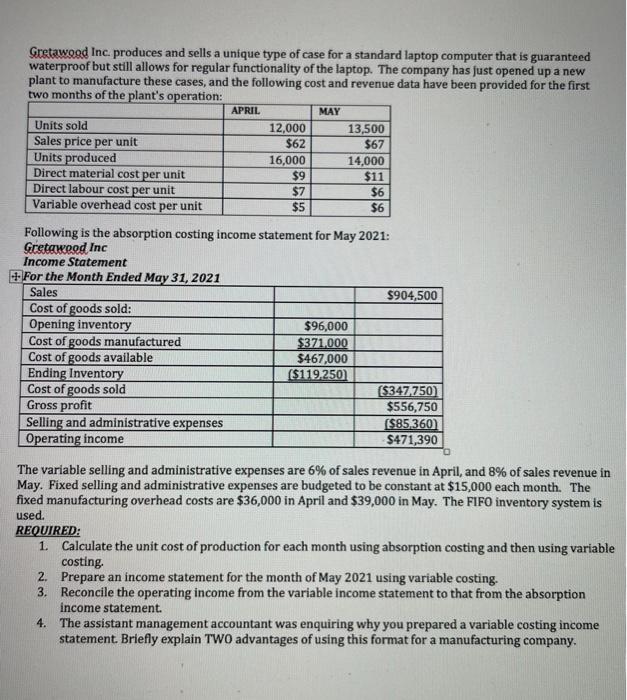

Gretawood Inc. produces and sells a unique type of case for a standard laptop computer that is guaranteed waterproof but still allows for regular functionality of the laptop. The company has just opened up a new plant to manufacture these cases, and the following cost and revenue data have been provided for the first two months of the plant's operation: APRIL MAY Units sold 12,000 13,500 Sales price per unit $62 $67 Units produced 16,000 14,000 Direct material cost per unit $9 $11 Direct labour cost per unit $7 $6 Variable overhead cost per unit $5 $6 Following is the absorption costing income statement for May 2021: Gretakeed Inc Income Statement + For the Month Ended May 31, 2021 Sales $904,500 Cost of goods sold: Opening inventory $96,000 Cost of goods manufactured $371.000 Cost of goods available $467,000 Ending Inventory ($119.250) Cost of goods sold (5347.750 Gross profit $556,750 Selling and administrative expenses ($85.360 Operating income $471,390 The variable selling and administrative expenses are 6% of sales revenue in April, and 8% of sales revenue in May. Fixed selling and administrative expenses are budgeted to be constant at $15,000 each month. The fixed manufacturing overhead costs are $36,000 in April and $39,000 in May. The FIFO inventory system is used. REQUIRED: 1. Calculate the unit cost of production for each month using absorption costing and then using variable costing 2. Prepare an income statement for the month of May 2021 using variable costing. 3. Reconcile the operating income from the variable income statement to that from the absorption income statement. 4. The assistant management accountant was enquiring why you prepared a variable costing income statement. Briefly explain TWO advantages of using this format for a manufacturing company. Gretawood Inc. produces and sells a unique type of case for a standard laptop computer that is guaranteed waterproof but still allows for regular functionality of the laptop. The company has just opened up a new plant to manufacture these cases, and the following cost and revenue data have been provided for the first two months of the plant's operation: APRIL MAY Units sold 12,000 13,500 Sales price per unit $62 $67 Units produced 16,000 14,000 Direct material cost per unit $9 $11 Direct labour cost per unit $7 $6 Variable overhead cost per unit $5 $6 Following is the absorption costing income statement for May 2021: Gretakeed Inc Income Statement + For the Month Ended May 31, 2021 Sales $904,500 Cost of goods sold: Opening inventory $96,000 Cost of goods manufactured $371.000 Cost of goods available $467,000 Ending Inventory ($119.250) Cost of goods sold (5347.750 Gross profit $556,750 Selling and administrative expenses ($85.360 Operating income $471,390 The variable selling and administrative expenses are 6% of sales revenue in April, and 8% of sales revenue in May. Fixed selling and administrative expenses are budgeted to be constant at $15,000 each month. The fixed manufacturing overhead costs are $36,000 in April and $39,000 in May. The FIFO inventory system is used. REQUIRED: 1. Calculate the unit cost of production for each month using absorption costing and then using variable costing 2. Prepare an income statement for the month of May 2021 using variable costing. 3. Reconcile the operating income from the variable income statement to that from the absorption income statement. 4. The assistant management accountant was enquiring why you prepared a variable costing income statement. Briefly explain TWO advantages of using this format for a manufacturing company