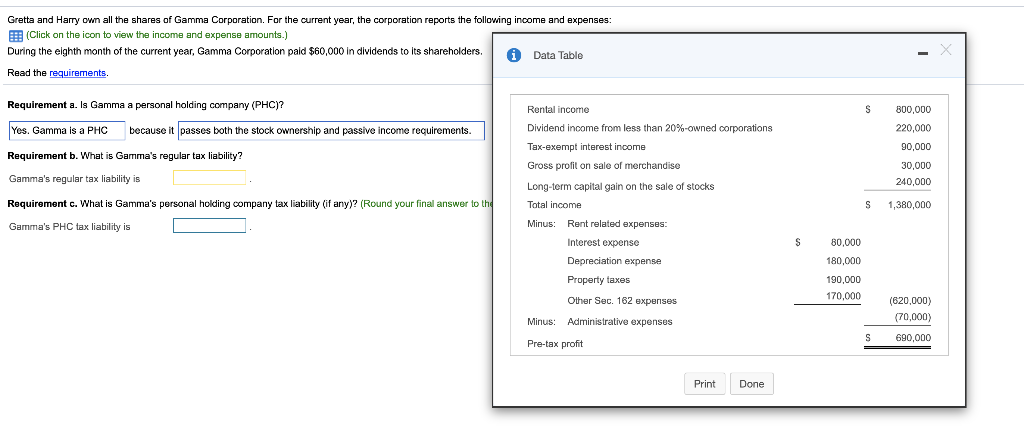

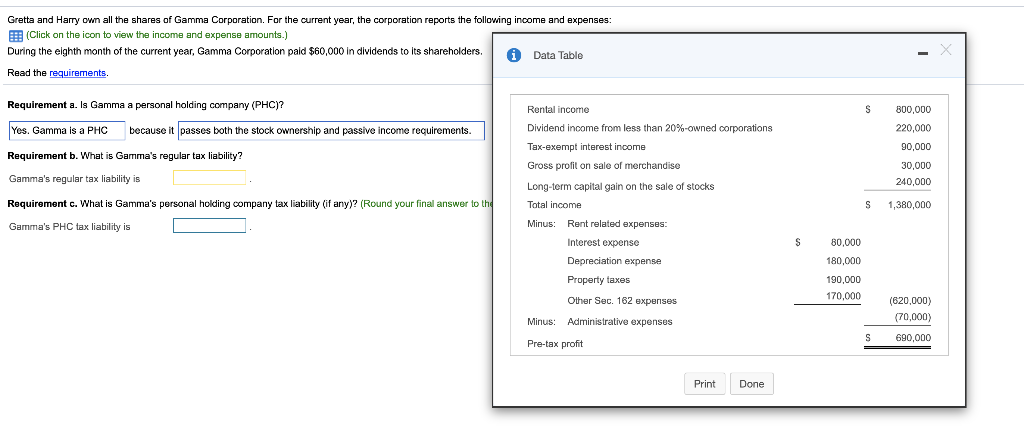

Gretta and Harry own all the shares of Gamma Corporation. For the current year, the corporation reports the following income and expenses: (Click on the icon to view the income and expense amounts.) During the eighth month of the current year, Gamma Corporation paid $60,000 in dividends to its shareholders. i Data Table Read the requirements. Requirement a. Is Gamma a personal holding company (PHC)? S Yes. Gamma is a PHC because it passes both the stock ownership and passive income requirements. 800,000 220,000 90,000 Requirement b. What is Gamma's regular tax liability? Gamma's regular tax liability is 30,000 240,000 Rental income Dividend income from less than 20%-owned corporations Tax-exempt interest income Gross profil on sale of merchandise Long-term capital gain on the sale of stocks Total income Minus: Rent related expenses: Interest expense Depreciation expense Property taxes Requirement c. What is Gamma's personal holding company tax liability (if any)? (Round your final answer to the S 1,380,000 Gamma's PHC tax liability is S 80,000 180,000 190.000 170,000 Other Sec. 162 expenses Minus: Administrative expenses (620,000) (70,000) 690,000 3 S Pre-tax profit Print Done Gretta and Harry own all the shares of Gamma Corporation. For the current year, the corporation reports the following income and expenses: (Click on the icon to view the income and expense amounts.) During the eighth month of the current year, Gamma Corporation paid $60,000 in dividends to its shareholders. i Data Table Read the requirements. Requirement a. Is Gamma a personal holding company (PHC)? S Yes. Gamma is a PHC because it passes both the stock ownership and passive income requirements. 800,000 220,000 90,000 Requirement b. What is Gamma's regular tax liability? Gamma's regular tax liability is 30,000 240,000 Rental income Dividend income from less than 20%-owned corporations Tax-exempt interest income Gross profil on sale of merchandise Long-term capital gain on the sale of stocks Total income Minus: Rent related expenses: Interest expense Depreciation expense Property taxes Requirement c. What is Gamma's personal holding company tax liability (if any)? (Round your final answer to the S 1,380,000 Gamma's PHC tax liability is S 80,000 180,000 190.000 170,000 Other Sec. 162 expenses Minus: Administrative expenses (620,000) (70,000) 690,000 3 S Pre-tax profit Print Done