Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Griffey Corporation has 4 0 , 0 0 0 of accumulated EP and incurs a loss of $ 3 0 , 0 0 0 for

Griffey Corporation has of accumulated EP and incurs a loss of $ for the year. The loss

accrues ratably through the year. On June Griffey Corporation distributes to its sole

shareholder, Ken. How much of the distribution will get dividend treatment? How much of the

distribution will reduce Kens basis in his Griffey stock?

Dividend income: $

Reduction in stock basis: $QUESTION CHAPTER

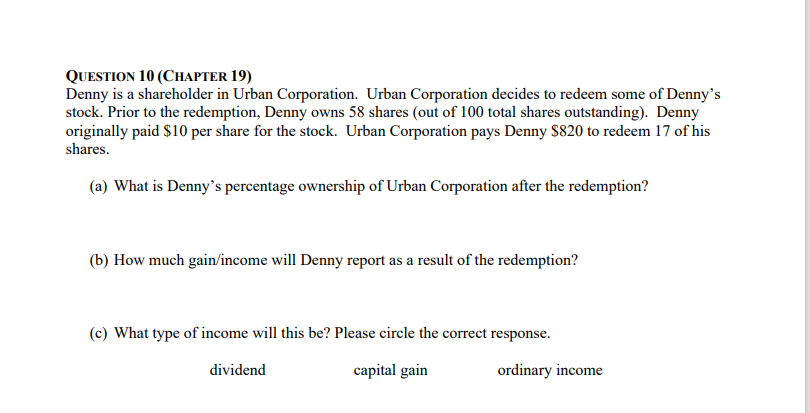

Denny is a shareholder in Urban Corporation. Urban Corporation decides to redeem some of Denny's

stock. Prior to the redemption, Denny owns shares out of total shares outstanding Denny

originally paid $ per share for the stock. Urban Corporation pays Denny $ to redeem of his

shares.

a What is Denny's percentage ownership of Urban Corporation after the redemption?

b How much gainincome will Denny report as a result of the redemption?

c What type of income will this be Please circle the correct response.

dividend

capital gain

ordinary income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started