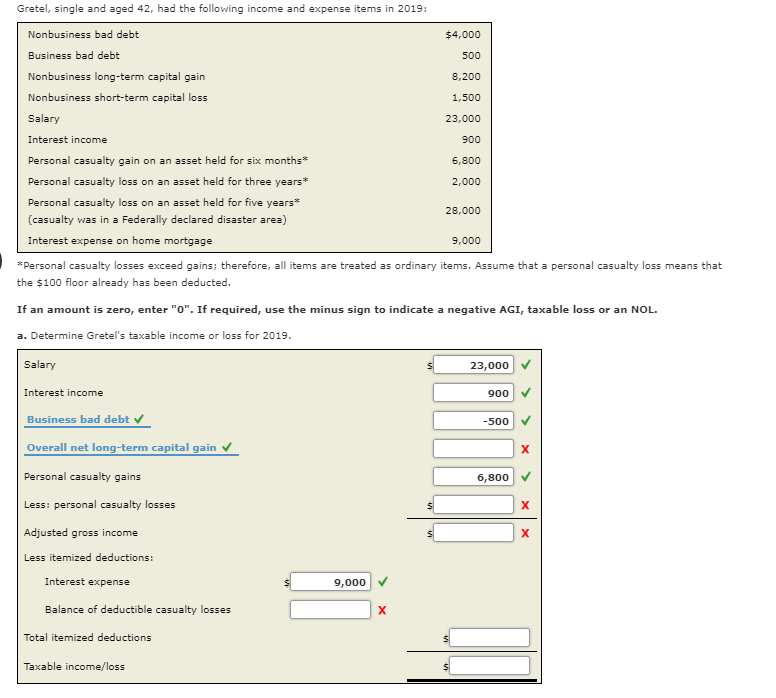

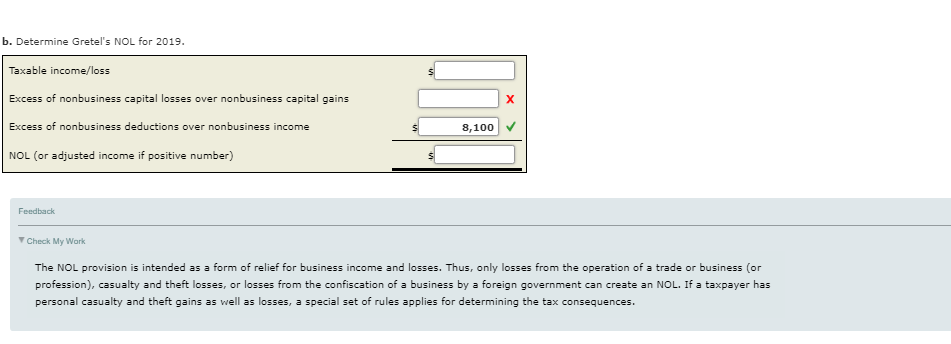

Gretel, single and aged 42, had the following income and expense items in 2019: Nonbusiness bad debt $4,000 Business bad debt 500 Nonbusiness long-term capital gain 8,200 Nonbusiness short-term capital loss 1,500 Salary 23,000 Interest income 900 Personal casualty gain on an asset held for six months* 6,800 Personal casualty loss on an asset held for three years 2,000 Personal casualty loss on an asset held for five years 28,000 (casualty was in a Federally declared disaster area) Interest expense on home mortgage 9,000 Personal casualty losses exceed gains; therefore, all items are treated as ordinary items. Assume that a personal casualty loss means that the $100 floor already has been deducted. If an amount is zero, enter "0". If required, use the minus sign to indicate a negative AGI, taxable loss or an NOL. a. Determine Gretel's taxable income or loss for 2019 Salary 23,000 Interest income 900 Business bad debt 500 Overall net long-term capital gain Personal casualty gains 6,800 Less: personal casualty losses Adjusted gross income Less itemized deductions: Interest expense 9,000 Balance of deductible casualty losses Total itemized deductions Taxable income/loss X X b. Determine Gretel's NOL for 2019 Taxable income/loss Excess of nonbusiness capital losses over nonbusiness capital gains Excess of nonbusiness deductions over nonbusiness income 8,100 NOL (or adjusted income if positive number) Feedback Check My Work The NOL provision is intended as a form of relief for business income and losses. Thus, only losses from the operation of a trade or business (or profession), casualty and theft losses, or losses from the confiscation of a business by a foreign government can create an NOL. If a taxpayer has personal casualty and theft gains as well as losses, a special set of rules applies for determining the tax consequences. Gretel, single and aged 42, had the following income and expense items in 2019: Nonbusiness bad debt $4,000 Business bad debt 500 Nonbusiness long-term capital gain 8,200 Nonbusiness short-term capital loss 1,500 Salary 23,000 Interest income 900 Personal casualty gain on an asset held for six months* 6,800 Personal casualty loss on an asset held for three years 2,000 Personal casualty loss on an asset held for five years 28,000 (casualty was in a Federally declared disaster area) Interest expense on home mortgage 9,000 Personal casualty losses exceed gains; therefore, all items are treated as ordinary items. Assume that a personal casualty loss means that the $100 floor already has been deducted. If an amount is zero, enter "0". If required, use the minus sign to indicate a negative AGI, taxable loss or an NOL. a. Determine Gretel's taxable income or loss for 2019 Salary 23,000 Interest income 900 Business bad debt 500 Overall net long-term capital gain Personal casualty gains 6,800 Less: personal casualty losses Adjusted gross income Less itemized deductions: Interest expense 9,000 Balance of deductible casualty losses Total itemized deductions Taxable income/loss X X b. Determine Gretel's NOL for 2019 Taxable income/loss Excess of nonbusiness capital losses over nonbusiness capital gains Excess of nonbusiness deductions over nonbusiness income 8,100 NOL (or adjusted income if positive number) Feedback Check My Work The NOL provision is intended as a form of relief for business income and losses. Thus, only losses from the operation of a trade or business (or profession), casualty and theft losses, or losses from the confiscation of a business by a foreign government can create an NOL. If a taxpayer has personal casualty and theft gains as well as losses, a special set of rules applies for determining the tax consequences