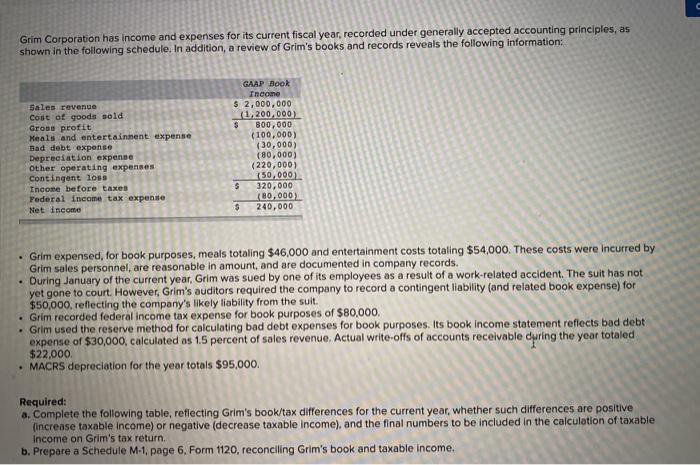

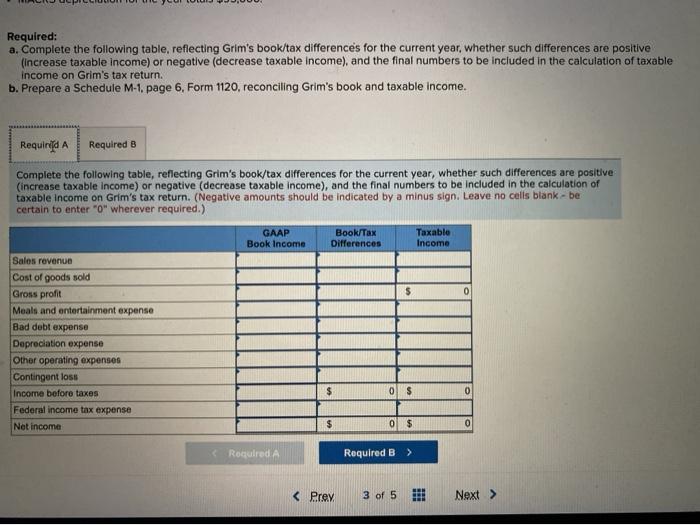

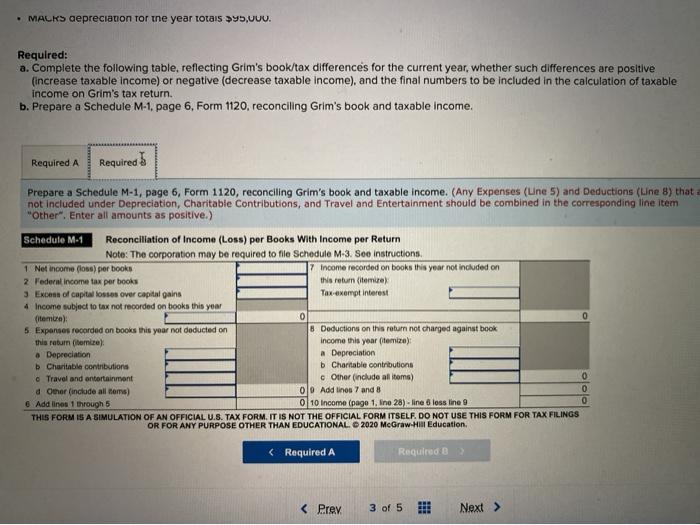

Grim Corporation has income and expenses for its current fiscal year, recorded under generally accepted accounting principles, as shown in the following schedule. In addition, a review of Grim's books and records reveals the following information: Sales revenue Cost of goods sold Gross profit Meals and entertainment expense Bad debt expense Depreciation expense Other operating expenses Contingent loss Income before taxes Federal income tax expense Net income GAAP Book Income $ 2,000,000 (1.200.000) $ 800,000 (100,000) (30,000) (80,000) (220,000) (50,000 $ 320,000 (B0,000) $ 240,000 Grim expensed, for book purposes, meals totaling $46,000 and entertainment costs totaling $54,000. These costs were incurred by Grim sales personnel are reasonable in amount, and are documented in company records. . During January of the current year , Grim was sued by one of its employees as a result of a work-related accident. The suit has not yet gone to court. However , Grim's auditors required the company to record a contingent liability (and related book expense) for $50,000, reflecting the company's likely liability from the suit. Grim recorded federal income tax expense for book purposes of $80,000. Grim used the reserve method for calculating bad debt expenses for book purposes. Its book income statement reflects bad debt expense of $30,000, calculated os 15 percent of sales revenue. Actual write-offs of accounts receivable during the year totaled $22.000 MACRS depreciation for the year totals $95,000. Required: a. Complete the following table, reflecting Grim's book/tax differences for the current year, whether such differences are positive (increase taxable income) or negative (decrease taxable income), and the final numbers to be included in the calculation of taxable b. Prepare a Schedule M1, page 6, Form 1120, reconciling Grim's book and taxable income. Income on Grim's tax return Required: a. Complete the following table, reflecting Grim's book/tax differences for the current year, whether such differences are positive (increase taxable income) or negative (decrease taxable income), and the final numbers to be included in the calculation of taxable income on Grim's tax return. b. Prepare a Schedule M-1, page 6, Form 1120, reconciling Grim's book and taxable income. Requinid A Required B Complete the following table, reflecting Grim's book/tax differences for the current year, whether such differences are positive (increase taxable income) or negative (decrease taxable income), and the final numbers to be included in the calculation of taxable income on Grim's tax return. (Negative amounts should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required.) GAAP Book Income Book/Tax Differences Taxable Income $ 0 Sales revenue Cost of goods sold Gross profit Meals and entertainment expense Bad debt expense Depreciation expense Other operating expenses Contingent loss Income before taxes Federal income tax expense Net income $ 0$ 0 $ 0 $ 0 (Required A Required B > MALRS depreciation for the year totais >95,000. Required: a. Complete the following table, reflecting Grim's book/tax differences for the current year, whether such differences are positive (increase taxable income) or negative (decrease taxable income), and the final numbers to be included in the calculation of taxable income on Grim's tax return. b. Prepare a Schedule M-1, page 6, Form 1120, reconciling Grim's book and taxable income. Required A Required Prepare a Schedule M-1, page 6, Form 1120, reconciling Grim's book and taxable income. (Any Expenses (Line 5) and Deductions (line 8) that not included under Depreciation, Charitable contributions, and Travel and Entertainment should be combined in the corresponding line item "other". Enter all amounts as positive.) Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3. See Instructions 1 Net Income (los) per books 7 Income recorded on books this year not included on 2 Federal income tax per books this return (itemize 3 Excess of capital osses over capital gains Tax-exempt interest 4 Income subject to tax not recorded on books this year (tema) 0 0 5 Expenses recorded on books this year not deducted on 8 Deductions on this return not charged against book this return itemize): income this year (temize): Depreciation a Depreciation b Charitable contributions b Charitable contributions Travel and entertainment c Other (include all items) a Other (include alls) 010 Add lines 7 and 8 0 Add lines 1 through 5 0 10 Income (page 1, Ine 28) - line 5 loss line 9 0 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2020 McGraw-Hill Education,