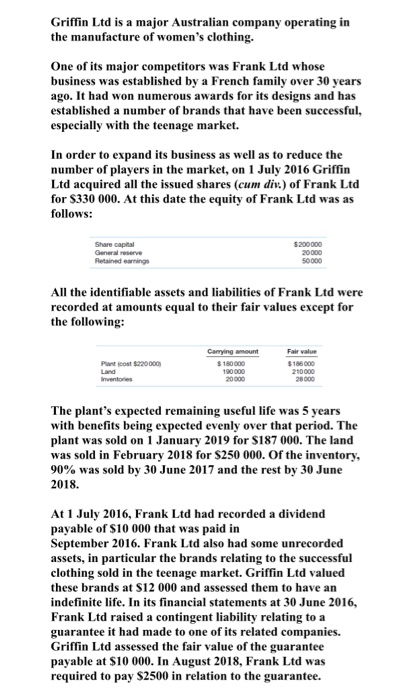

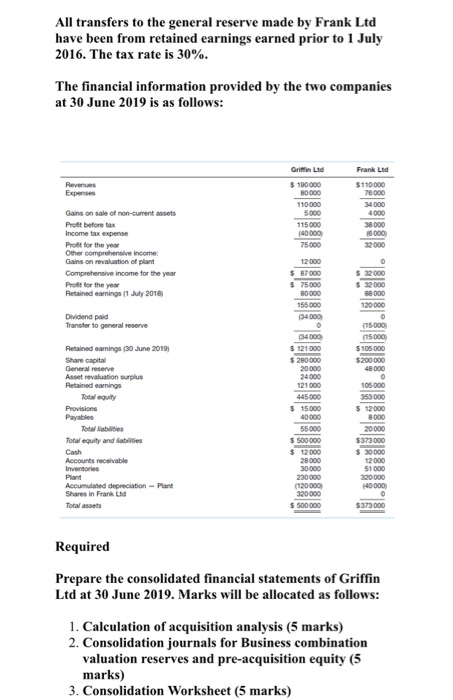

Griffin Ltd is a major Australian company operating in the manufacture of women's clothing. One of its major competitors was Frank Ltd whose business was established by a French family over 30 years ago. It had won numerous awards for its designs and has established a number of brands that have been successful, especially with the teenage market. In order to expand its business as well as to reduce the number of players in the market, on 1 July 2016 Griffin Ltd acquired all the issued shares (cum div.) of Frank Ltd for $330 000. At this date the equity of Frank Ltd was as follows: Share capital General reserve Pertained earnings $200 000 20000 50000 All the identifiable assets and liabilities of Frank Ltd were recorded at amounts equal to their fair values except for the following: Piant cost $220000 Carrying amount $ 180000 190000 $100 210000 The plant's expected remaining useful life was 5 years with benefits being expected evenly over that period. The plant was sold on 1 January 2019 for $187 000. The land was sold in February 2018 for $250 000. Of the inventory, 90% was sold by 30 June 2017 and the rest by 30 June 2018. At 1 July 2016, Frank Ltd had recorded a dividend payable of $10 000 that was paid in September 2016. Frank Ltd also had some unrecorded assets, in particular the brands relating to the successful clothing sold in the teenage market. Griffin Ltd valued these brands at $12 000 and assessed them to have an indefinite life. In its financial statements at 30 June 2016, Frank Ltd raised a contingent liability relating to a guarantee it had made to one of its related companies. Griffin Ltd assessed the fair value of the guarantee payable at $10 000. In August 2018, Frank Ltd was required to pay $2500 in relation to the guarantee. All transfers to the general reserve made by Frank Ltd have been from retained earnings earned prior to 1 July 2016. The tax rate is 30%. The financial information provided by the two companies at 30 June 2019 is as follows: Griffin Ltd Revenue sets Gains on sale of non-current Profit before tax $190000 80000 110000 5000 115000 140 000 38000 75 000 Profit for the year Other comprehensive income Gains on evaluation of plant Comprehensive income for the year Profit for the year Retained earnings 11 July 2018) $ 87000 $ 32000 120000 Dividend paid Transfer to general reserve 15000 (15.000 $ 121000 $105000 Retained earnings (30 June 2019) Share capital General reserve Asset revaluation surplus Provisions Payables Totabilities Total equity and abilities 121 000 445000 $ 15000 40000 55000 $ 500 000 $ 12000 105 000 353000 $ 12000 8000 20000 $373 000 230000 320 000 Accounts receivable Inventories Plant Accumulated depreciation - Plant Shares in Frank Ltd Total assets $ 500 000 $373000 Required Prepare the consolidated financial statements of Griffin Ltd at 30 June 2019. Marks will be allocated as follows: 1. Calculation of acquisition analysis (5 marks) 2. Consolidation journals for Business combination valuation reserves and pre-acquisition equity (5 marks) 3. Consolidation Worksheet