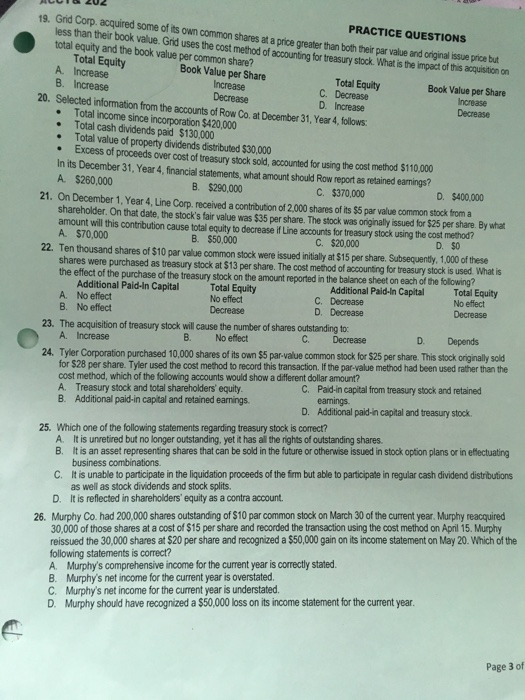

Grid Corp acquired some of its own common shares at a price greater than both their par value and original issue price but less than their book value. Grid users the cost method of accounting for treasury stock. What is the impact of this acquisition on total equity and the book value per common share? Selected information from the accounts of Row Co. at December 31, year 4 follows: Total income since incorporation $420,000 Total cash dividend s paid $130,000 Total value of property dividends distributed $30,000 Excess of proceeds over cost of treasury stock sold, accounted for using the cost method $110,000 In its December 31, Year 4, financial statements, what amount should Row report as retained earnings? A. $260,000 B. $290,000 C.$370,000 D.$400,000 On December 1 year 4, Line Corp, received a contribution of 2,000 shares of its $5 per value common stock from a shareholder. On that date the stock's fair value was $35 per share. The stock was originally issued for $25 per share. By what amount will this contribution cause total equity to decrease if Line accounts for treasury stock using the cost method? A. $70,000 B. $50,000 C. $20,000 D. $0 Ten thousand shares of $10 par value common stock were issued init ally at $ 15 per shre subsequently. 1,000 of these shares were purchased as treasury stock at $13 per share. The cost method of accounting for treasury stock is used. What is the effect of the purchase of the treasury stock on the amount reported in the balance sheet on each of the following? The acquisition of treasury stock will cause the number of shares cutstanding to: A. Increase B. No effect C. Decrease D. Depends Tyler corporation purchased 10,000 shares of its own $5 per. Value common stock for $25 per share. This stock criginally scid for $ 28 per share. Tyler used the cost method to record this transaction. If the par-value method had been used rather than the cost method, which of the following accounts would show a different dollar amount? A. Treasury stock and total share holders equity. B. Additional paid-in capital and retained earnings. C. Paid in capital from treasury stock and retained earnings. D. Additional paid-in capital and treasury stock. Which one of the following statements regarding treasury stock is correct? A. It is unretired but no longer outstanding, yet it has all the rights of outstanding shares. B. It is an asset represending shares that can be sold in the future or otherwise issued in stock option plans or in effectuating business combinations. C. It is unable to participate in the liquidation proceeds of the firm but able to participate in regular cash dividend distributions as well as stock dividends and stock splits. D. It is reflected in shareholders equity as a contra account. Murphy Co. had 200,000 shares outstanding of $10 par common stock on March 30 of the current year. Murphy reacquired 30,000 of those shares at a cost of $15 per share and recoded the transaction using the cost method on April 15. Murphy reissued the 30,000 shares at $20 per share and recognized a $ 50,000 gain on its income statement on May 20. Which of the following statements is correct? A. Murphy's comprehensive income for the current year is correctly stated. B. Murphy's net income for the current year is overstated C. Murphy's net income for the current year is understated. D. Murphy should have recognized as $50,000 loss on its income statement for the current year